Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 May, 2021

By Anser Haider and Stefen Joshua Rasay

The video game industry kicked off the year with a bang as the coronavirus pandemic continued to drive record levels of player engagement and sales for all major U.S. publishers.

Activision Blizzard Inc., Electronic Arts Inc. and Take-Two Interactive Software Inc. all beat earnings expectations for the March quarter and forecast growth for the rest of the year, allaying concerns that demand for gaming would decline after the pandemic. While analysts cautioned that the industry may still experience a slight dip after shelter-at-home orders are lifted globally, they remain optimistic about the market's future overall.

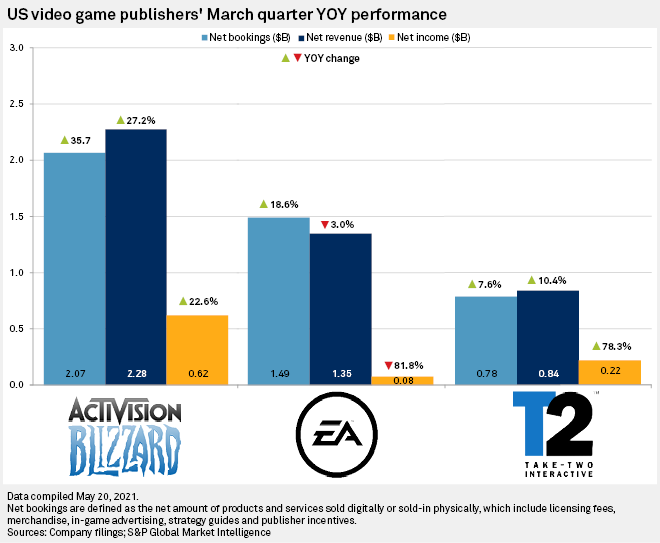

Activision led among the major U.S. game publishers in the March quarter, with its key franchises across consoles, PC and mobile all delivering significant growth. The company's total net revenues grew 27.2% year over year to $2.28 billion, while net income grew 22.6% to $619 million. Net bookings — products and services sold both digitally and physically — grew 35.7% to $2.07 billion.

Activision raised its full-year guidance on expectations that its existing and future titles will continue pulling in additional players after the pandemic as well.

"As we look forward, we see a long-term trend of more people gaming than ever before in more geographies and on more platforms," Activision CEO Bobby Kotick said during the company's recent earnings conference call.

Activision's chief rival, EA, saw its March-quarter revenue and net income decline year over year to $1.35 billion and $76 million, respectively, due to a lighter slate of new title releases compared to the competition. However, net bookings for the quarter were up about 18.6% to $1.49 billion, driven by recurring spending in EA's evergreen titles. The company also forecast growth for its fiscal year 2022, which ends March 31, 2022.

Take-Two Interactive also forecast growth for its fiscal year, following March-quarter revenues that grew 10.4% year over year to $839.4 million and net income that was up 78.3% to $218.8 million. Net bookings for the company were up 7.6% to $784.5 million.

Speaking about Take-Two's outlook, CEO Strauss Zelnick said the company anticipates the overall addressable market for the gaming industry to be notably larger going forward than it was before the pandemic.

According to a new study by games market data firm Newzoo, the global games market is set to generate revenues of $175.8 billion this year, down 1.1% from $177.8 billion in 2020.

"When contextualizing the games market in 2021, it is important to mention that 2020 was a unique growth year," said Tom Wijman, market lead for games at Newzoo. "COVID-19-related lockdown measures spurred enormous interest in gaming across all regions and platforms."

Wijman noted that even with a slight decline, Newzoo's forecast for 2021 is still above what it was a year ago. Moreover, the research firm expects the games market to pull in $204.6 billion in 2023, almost $4 billion above Newzoo's prior-year forecast.

Gaming industry advisory firm Gamesone also forecasts continued growth for the gaming industry. According to its latest valuation as of market close on April 23, Gamesone estimated that the public game-industry market totaled more than $2.1 trillion.

Evan Van Zelfden, analyst and managing director at Gamesone, said even though 2021 can be viewed as a statistical anomaly with potential declining revenue after the pandemic, the industry will continue its trend of steady growth in the long run.

"More than ever, retail investors are locked-on to the passion thesis: they've always known gaming would rule the world," Van Zelfden said. "Institutional investors may share that realization now as well. Regardless, everyone who buys and holds has the same outcome five or ten years from now."

Although the impact of the pandemic on both engagement and spending in 2020 was positive overall, there were also significant hurdles that stemmed from lockdown restrictions. Work-from-home mandates interrupted the development of many software titles, with many releases pushed to the second half of this year or to 2022.

While both Activision and EA recently confirmed that the latest installments of their respective flagship franchises are set to launch on schedule by the holiday season, analysts questioned whether the companies are cutting corners to meet their annual deadlines in order to keep shareholders happy.

Van Zelfden said the messy launch of Cyberpunk 2077 by Polish studio CD Projekt Red last December should be an important lesson to other publishers that it is better to miss a launch date than it is to sell a game impacted by COVID-19 production issues.

"CD Projekt lost two-thirds of their market cap after the launch of Cyberpunk and now the question on everyone's mind is whether their reputation can recover," Van Zelfden said. "Certainly, Activision and EA would do better missing a quarter or two rather than having a majority of their value destroyed by launching a bad product."

However, Neil Barbour, an analyst at Kagan, a media research group within S&P Global Market Intelligence, argued that bad reviews may or may not sink a game's long-term financial viability, and having no game at all on store shelves in the run-up to Christmas would likely wreak larger financial havoc for the publishers.

"Publishers are trying to carve out a more consistent revenue profile with live service games and other digital add-on content, but they're still largely reliant on big end-of-year releases selling millions of copies at $60 or $70 a pop," Barbour said.

The pandemic also led to a global supply shortage of essential chips used in gaming hardware, including Microsoft Corp.'s new Xbox Series S/X and Sony Group Corp.'s new PlayStation 5 consoles. To ensure that their games reach the maximum number of consumers, most publishers, including Activision and EA, plan to launch their forthcoming titles on older consoles as well.

"It's not that surprising to see the big publishers keep an eye on the old hardware while targeting the new generation," Barbour said. "A year of console sales, even in the best conditions, is usually not enough to build the kind of installed base the big blockbuster games are used to."