S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 May, 2022

By Anser Haider

As pandemic-driven growth in the video game industry dissipates, gaming companies are pinning their hopes on splashy new installments of tentpole franchises.

With consumers spending less time playing games than they were during the peak of COVID-19's lockdowns in 2020, gaming content revenue's year-over-year growth rate halved in 2021 and is expected to slow further this year, according to estimates from Kagan, a media research group within S&P Global Market Intelligence.

Despite slowing growth trends, analysts remain optimistic that the industry can reclaim its luster on the enduring strength of popular game franchises, many of which are set to launch new installments across both dedicated gaming hardware and mobile in the near future.

"It was unrealistic to expect games to retain the engagement they saw during the pandemic," said Michael Goodman, director of digital media strategies at Strategy Analytics. "On the flipside, a lot of chaos that was caused by the pandemic has now started subsiding as well, paving the way for companies to start churning out new hits with minimal interruptions."

COVID-19 woes

While the pandemic resulted in record engagement levels within gaming, it also caused severe workflow disruptions at most major studios, resulting in longer development cycles and even delays for a host of high-profile titles.

These disruptions also took a toll on major titles that did manage to launch, including Activision Blizzard Inc.'s Call of Duty: Vanguard and Electronic Arts Inc.'s Battlefield 2042. Although both titles were the latest installments in the companies' wildly popular franchises, they underperformed in the crucial holiday season.

As a result, both Activision and EA missed analyst estimates in the March quarter. Activision Blizzard's revenue for the March quarter stood at $1.48 billion, compared to S&P Capital IQ estimates of $1.80 billion. EA's revenue for the quarter totaled $1.75 billion in the quarter, just under estimates of $1.77 billion. Take-Two Interactive Software Inc., which has suffered from a slew of delayed games since 2021, also missed analyst estimates on its earnings forecast for the coming quarters.

Older consoles

Another lingering issue that game publishers are grappling with is the ongoing supply chain shortages that have crippled the production of video game consoles, including Microsoft Corp.'s Xbox Series X and Sony Group Corp.'s PlayStation 5. With a large number of consumers unable to get their hands on the devices, publishers are continuing to launch most of their titles on last-generation Xbox and PlayStation consoles.

While this strategy ensures that publishers' games are accessible by a much more established install base, there are also drawbacks that could impact sales in the long run, Kagan analyst Neil Barbour said.

"Without a healthy installed base for the new consoles, developers will have to continue to account for the older hardware, which will hold them back from fully leveraging the new horsepower to roll out captivating new features and better graphics," Barbour said. "That's going to lead to consumers feeling like they're not getting a lot of bang for their buck, particularly for these annualized franchises."

Promising pipelines

Despite the lack of current-generation hardware, the situation is more promising on the software side of gaming, with development cycles back to normal in most areas of the world, Goodman said.

"With COVID hopefully in the rearview mirror now, studios can return to functioning at full capacity and focusing on churning out hits that aren't constrained by work-from-home limitations," Goodman said.

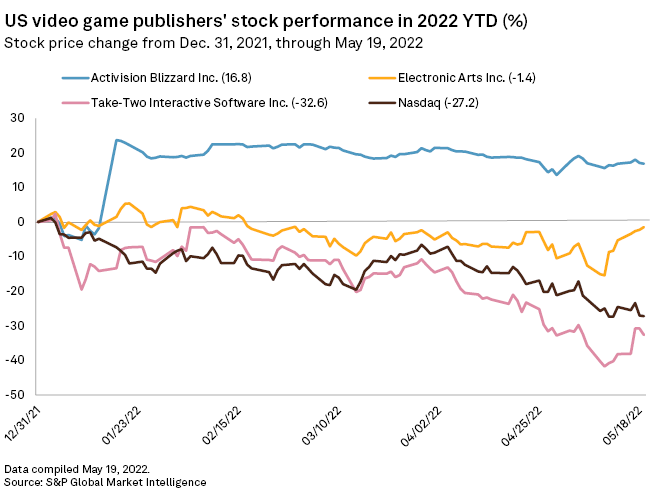

This sentiment was echoed by equity analysts, most of whom maintained their positive stock ratings on the three major U.S. publishers even as shares at EA and Take-Two stumbled.

After its last Call of Duty game failed to make a splash in the market, Activision is hoping to reverse its fortunes this holiday season with the next installment, Modern Warfare 2. Benchmark analyst Mike Hickey, who maintained a $100 price target and "buy" rating on the company's stock, said Activision can see growth in 2022 on the launch of the game.

Hickey also believes that Microsoft's pending acquisition of Activision has created a "valuation floor" for the gaming company. Moreover, if the U.S. Federal Trade Commission winds up rejecting the deal, Activision would still have a strong year on the strength of Modern Warfare 2 as well as its growing slate of mobile titles, the analyst added.

In mid-January, Microsoft agreed to acquire Activision Blizzard for $95.00 per share in cash, making it Microsoft's largest acquisition ever by value. Deal completion is expected in Microsoft's fiscal year ending June 30, 2023. Speculation is rife that regulators may target the deal.

EA-okay

EA's pipeline for its fiscal year 2023 ending in March 2023 also includes a range of heavy-hitters, including a sequel to Star Wars: Jedi Fallen Order, a remake of cult favorite horror title Dead Space and new annual installments in the best-selling FIFA franchise.

Earlier this month, EA said it is ending the licensing agreement it has had for nearly three decades with FIFA. From 2023, new installments of the soccer game will be called EA Sports FC. Analysts believe that the new branding will not derail the game franchise's market power.

"With a clean balance sheet, consistent and strong free cash flow generation, and a stable of other healthy franchises already in hand, EA is set up pretty well to weather continued market volatility," Moffett Nathanson analyst Clay Griffin said, upgrading the company's stock to a "buy" rating with a $141 price target.

MKM Partners analyst Eric Handler, who has a "buy" rating and a $162 price target on EA, said investor sentiment has been "overly negative" in recent years.

"The building blocks appear to be in place to better leverage and accelerate growth with the company's sports franchises and other leading brands over the next couple of years," Handler said.

Take-Two

Take-Two is set to complete its acquisition of mobile game developer Zynga Inc. on May 23. Following the acquisition, Take-Two will inherit a collection of mobile titles, teams that know how to run them, and capabilities that can cross-pollinate with their own to drive better success in free-to-play titles, Griffin said.

"But the main attraction remains: Take-Two's pipeline of upcoming games from its considerable portfolio of IP," Griffin said.

The company plans to launch 69 games by fiscal 2025, including what is widely expected to be the next installment of its blockbuster Grand Theft Auto franchise. Since its launch in 2013, Grand Theft Auto V has sold more than 160 million units, cementing it as one of the best-selling video games of all time.

"Grand Theft Auto is a gift that keeps on giving, and you can be sure that the next game is going to be absolutely massive, so I wouldn't bet against Take-Two anytime soon," Goodman said.