Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Jan, 2021

By Brian Scheid

An ongoing retail trader revolution in equity markets, which blossomed from an epic short squeeze on institutional investors who bet heavily against beleaguered video game retailer GameStop Corp., may have upended Wall Street speculative strategies.

"The GameStop phenomenon will forever change how we look at short selling," said Edward Moya, a senior market analyst at OANDA. The Reddit-fueled frenzy on Wall Street is likely to lead to an increase in margin requirements from brokerages and will almost certainly lead to strict controls on future short selling, he added.

Short selling, in which an investor borrows and sells shares with an intention of buying and returning them later at a lower price, became increasingly challenging during the pandemic as fiscal and monetary stimulus kept otherwise doomed companies alive, Moya said.

The degree of difficulty was raised exponentially as an army of retail traders from Reddit, TikTok and other corners of the internet launched a frenzied market battle against hedge funds and other investors who had amassed large short positions against stocks teetering on the brink of ruin.

The battle has driven previously embattled stocks like GameStop and AMC Entertainment Holdings Inc. to dizzying new highs, caused major brokerages to restrict trading and cost short sellers billions of dollars.

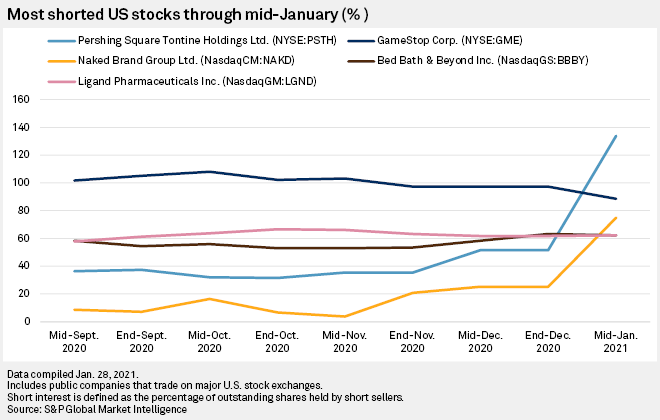

GameStop stock was the most shorted of 2020, according to S&P Global Market Intelligence data, reaching a peak of 108% of shares outstanding in mid-October.

It began 2020 below $6 and was under $4 in mid-July as many of the video game retailer's brick-and-mortar stores closed and the company struggled to compete with its online competitors. The stock has surged after being championed on online forums and was traded heavily by retail investors through Robinhood Markets Inc. and other commission-free brokerages. On Jan. 28, the stock hit $483 before closing at $193.60.

AMC's stock jumped from $5 on Jan. 26 to $20 on Jan. 27 with short interest at about 13.3% of shares outstanding.

"Equity markets are supposed to be credible markets of value with some speculation," Andrew Brenner, head of international fixed income at National Alliance Securities, said in a Jan. 29 note. "This is out of control and will end badly for equity investing."

The impacts on short selling are likely to be widespread, Moya said.

"The future of short selling will need to respect the power of the retail trader and realize that having a strong fundamental argument against is not reason enough to short," he said. "Short sellers have thrived in the past in exposing fraud or identifying extremely unjustified valuations, but now they will need to clearly outline their thresholds on how much pain they can stomach if another GameStop-type incident occurs."

Matt Weller, global head of market research at GAIN Capital, said the surge in GameStop, AMC and other "meme" stocks will lead all hedge funds to review and tighten internal controls on short positions. It will also serve as a permanent reminder for market makers of the dangers of naked short positions, he said.

"Much like how the Black Monday crash of 1987 fundamentally changed the way that options price in downside risk, we may look back at this month's moves as another fundamental shift in how traders price risk," he said.

It could also lead to a new wave of regulatory scrutiny, said Michael Hewson, chief market analyst with CMC Markets.

"The market turmoil is highlighting a number of areas within the market that might prompt regulatory scrutiny in the future, namely the monitoring of retail trade chat forums and message boards, and how they drive markets," Hewson wrote in a Jan. 28 note. "With large numbers of small investors swarming over heavily shorted stocks in what looked like a coordinated move, the frenzy raises all sorts of questions with respect to possible market manipulation."

The retail frenzy came as short interest in all 11 of the S&P 500's sectors was being pared back.

Through mid-January, the latest available data, short interest in the S&P 500 amounted to 3.32% of shares outstanding, down from 3.4% as of the end of December and the recent high of 4% in mid-March, when the market troughed in the early weeks of the pandemic.

Consumer discretionary stocks, which has drawn the most short interest of any of the large-cap index's sectors, saw short interest fall to 5.41% in mid-January, down from 5.57% at the end of December and 6.8% in mid-March.