S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Feb, 2023

By Dylan Thomas and Muhammad Hammad Asif

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity fundraising got significantly harder in 2022, and prospects for 2023 are not looking much better.

More than three-quarters of the private equity executives who participated in the S&P Global Market Intelligence 2023 Private Equity Outlook Survey said they expected fundraising conditions to remain the same or grow even worse this year. The largest portion of respondents, over 45%, predicted conditions would deteriorate.

That is a troubling outlook for an industry that just saw the number of funds reaching final close in 2022 fall nearly 46% year over year. Total fundraising surpassed the $1 trillion mark in 2021 but fell more than 10% in 2022 to less than $923 billion. And experts at private markets data source Preqin do not anticipate a true turnaround until 2024, at the earliest.

If there is a silver lining to the gloomy fundraising outlook, it is that institutional investors are starting to feel some relief after years of ratcheting pressure from an accelerating fundraising cycle. They are gaining a little more leverage in talks with fund managers.

Read more about the 2023 Private Equity Outlook Survey results.

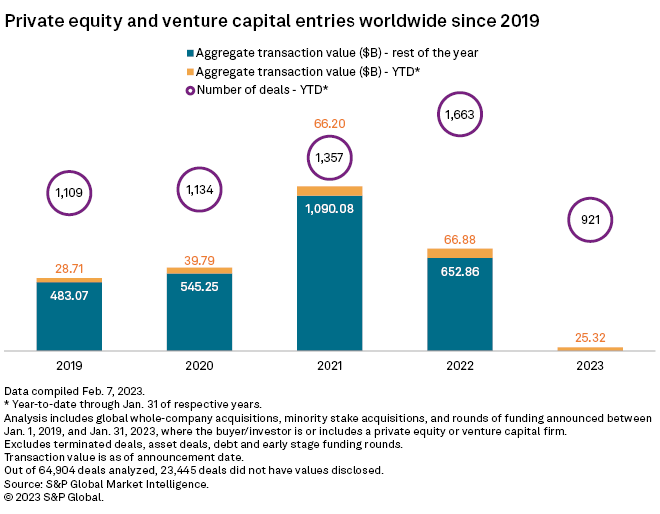

CHART OF THE WEEK: Slow start to 2023 PE dealmaking

⮞ The value of global private equity entries in January fell 62.1% year over year to just $25.32 billion.

⮞ With just 921 private equity deals recorded worldwide, it was the industry's slowest January since at least 2019, when there were 1,109 deals by Jan. 31.

⮞ A slowdown in private equity-backed M&A that began in 2022 amid rising inflation, interest rate hikes and a murky economic outlook is expected to continue through at least the first half of 2023.

TOP DEALS AND FUNDRAISING

* Stone Point Capital LLC and Mubadala Investment Co. PJSC, along with other coinvestors, agreed to acquire a 20% stake in Truist Financial Corp.'s insurance business, Truist Insurance Holdings Inc., for $1.95 billion. On deal closing, expected in the second quarter, Truist Insurance will form a five-member board with four directors appointed by Truist and one by Stone Point.

* KKR & Co. Inc.-controlled life sciences platform Gamma Biosciences agreed to sell its operating company, Astrea Bioseparations Ltd., to Biotage AB (publ) at an enterprise value of about $190 million in a stock transaction. Gamma is eligible to receive up to $45 million in milestone-based cash payments after closing and will inject about $25 million of capital into Astrea.

* Inflexion Pvt. Equity Partners LLP will buy a majority stake in operations management consulting services company DSS Sustainable Solutions Switzerland SA, or dss+, from Gyrus Capital SA, which will keep a significant minority stake. Inflexion will finance the investment through Inflexion Buyout Fund VI.

* Rainier Partners LP raised $300 million for its first fund, Rainier Partners Fund I LP, exceeding the $250 million target. The firm invests in lower-middle-market services businesses across North America.

MIDDLE-MARKET HIGHLIGHTS

* Parthenon Capital Partners agreed to purchase Global Payments Inc.'s gaming solutions business, Global Payments Gaming Services Inc., for $415 million. The deal is scheduled to close in the first quarter.

* SCF Partners Inc. bought mineral mining and quarrying services company Global E&C Ltd. from Global Energy Holdings Ltd. Global Energy will retain its other Aberdeen, Scotland-based energy businesses.

* The EQT Mid Market Asia III fund, which is managed by BPEA EQT, sold its minority interest in VBill Ltd. through a put option. The Beijing-based third-party payment service provider bought back the shares.

FOCUS ON: INTERNET SOFTWARE AND SERVICES

* Vista Equity Partners Management LLC unit Vista Credit Partners LP provided $175 million in fresh funding to revenue management solutions provider Demandbase Inc.

* Valor Management Corp.-managed Valor Siren Ventures I LP, in partnership with Augeo Affinity Marketing Inc., acquired Brand Networks LLC, which provides social marketing and advertising solutions.

* An investor group including private equity firms Benson Oak Ventures, LOUD Capital and SideCar Angels Inc. sold dating application Something More Inc. to Tawkify Inc.

* Initial Capital LLP and DNX Ventures LLC divested Toronto-based employee engagement and distributed team culture platform WFHomie Inc. to GoCo.io Inc.

For further private equity deals, read our latest In Play report, which looks at potential private equity-backed M&A, including rumored transactions, each week.