Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 May, 2023

By Dylan Thomas and Joyce Guevarra

Private equity fund managers are accelerating their outreach to wealthy individuals as the flow of capital from institutional investors slows.

By various estimates, there is $75 trillion to $85 trillion in global private wealth held by individuals who qualify to invest in alternative assets, but only a sliver of that total is in private equity funds. Unlocking that market is critical to large alternative asset managers, who "have growth ambitions beyond what they've been able to raise among institutional investors," said Or Skolnik, a member of the private equity and alternative investors practice at Bain & Co.

In the near term, those same private fund managers are grappling with what some describe as "the most difficult fundraising environment ever," he added.

"That set of challenges has kind of accelerated the push toward individual capital by many who say, 'You know what? Now is the time to really expand the aperture of what we're doing from a fundraising perspective,'" Skolnik said.

Institutional investor constraints

Blackstone Inc. President and COO Jonathan Gray described the retail market as "an enormous area of opportunity" on the firm's first-quarter earnings call, citing the firm's estimate that the globe's wealthiest individuals hold $85 trillion.

"On average, folks in the individual investor space are only allocated 1% or 2% to alternatives as opposed to our institutional clients who are 25% or 30%, so there seems to us to be a lot of runway in this area," Gray said.

Meanwhile, institutional investors, particularly public pension funds in the US and Europe, are in a capital crunch facing a denominator effect and slowing distributions from fund managers.

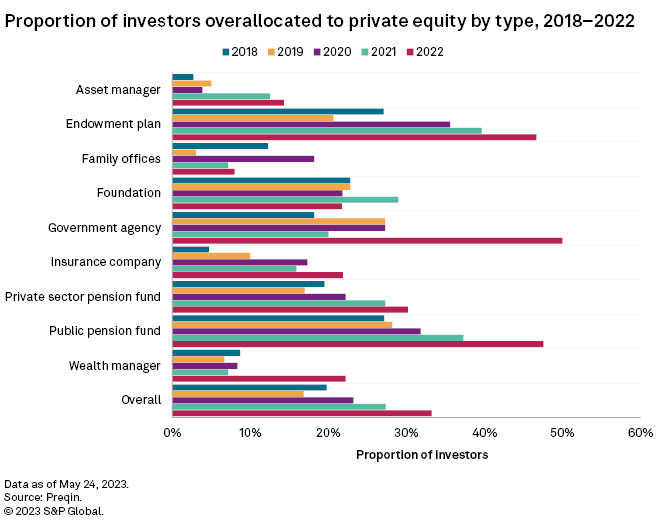

Preqin Ltd. in 2022 found a growing number of institutional limited partners were overallocated to private capital, and private equity in particular, limiting their ability to make new commitments. A smaller portion of investors in the noninstitutional category were overallocated to private equity, meaning they had more freedom to boost their commitments to the asset class.

Product offerings

Fund managers are attempting to capitalize on the opportunity with tokenized funds, as well as an expanding array of semi-liquid investment products tailored to individual investors, such as tender offer funds, interval funds, business development companies and nontraded real estate investment trusts. Assets under management in these vehicles jumped 93.8% to $245.9 billion in the US between 2020 and 2022, according to Cerulli Associates Inc., a consulting and data firm serving the financial industry.

In the previous five-year period ending 2020, assets in those vehicles increased less than 19%.

The longer time frame for buyout-style private equity investments is a key reason the semi-liquid products have been slower to open to individual investors, who in general demand more liquidity than the institutional investors private equity typically works with, said Daniil Shapiro, who leads alternative investment research for Cerulli. Private equity fund managers need time to play out their value-creation strategies, with the typical private equity fund cycle running seven to 10 years.

New capabilities

Skolnik said securing commitments from retail investors is a very different proposition from raising capital from pension funds and sovereign wealth funds. For those institutional investors, who typically employ professional investment committees experienced in private markets, the transaction with a fund is more like a business-to-business sale, he said.

"Going after individual capital, even if you're talking about high-net-worth individuals, it's just a very, very different motion," Skolnik said, noting that the transaction typically goes through an intermediary — the wealthy individual's financial adviser — and that funds entering the retail market need to focus on brand recognition among both financial advisers and their clients.

"By and large, even a firm like Blackstone has not yet created nearly the same brand awareness as a Fidelity or a Vanguard," he said, naming two public fund providers.

There is also the issue of staffing. The relatively small groups fund managers send to meet face-to-face with institutional investors are being supplemented by teams focused on outreach to the private wealth distribution channels.

"Some of these firms have large internal consulting groups which help [private wealth] advisers use their products," Shapiro said.

Demand doubts

While the supply of the products targeted to individual investors is growing, there are questions about demand from the marketplace, Shapiro said.

Investors must overcome concerns about the risk profile of the investments, the lack of liquidity and the higher fees demanded by alternative asset managers. Advisers must evaluate which of their clients are best suited — not just financially but psychologically — to keep their money locked up for a relatively long time compared with other investments, Shapiro said.

The time and effort required in "getting five clients a 1% allocation to a private credit fund" may not be worth it for some advisers, Shapiro said.