S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 Dec, 2022

By Harry Terris and Xylex Mangulabnan

Wholesale borrowing by banks has been shooting up as a deposit surge in 2020 and 2021 has started to reverse. Systemwide wholesale funding levels remain considerably lower than before the pandemic, but analysts say the data could indicate pockets of acute stress.

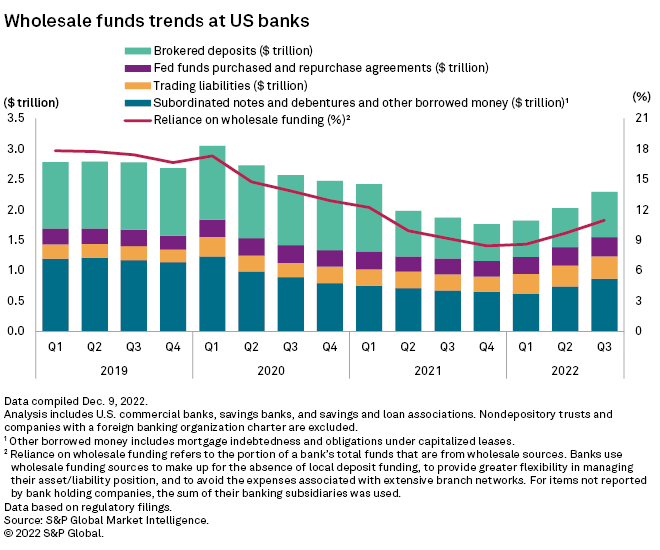

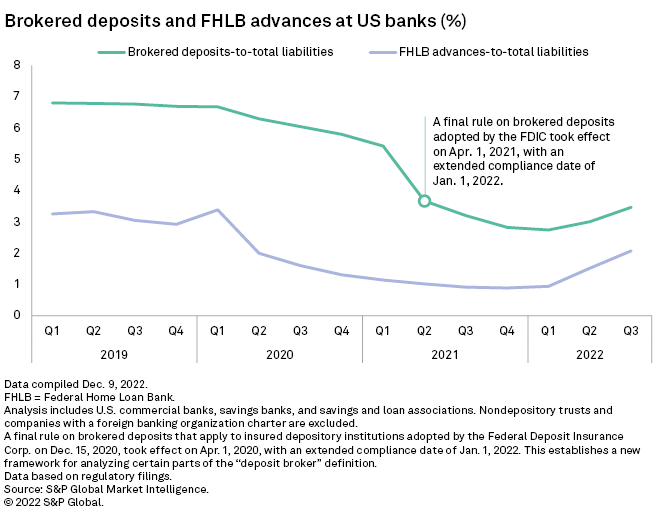

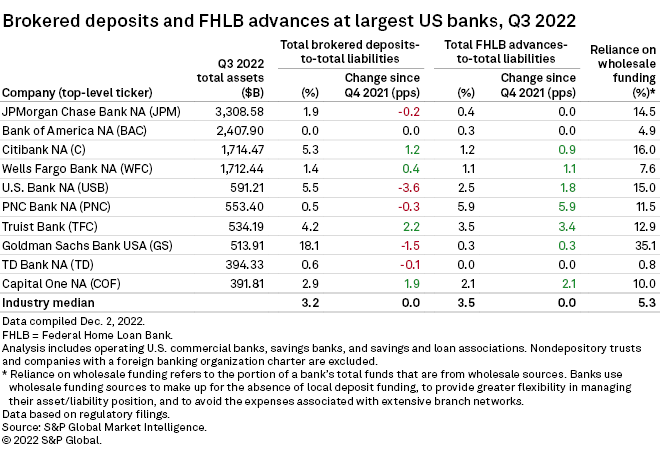

Wholesale borrowing across the industry, including deposits obtained through brokers and advances from government-sponsored institutions, jumped 30.1% from the end of 2021 — before the Federal Reserve started raising interest rates — to $2.291 trillion at the end of the third quarter of 2022, according to data from S&P Global Market Intelligence. The ratio of wholesale to total funding jumped 2.5 percentage points over the same time, to 11.0%.

That is well below the ratio of 16.7% at the end of 2019, but wholesale borrowing has been uneven with percentages of funding represented by brokered deposits or Federal Home Loan Bank, or FHLB, advances leaping by 20 percentage points or more over the year among the most active banks. Simultaneously, a spike in bank borrowing from the Fed's discount window to a recent peak of more than $10 billion could reflect crunches at some institutions as liquidity conditions have tightened abruptly.

At a minimum, the trends are another signal of escalating funding costs for banks. "We had money falling from the sky, which grew deposits. That's going to reverse," PNC Financial Services Group Inc. Chairman, President and CEO William Demchak said at a conference in December. "We're going to have higher reliance on wholesale and cost of funds are going to go up."

|

|

Mean reversion

To a large extent, the trends reflect a return toward norms after fiscal and monetary stimulus flooded into deposit coffers in 2020 and 2021.

Even after the jump in FHLB borrowing through the third quarter of 2022, banks have only used about 10% of their available capacity through the system, according to an analysis by Janney Montgomery Scott analyst Feddie Strickland in November. Capacity depends on factors like available collateral in the form of securities and loans.

PNC added $30.08 billion of FHLB advances in the second and third quarters of 2022 and said it has about $63.9 billion of unused secured borrowing capacity with the FHLB and Fed at Sept. 30.

Demchak said "taking out a fairly big slug" from the FHLB allowed the bank to get ahead of deposits leaving the system and that rates available on the money provided a positive carry trade.

Truist Financial Corp. is another large bank that significantly increased its FHLB advances, along with brokered deposits, in 2022.

|

Big swings

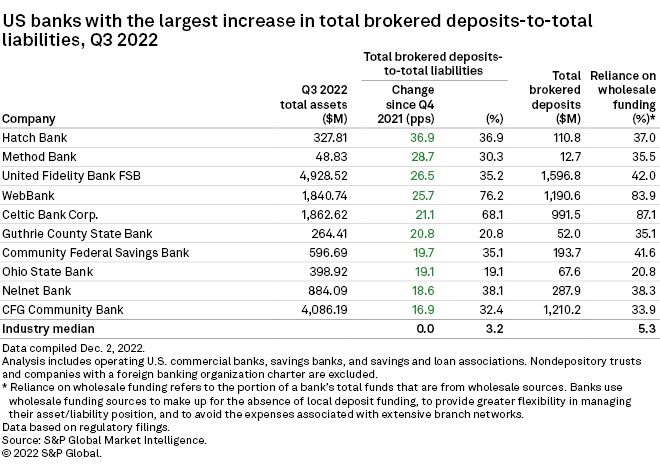

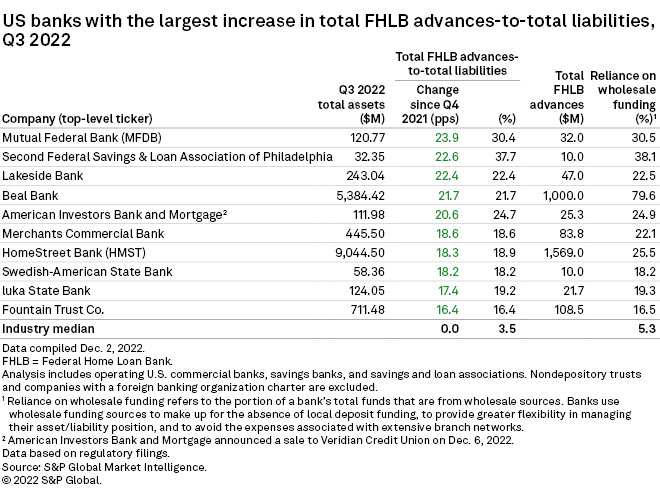

The biggest increases in reliance on brokered deposits and FHLB advances in the first three quarters of 2022 were at a group of smaller banks, where ratios of one or the other form of borrowing to total liabilities increased by 16.4 to 36.9 percentage points.

At HomeStreet Inc., where FHLB advances increased by 18.3 percentage points to 18.9%, executives said in October that they would seek to replace wholesale borrowings by offering promotional certificates of deposit and projected that the bank's net interest margin would bottom in the fourth quarter.

|

|

* Download a template to generate a bank's regulatory profile.

* Download a template to compare a bank's financials to industry aggregate totals.

Discount window tremors

Analysts at Moody's said in a November note that the discount window borrowing is likely due at least in part to deposit outflows and "could point toward deeper funding weaknesses in some corners of the banking sector."

Individual discount window borrowers are made public after a two-year lag. The Fed describes primary credit available at the discount window as "the principal safety valve for ensuring adequate liquidity in the banking system," though it sought to destigmatize use early in the pandemic with steps including bringing the cost of primary credit to the upper end of the target range for its main policy rate.

Primary credit spiked to a weekly average of $49.58 billion in April 2020. It fell to a weekly average of less than $1 billion from May 2021 through early 2022 before the recent liftoff.

Rates strategists at BofA Global Research also speculated that the increase in primary credit "is likely rooted in some banks underestimating the speed of deposit outflows and potential rate rise." In a note in December, they observed that some small banks might have few alternative options because of constraints like negative tangible equity from underwater bond portfolios that would make them ineligible for FHLB advances.

Still, the BofA analysts said the Fed is unlikely to be surprised by the activity and that it probably won't have a material impact on monetary policy.

"Some banks may indeed see tight liquidity or potentially fail with the Fed's policy tightening, but we would be surprised if they are of systemic importance," they said.