S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Dec, 2022

The Federal Trade Commission's move to block Microsoft Corp.'s pending deal to acquire Activision Blizzard Inc. threatens to upend the software company's ambitions to grow its gaming business.

The agency's complaint against the deal may also have implications for other tech companies pursuing similar deals in the gaming space.

"It does indeed mean that if you are a large tech enterprise and you seek to carry out a transaction, you are going to face close scrutiny from the FTC," said William Kovacic, a former FTC chair and current law professor at George Washington University. "This is the most important instance to date where the FTC has sought to fulfill its promise to enforce merger policy more aggressively. This is the biggest test to date of their efforts."

The agency voted 3-1 along party lines to bring the complaint, with Republican Commissioner Christine Wilson voting no. The agency claims that with Activision's franchises, Microsoft would harm competition in several ways, including manipulating Activision's pricing and degrading its game quality or player experience on rival consoles and gaming services.

Activision is a Santa Monica, Calif.-based video game publisher of several popular game franchises including Call of Duty, World of Warcraft and Candy Crush.

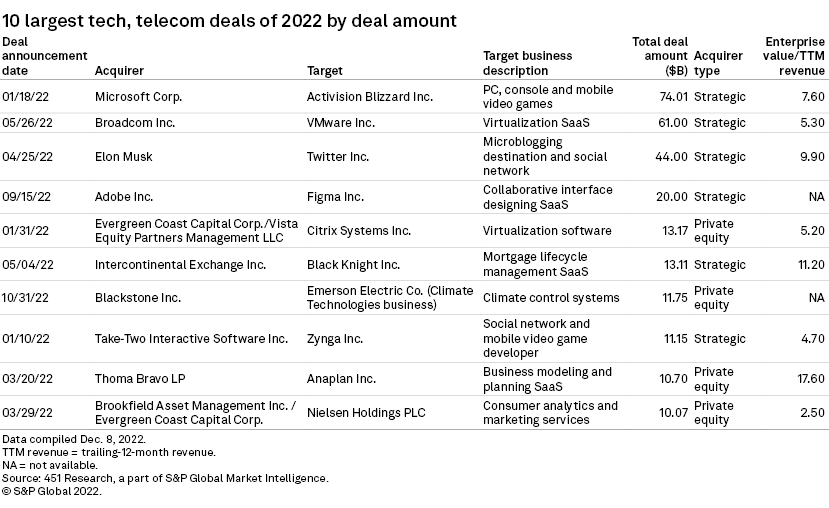

The $74.01 billion transaction is the largest announced tech and telecom acquisition of 2022, followed by Broadcom Inc.'s deal to acquire VMware Inc. and Elon Musk's purchase of Twitter Inc., according to 451 Research.

Gaming rivalry

The FTC

"Microsoft has already shown that it can and will withhold content from its gaming rivals," said Holly Vedova, director of the FTC's Bureau of Competition. "Today we seek to stop Microsoft from gaining control over a leading independent game studio and using it to harm competition in multiple dynamic and fast-growing gaming markets."

Microsoft did not respond to a request for comment. The company said in September that it remained "committed to making the same version of Call of Duty available on PlayStation on the same day the game launches elsewhere. We will continue to enable people to play with each other across platforms and across devices."

Whether the FTC is successful will depend on how persuasive the agency's evidence is in proving a theory of harm, Kovacic said, adding that Microsoft had been making an effort to address regulators' concerns.

"Microsoft may argue to the court that they have good solutions in place and that the FTC unwisely rejected them," Kovacic said.

CFRA Research's John Freeman believes there is some merit in the FTC's case. Freeman, a vice president of equity research who covers software and video games, noted that cutting-edge console gaming is a niche market controlled largely by Microsoft's Xbox and Sony Corp.'s PlayStation. A third major player is Nintendo Co. Ltd.

Metaverse at play

Microsoft is specifically interested in the value of Activision's Call of Duty users who are playing against each other in real time, said Freeman. "Hundreds of millions of active players; that's a nice asset that Microsoft could most definitely monetize," Freeman said. "Call of Duty is a very narrowly defined metaverse that Microsoft could expand out."

Kagan analyst Neil Barbour said Call of Duty is indeed the primary intellectual property that Microsoft would acquire in the deal but that the company is not focused on persistent virtual worlds.

"That isn't to say that Microsoft can't grow those development resources and intellectual properties into something that would more resemble what we now consider a metaverse," Barbour said. "Activision Blizzard isn't in the metaverse business right now, and they don't really have a clear path to getting in the metaverse business in the next three to five years."

Activision officials expressed confidence that the deal would overcome any regulatory hurdles.

Lulu Cheng Meservey, Activision's executive vice president of corporate affairs and chief communications officer, said in a statement on Twitter that the deal benefits gamers and the industry, especially given competition from abroad. "This vote departs from precedent but the law hasn't changed," Meservey said. "We look forward to proving our case in court and closing our deal with Microsoft."

Activision Blizzard CEO Bobby Kotick in a Dec. 8 letter to employees expressed confidence that the deal would still go through. "The allegation that this deal is anti-competitive doesn't align with the facts, and we believe we'll win this challenge," Kotick said.

451 Research is part of S&P Global Market Intelligence.