Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Apr, 2021

By Cathal McElroy and Francis Garrido

French retail businesses in the Paris neighborhood of Gobelins are among those hit hard by measures to prevent the spread of COVID-19. Source: Frédéric Soltan/Corbis News via Getty Images |

As France comes to terms with another nationwide COVID-19 lockdown, the owners of non-food retail, hospitality and leisure properties, in particular, face a lengthy period of closure when they might have instead been looking forward to the opening of the country's tourism season during a busy Easter break.

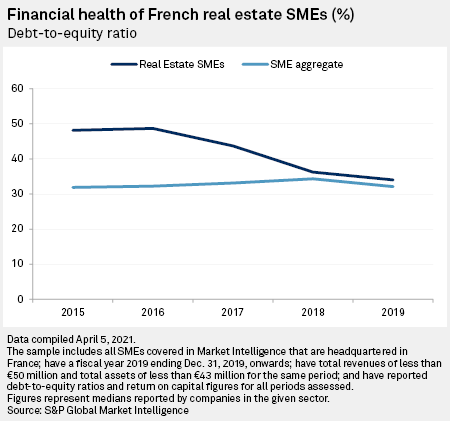

The blow will undoubtedly be hard felt, but many property businesses should take some comfort from the relative health with which they entered the pandemic. S&P Global Market Intelligence data shows that the median debt-to-equity ratio among French real estate small and medium-sized enterprises fell from 48.16% in 2015 to 34.01% by the end of 2019.

"Most investors generally have been trying to manage down their debt-to-equity ratio over recent years, just to get it into a position to protect themselves," Damian Harrington, head of Europe, the Middle East and Africa research at real estate services firm Colliers International, said in an interview. "From 2018 to 2019, everybody was concerned that there was going to be some kind of [economic] wobble because we were quite long into the cycle, but nobody really knew what it was going to be."

Real estate was at the heart of the 2008 global "wobble," which was spawned by loose lending to homeowners in the U.S. The contagion that subsequently spread through the global financial system exposed similarly reckless lending to the commercial property sector in several major markets, with many property firms entering the crisis highly leveraged.

For French real estate SMEs, at least, those lessons appear to have been learned as their average debt-to-equity ratio fell 14 percentage points in the five years to the end of 2019, Market Intelligence data shows. This compares with broadly flat debt-to-equity among French SMEs generally during the same five-year period, albeit from a lower starting point.

After bottoming out in 2009, French real estate investment rose to between €20 billion and €30 billion per year between 2014 and 2018, before enjoying a record year in 2019, when €37.6 billion was invested, according to data from real estate services firm Knight Frank. The strength of the French market even saw Paris overtake London as Europe's most popular destination for property investment in offices.

"The boost to the French investment market has resulted in French investors generally depending less on debt," said David Bourla, chief economist and head of research at Knight Frank. "They have much more reduced [loan-to-value] ratios."

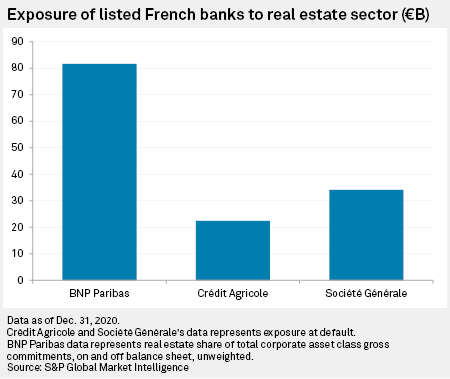

Still, France's major lenders retain significant exposure to the sector. BNP Paribas SA's gross exposure to commercial real estate, which is mainly in Europe, was €71.1 billion, 3.9% of the group's total on- and off-balance sheet commitments, as of Dec. 31, 2020. Doubtful loans totaled €1.64 billion, representing 2.3% of the bank's total exposure to the sector, the company's 2020 annual financial report showed. France's other two major listed lenders, Crédit Agricole SA and Société Générale Société anonyme, had exposures at default to real estate of €22.46 billion and €34.13 billion, respectively.

While the flourish of interest in French real estate in the years prior to the pandemic helped strengthen investors' balance sheets, it also squeezed returns as competition for assets increased. French real estate SMEs' average return on capital fell to 1.69% in 2019 from a peak of 2.46% in 2015, Market Intelligence data shows. French SMEs as a whole recorded a slightly smaller fall in average returns on capital during the same period, but from a much higher base.

"For years, target returns [in real estate] have been creeping in because the market has been just so much more competitive," said Harrington. "There's so much capital out there."

The damage inflicted to certain sections of the real estate sector by COVID-19 has made the holders of that capital much more circumspect.

"Buyers are increasingly cautious, as well as bankers, when they are looking at an asset to buy," said Bourla. "They want to be sure that the occupier is solid, and that there will be a good level of cashflow with that asset."

Non-food retail, hospitality and leisure properties have borne the brunt of the damage inflicted on the property market by the pandemic. Landlords have struggled to collect rent from tenants whose income has collapsed as customers stay away from their premises. U.K.-based retail landlord Hammerson PLC, which has a portfolio of retail assets in France worth around £1.15 billion as of Dec. 31, 2020, collected just 58% of first-quarter rent from its French assets as of March 5.

"Retail is where there are real question marks," said Harrington. "Nobody really knows where that's gone, but values are definitely dropping because yields are moving out. Nobody really knows where [retail] rents are going to sit because everything is being pushed toward a turnover-based model."

Owners of certain kinds of subprime properties in regional towns and cities — the kind more likely to be owned by real estate SMEs rather than large institutional investors — are also more vulnerable to the impact of the COVID-19 shock, Harrington added.

For French lenders, the real risk from their property exposure might be more indirect than it was during the global financial crisis, said Harrington. It is not so much the financial health of landlords that banks should be worried about, but of their tenants, on whom they rely for survival.

"There is potentially a liquidity blockage when it comes to banks' lending to businesses," said Harrington. "Debt-to-equity value ratios have really come in [for real estate investors], so there isn't really a risk there. It's more about the tenant paying rent — do they have the capital to keep going?"