S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Dec, 2021

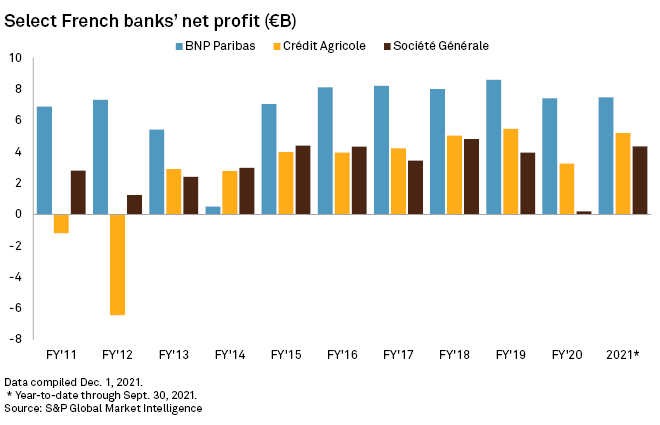

France's largest banks have rebounded impressively from the disruption caused by the COVID-19 pandemic and are on course to post stellar full-year results, analysts said.

Strong investment banking performance throughout the year has helped boost the revenue and profits of the country's biggest lenders, including BNP Paribas SA, Crédit Agricole SA and Société Générale SA, while a sustained recovery in French retail banking since the second quarter and lower costs of risk have also contributed.

"Overall, French banks' results have beaten expectations," Arnaud Journois, vice president at credit rating agency DBRS Morningstar, said in an interview. "Some analysts are even talking about a potential record year for the French banking system, that we are in an even better position now than we were pre-COVID. What we have observed is a complete recovery in revenues."

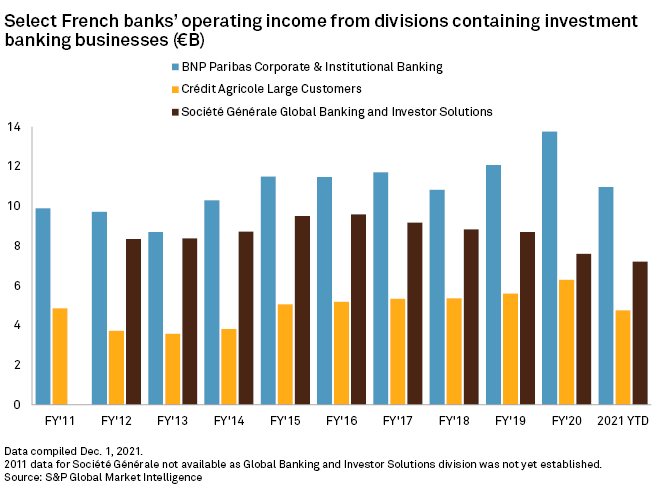

Strength in investment banking

BNP Paribas is forecast to achieve a full-year net profit of €8.63 billion, according to consensus analyst estimates compiled by S&P Global Market Intelligence. This would be the biggest full-year profit since Market Intelligence began tracking the data for the company in 1999.

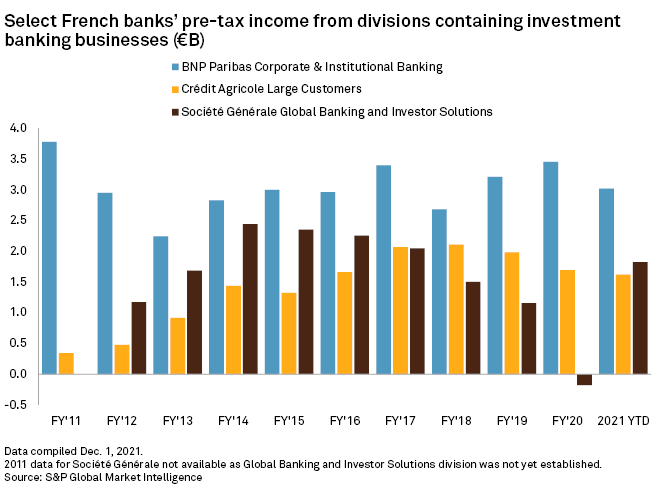

BNP Paribas' global markets business, part of its corporate and institutional banking division, has driven much of the bank's progress in 2021. Excluding the recently integrated Exane business, BNP's revenues from equities are set to reach €3 billion in 2021 based on year-to-date performance, 34% above 2015, which was the best year in the last decade, Benjamin Toms, banks analyst at RBC Europe Limited, said in a Nov. 2 note.

SocGen's global markets division has been similarly instrumental to its success in 2021. Revenue estimates for the business have increased 12% in 2021 and it has driven half of the bank's 10% growth in pre-provision operating profit in the year, Toms said. "Strong revenue trends have been industrywide, but Société Générale's focus on derivatives and structured products has been a particular driver of strength," said Toms. The bank is forecast to return to pre-pandemic net profit levels for full-year 2021, according to consensus estimates.

Still, some concerns exist around the sustainability of the French banks' performance in this area. "[Revenues from corporate and institutional banking are] always a question mark for us in terms of predictability and stability of the revenue base," said Nicolas Hardy, executive director in the financial institutions team at Scope Ratings. "It's intrinsically volatile."

Crédit Agricole SA, or CASA, is forecast to achieve a full-year net profit of €4.92 billion, which would be the highest such figure since Market Intelligence began tracking the data for the company in 2002. The bank's asset gathering division performed strongly in the first nine months of 2021 as pretax profits increased 33.8% compared to the same period in 2020 and 14.8% compared to the same period in 2019, according to Market Intelligence data.

CASA is benefiting from a good environment in asset management revenues via its 70% stake in asset manager Amundi, said Toms in a Nov. 12 note. "Our Amundi earnings estimates are 10% above consensus. Flows in Amundi's high-margin retail business have been strong during 2021, and we expect this to continue over the next two years."

Retail banking recovery

All three of France's largest listed banks are further benefiting from a sustained recovery in profits from French retail banking. In the second quarter, the lenders' net income from French retail banking increase by an average of 110.2% quarter over quarter, according to Market Intelligence calculations. The return to higher net income levels largely held up in the third quarter with an average quarter-over-quarter decline of just 2.0% across the three banks.

"The retail and domestic banking market has proven its resilience," said Sam Theodore, senior consultant for Scope Insights. "The French economy is growing now, French [small and medium-sized enterprises] are in business and, to some extent, the post-pandemic recovery is happening much better in France than in Germany."

The emergence of the omicron COVID-19 variant is unlikely to derail French banks' positive performance in the fourth quarter, Theodore added. "Compared to other large countries, like the U.S., Germany or the U.K., the anti-COVID social discipline in France is relatively higher. Around 88% of the adult population is fully vaccinated, there is wide usage of face masks and ubiquity of medical passes," said Theodore. "The government makes it clear that another lockdown is unlikely and is not being contemplated."

The strength of France's recovery from the COVID-19 pandemic's initial impacts has also been reflected in the decline in the three banks' cost of risk. BNP's cost of risk for the first nine months of 2021 stood at 42.2% of the figure for the whole of 2020, while CASA's was 34.7% and SocGen's was 18.6%, according to Market Intelligence calculations.

"The operating environment has improved and all the uncertainties we had concerning asset quality and profitability in the follow-up to the COVID-19 outbreak have eased or lessened," said Journois.