S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 Jan, 2021

By Yannic Rack

|

Total and SunPower's 75-MW solar plant in Prieska, South Africa, one of the largest in the country. |

Total SE has pulled ahead of the competition in reinventing itself as a broader energy company, deepening its push into renewable energy by buying up companies and assets at a much faster pace than any of its peers in the oil and gas industry.

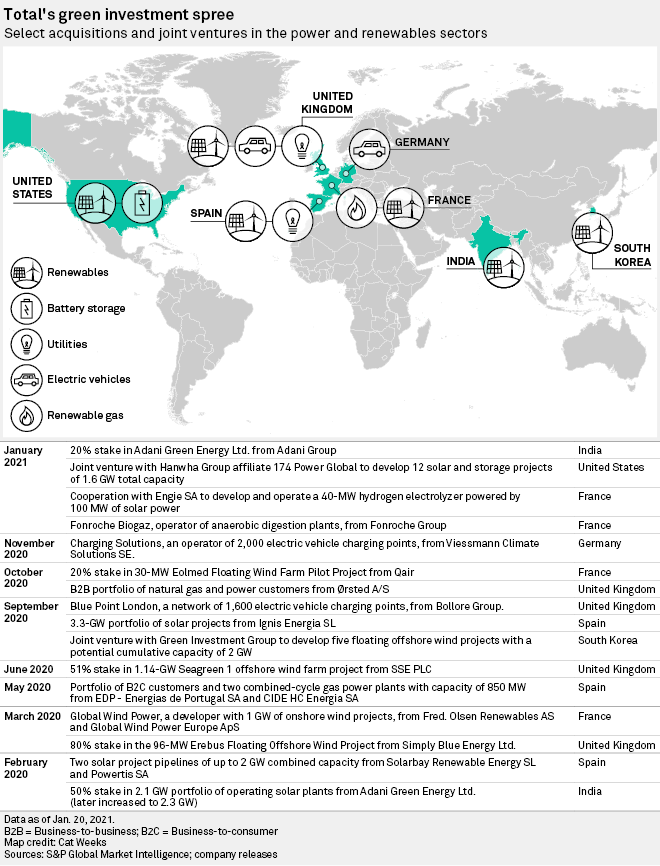

The company struck a $2.5 billion deal this month to buy a minority stake in Adani Green Energy Ltd., the listed solar power producer controlled by Indian tycoon Gautam Adani. The transaction, which also gives Total a 50% stake in Adani's roughly 3.4 GW of installed solar power plants, was the latest in a string of deals that has put the French group at the forefront of the oil industry's drive to diversify portfolios.

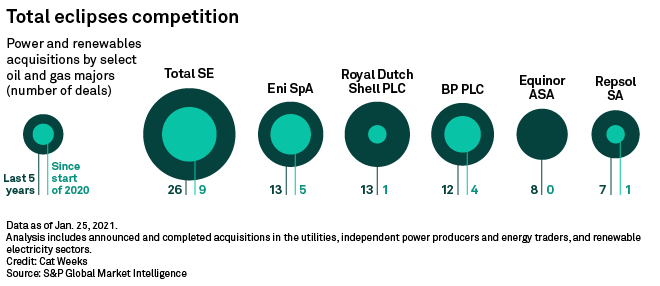

Over the past 12 months, Total has announced at least nine acquisitions in the renewable energy and power sectors, almost as many as its five largest European rivals combined, according to an S&P Global Market Intelligence analysis.

While Total has long been more acquisitive than others when it comes to decarbonization, 2020 marked an acceleration for the company. Along with many other majors, Total recently announced targets to lower its emissions and broaden its business, setting a goal to develop 35 GW of renewables capacity by 2025 and direct 20% of its spending to low-carbon electricity by the end of the decade.

"We are not there, in the low-carbon world, in electricity, to make some light diversification," Philippe Sauquet, president of Total's gas, renewables and power business, said in an interview. "It's really a gigantic move. If you want to do that in accordance with the growth of the market, or even go quicker ... we couldn't limit ourselves to organic growth."

Although none of its recent deals were on the scale of the one with Adani, the company's buying spree has given it a foothold in a wide range of industries across power and renewables.

Since the start of 2020, Total's acquisitions have ranged from offshore wind and solar projects to gas-fired power plants and even retail utility businesses. On top of that, the company signed deals in adjacent sectors, such as electric vehicle charging and biogas production, and it launched joint ventures to develop green hydrogen and battery storage projects.

"This is the kind of broad-based, diversified approach that all these companies are taking — simply because they need to do everything to get to net zero," said Pavel Molchanov, an analyst at Raymond James. "It's an 'all of the above' solution."

Top of the list

Still, Total is the most aggressive of the six supermajors when it comes to pivoting its business to low-carbon alternatives, Molchanov said. Figures compiled by Raymond James show that the company spent an estimated 15% of its capital expenditure on renewables and other clean technologies in 2020, roughly double and triple of what Royal Dutch Shell PLC and BP PLC spent, respectively.

"It's a short list, but Total is at the top of that list," Molchanov said.

All six companies still spend the vast majority of their money on their traditional businesses in oil and gas. Shell and BP have also played down the role of further large-scale M&A in their diversification, saying recently that they prefer to build out their development pipelines through existing platforms, such as Lightsource BP Renewable Energy Investments Ltd.

While the other European majors have made fewer renewables acquisitions than Total over the past 12 months, they have still announced new projects and joint ventures, secured auction awards and snapped up development pipelines.

Among the larger deals were Eni SpA's acquisition of a 20% stake in the Dogger Bank A and B offshore wind project in the U.K. from utility SSE PLC and Norwegian state-owned oil company Equinor ASA. And BP shelled out $1.1 billion to become a partner in Equinor's two planned wind farms off the U.S. East Coast, the Empire Wind and Beacon Wind projects.

Relative to their size, the smaller majors are also moving aggressively. Spain's Repsol SA is pouring about a quarter of its capex into green energy, while Eni and Equinor are not far behind Total in terms of shifting their investments, according to Raymond James.

The pandemic and oil price crash of 2020 might have brought a halt to that expansion. But, like the rest of the European majors, Total decided to stick with its decarbonization drive even while cutting capex in the rest of the business. In September 2020, the company said it would build 35 GW of wind and solar plants by 2025, up from a previous goal of 25 GW.

"We didn't compromise on our objectives. On the contrary, we found nice opportunities to make some acquisitions at much lower prices," Sauquet said, granting that the dynamic could continue. "It's clear that some small companies are lacking cash, and yes, there is a very strong likelihood that there will be companies willing to sell," he said.

Despite a tough year in the oil patch, the company has ample room to keep going. Jakub Zasada, an analyst at Fitch Ratings, said Total has significant flexibility in its capex plan and projected leverage for the coming years is within the guidance for the company's credit rating.

"They have the headroom necessary to make some additional investments," Zasada said, adding that he expects that all of the majors will need to keep acquiring assets to reach their targets. Still, during its strategic presentation in 2020, Total surprised the analyst with the number of projects it is already involved in.

"It seems that they are quite serious about reaching this target, and reaching it sooner rather than later," he said.