Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Aug, 2022

By Beata Fojcik and Mohammad Taqi

For foreign banks still contemplating the future of their Russian operations, President Vladimir Putin's decree banning the disposal of such businesses has complicated matters. There is a silver lining: These subsidiaries are increasingly profitable.

OTP Bank Nyrt., Raiffeisen Bank International AG and UniCredit SpA, three of the foreign banks most exposed to Russia, all reported higher second-quarter profits for their subsidiaries in the country as the ruble surged amid soaring commodity prices, reduced imports to Russia and capital controls introduced by the central bank.

The lenders have said they are considering their options amid widespread corporate withdrawals from Russia following its invasion of Ukraine, but Putin's decree banning investors from countries that hit Russia with sanctions from selling stakes in local banks appears to have limited their options. The ban will be in place until the end of 2022, but Putin has the right to approve potential deals on a case-by-case basis.

Hungary-based OTP Bank "is investigating the possibilities of a sale, but the presidential decree ... created a new situation," a spokesperson told Market Intelligence.

OTP Bank's Russian unit has generated interest from potential local investors, but it is unclear if the sale discussions can continue in the light of the decree, OTP Bank CFO László Bencsik said during an Aug. 11 earnings call. The executive noted that the bank will monitor how competitors still present in Russia and generating "enormous profits" in the country address the situation.

RBI has been working for months on strategic options for the Russian business, but "due to the complex situation and the constantly changing framework conditions, the process will still take some time," said a spokesperson for the Austrian bank.

Italy-based UniCredit has also drawn interest in its Russian business both from local investors and potential buyers from countries that have not hit Russia with sanctions. "We have no pressure [to sell] given our position, but we are looking at options," CEO Andrea Orcel said during a July 28 earnings call, before the decree was made. UniCredit did not reply to a request for comment on how the decree affects its plans in Russia.

The three banks could look at the case of Citigroup Inc. for an alternative exit strategy. The U.S. lender said Aug. 25 that it would wind down its consumer and commercial banking operations in Russia and sell certain banking portfolios — a move still possible under the new decree. The move will cost Citi, which had been seeking to exit Russia since before the invasion, about $170 million and affect about 2,300 employees and 15 branches.

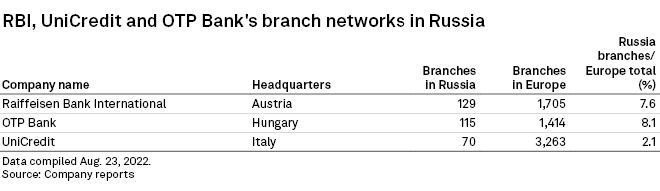

As of June 30, RBI and OTP had over 100 branches across Russia, while UniCredit had 70 branches. The percentage of Russia-based branches relative to the group branch network in Europe was the highest at OTP Bank.

Earnings boost

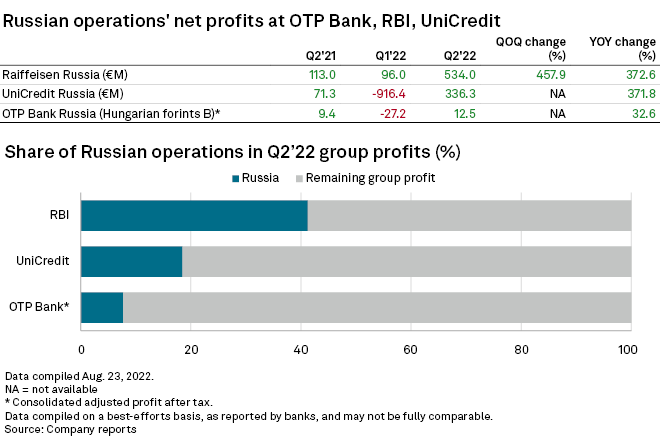

RBI's after-tax profit grew almost fivefold in quarterly terms in Russia and was a strong driver of the bank's second-quarter earnings. The profit remains entirely with the Russian unit due to a ban on dividend payouts and serves to strengthen the unit's equity base, the RBI spokesperson said.

OTP Bank generated 12.5 billion forints of second-quarter adjusted after-tax profit in Russia, after posting a net loss of 27.2 billion forints in the first quarter and a profit of 9.4 billion forints one year ago.

UniCredit posted a second-quarter net profit of €336.3 million from its Russian operations, rebounding from a significant loss in the first quarter. Partial release of loan loss provisions set aside in Russia in the first quarter contributed to the improved result, which was also the case for OTP Bank.

Risk aversion

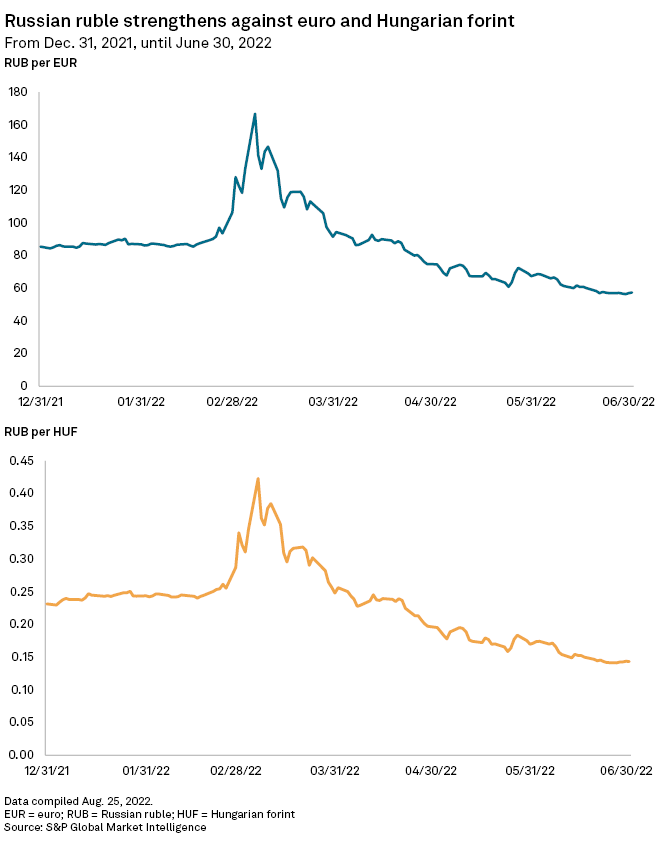

With uncertainty surrounding Russian operations, the three banks have taken measures to de-risk their operations in the country. RBI cut its loan portfolio in Russia by 22% quarter on quarter in ruble terms, but the strong performance of the Russian currency expanded the portfolio by 28.9% to €13.7 billion.

"The strong appreciation of the Russian ruble … was reflected in a significant increase in balance sheet items," RBI said. Since the outbreak of the war, no new loans had been granted in Russia, and the number of customers in the country had been reduced by 800,000 since the first quarter, the bank said.

OTP Bank also cut lending, but due to currency fluctuations, the share of the portfolio in the lender's total net loans increased to 4.5% in the second quarter from 3.2% in the first quarter. The bank adjusted its operating model in Russia to focus on consumer loans while reducing corporate lending, it told Market Intelligence.

At UniCredit, total risk-weighted assets related to Russia decreased by €2.7 billion quarter on quarter to €18.3 billion thanks to exposure de-risking.

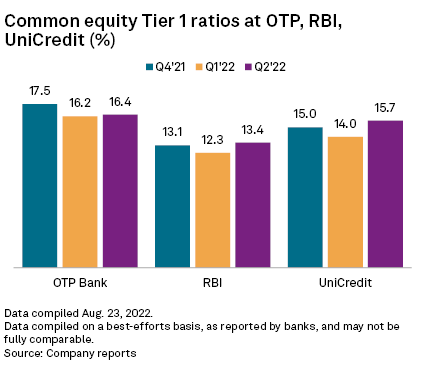

This reduced exposure combined with the surging ruble helped bolster the banks' capital ratios. UniCredit's group common equity Tier 1, or CET1, ratio grew by 173 basis points in the second quarter to 15.73%. Over 60 basis points of the hike were attributed by the Italian lender to the ruble fluctuations and de-risking activities in Russia.

The CET1 ratio at RBI's Russian unit strengthened by 131 basis points quarter on quarter to 13.15% thanks to retained earnings and the ongoing reduction of the portfolio. "We are careful not to reallocate the higher Russian CET1 into risk-weighted assets growth elsewhere in the group," RBI CEO Johann Strobl said during an Aug. 2 earnings call. RBI's group CET1 ratio increased to 13.4% from 12.3% in the first quarter, influenced by the group's M&A deals in Serbia and Bulgaria.

The CET1 ratio at OTP Bank also improved slightly quarter on quarter, growing to 16.4% from 16.2%. Foreign currency changes had the biggest positive impact on the ratio, according to the bank's second-quarter earnings presentation.

As of Aug. 30, US$1 was equivalent to 60.93 Russian rubles and 403.04 Hungarian forints.