S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 Sep, 2022

By Alison Bennett and Zain Tariq

The future of Ford Motor Co.'s industrial loan company charter application is up in the air.

Banking industry groups and consumer advocacy groups immediately took aim at Ford's July 22 application, stating that approval would allow the company to skirt regulations that traditional banks face. Meanwhile, industry experts are divided on the application's chances, with some predicting it has no shot under the current regulatory regime and others arguing that Ford's trustworthy name and the fact that other auto companies operate industrial banks bode well for the company.

|

If approved by the Federal Deposit Insurance Corp., the application would create Ford Credit Bank, which would be a direct and wholly owned subsidiary of Ford Motor Credit Co. LLC and an indirect wholly owned subsidiary of Ford Motor Company.

ILC approvals few and far between

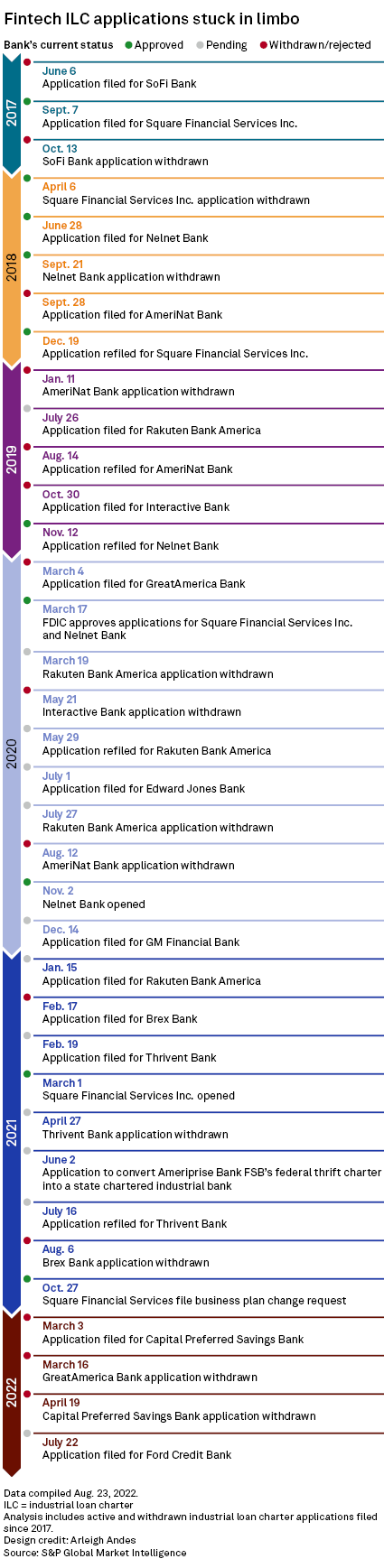

The recent path forward for industrial loan company, or ILC, charter approvals has been rocky, with most applicants withdrawing at least once and very few receiving approval.

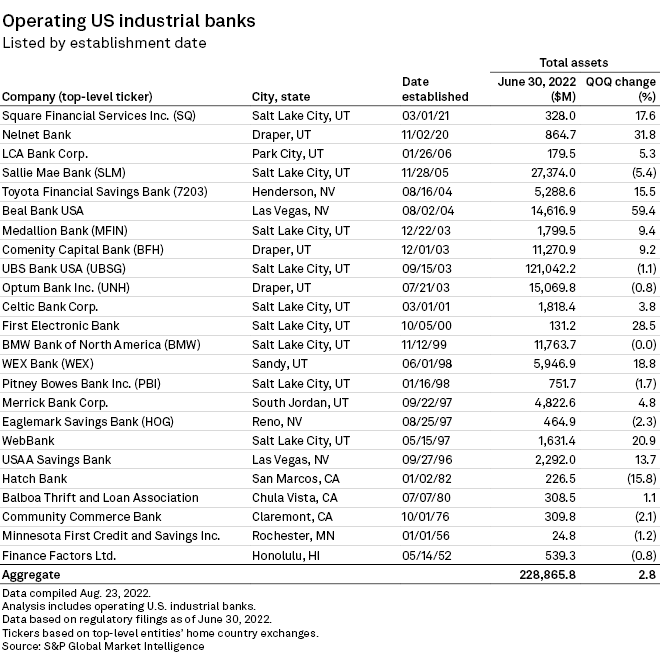

A total of 14 companies have applied for ILC charters since 2017, but only two of those companies have ultimately received FDIC approval: online financial company Square Financial Services Inc. and education financing company Nelnet Bank.

Prior to that, no new industrial bank had opened its doors since 2006.

Rakuten Bank America has a refiled application outstanding, and

Ford faces tall order

Given the uphill battle for other ILC hopefuls and regulators' current stance on financial services regulation, some industry experts believe Ford has very little chance of securing FDIC approval.

"There is likely to be a real regulatory resistance to this," Ian Katz, managing director at Capital Alpha Partners, said in an interview.

While the application "warrants watching," BTIG Director of Policy Research Isaac Boltansky is also "bearish" on Ford's chances.

In a note, Boltansky said that Ford was "strategically sound" in the framing of its application, which states the new entity would help support the financing of electric vehicles — a stance likely intended to dovetail with the Biden administration's support for those cars and trucks.

Still, "We believe the odds of Ford securing the FDIC's blessing are exceedingly low ... given the past reticence of FDIC Acting Chairman [Martin] Gruenberg regarding ILC charters and the vocal opposition from both traditional banking groups and consumer advocates," Boltansky wrote.

The FDIC should not make the financing operations of commercial companies, such as technology firms and auto firms, eligible for charters, Chris Cole, senior regulatory counsel at the Independent Community Bankers of America, or ICBA, said in an interview.

"It's always been our feeling that there should be a separation between banks and commercial activity," Cole said. "Any time you have a commercial company owning a bank, there will be a conflict of interest."

Others think Ford has a shot

Meanwhile, Frank Pignanelli, executive director of the National Association of Industrial Bankers, said Ford's "chances are pretty good," given that vehicle makers Toyota, BMW and Harley-Davidson all operate industrial banks.

Additionally, Ford and GM already have experience with financial services and they are "good, well-thought of names. There's a trust factor that is very high," Pignanelli said.

ILCs "are regulated the same as any other bank. There's a lot of regulations that are now in place," such as capital requirements and rules pertaining to the Community Reinvestment Act, according to Pignanelli.

The door for approval may be open for companies, like Ford, that already provide financing, one attorney said.

"I think if you are an applicant that has a traditional financing business, there is a case to make," Clifford Stanford, partner and head of the bank regulatory practice at Alston & Bird, said in an interview.

ILC opposition escalates

Banking industry groups' and consumer advocacy groups' fight against ILCs recently escalated when the House Financial Services Committee approved the "Close the ILC Loophole Act," clearing it for consideration by the full U.S. House.

The bill seeks to ensure that commercial and financial technology companies are subject to federal supervision to own or acquire ILCs.

Prior to the vote, auto industry groups and companies — including Ford — wrote to the committee in opposition, contending that the bill "will adversely impact the vehicle industry by eliminating decades-long [ILC] charters and unnecessarily creating a prohibition on future auto-related businesses seeking an ILC charter."

Proponents of the bill say there is hope for enactment, but that it may take time. With the midterm elections approaching, "We're aware of challenges. Time is running out," Susan Sullivan, ICBA vice president of government relations, said in an interview.

However, "I think we have a very strong, broad coalition supporting the bill on the House side," Sullivan said. "We'd love to see a bill introduced in the Senate."