Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Sep, 2021

|

| A concept design of Ford Motor Co.'s planned $5.8 billion BlueOvalSK Battery Park in Kentucky is shown above. When completed, the company's three new battery plants could add an annual 129 GWh of battery cell manufacturing capacity to the U.S. Source: Ford Motor Co. |

U.S. automaker Ford Motor Co. sent battery markets buzzing when it announced plans to spend $11.4 billion on battery and electric vehicle manufacturing, but it left unanswered questions of where it will find supplies of critical metals.

A suite of battery metals including lithium, nickel and cobalt, which are overwhelmingly mined and refined outside the U.S., face burgeoning supply deficits and volatile prices, among other supply chain constraints. That will create problems for Ford, which hopes to meet the rapidly increasing demand for EVs.

"Ford is in the same boat as everyone else," Caspar Rawles, head of price and data assessments at Benchmark Mineral Intelligence, said in an interview. "They're all going to be vying for the materials, which are expected to fall into deficits or already are in deficit. You're going to see a surge in demand, and we haven't had a corresponding uptick in new supply."

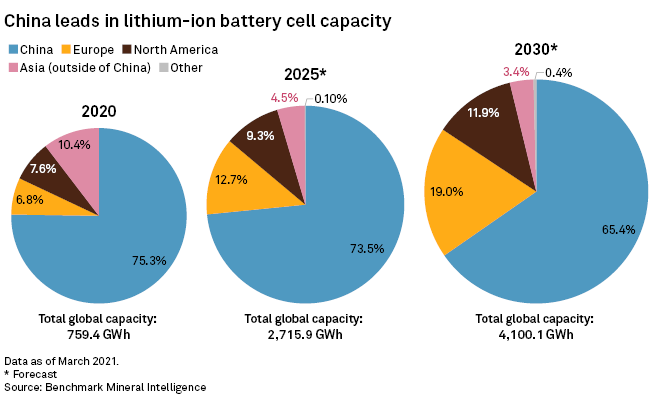

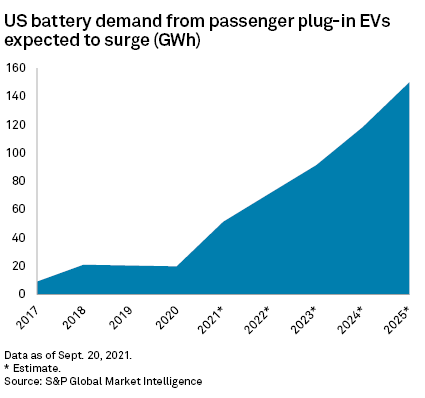

Ford's plan, announced Sept. 27, to construct a trio of lithium-ion battery factories in Kentucky and Tennessee aims to roughly double the 2020 U.S. battery production capacity by adding 129 GWh of manufacturing a year, with production starting at the plants in 2025. The project, built in collaboration with South Korean battery-maker SK Innovation Co. Ltd., could catapult the country up the ranks in global battery capacity at a time when U.S. contributions to the supply chain pale in comparison to counterparts like China. In 2020, North American lithium-ion battery cell capacity represented just 7.6% of global capacity, according to Benchmark Mineral Intelligence data. In comparison, 75.3% of battery cell capacity was located in China.

"It's a pretty big deal," Rawles said. "The U.S. and Canada have historically been behind in terms of building out lithium-ion battery capacity."

But the metals being mined upstream are in short supply. S&P Global Market Intelligence forecasts show global primary nickel supply facing a deficit in 2021, coming up short 128,000 tonnes. Although the outlook for refined cobalt has improved in recent months, the world could still see a 1,800-tonne shortfall this year, and supplies will be tight through 2025, according to Market Intelligence estimates. And while safe from a deficit in 2021, lithium will likely hit an estimated 30,000-tonne shortage in lithium carbonate equivalentby 2025.

"I think the raw material shortage is the biggest risk to electrical adoption out there in the market today," said Seth Goldstein, a senior equity analyst specializing in lithium and electric vehicles at Morningstar Research Services. "One of the potential barriers automakers are seeing is a lack of raw materials of namely the battery materials they need if we're going to get to the automakers' plans of 40% to 50% of their production being battery electric vehicles."

Ford aims to create a 3,600-acre "vertically integrated ecosystem" at its proposed Tennessee-based campus, dubbed Blue Oval City, to support the expansion of its EV lineup. But full vertical integration would require the battery metals and minerals to be mined nearby, and the U.S. provides a tiny fraction of the world's lithium, the battery ingredient hardest to replace with new technology. In 2020, the U.S. produced 2,985 tonnes of lithium carbonate equivalent, about 0.72% of global raw material supply, according to Market Intelligence data.

The Biden administration's rhetoric has focused since inauguration on spurring the entire domestic supply chain for batteries. U.S. President Joe Biden issued an executive order on supply chains in February, and the U.S. Energy Department set policy to promote battery supply chains in a June announcement.

"Strengthening our domestic supply chain will accelerate our efforts to decarbonize the economy — helping to power electric vehicles and boost grid storage and resiliency," U.S. Energy Secretary Jennifer Granholm said in a statement at the time.

The automaker relies on its battery cell partners for raw materials, according to a Ford spokesperson. However, the company is "evaluating all avenues to secure raw material supply," including recycled feeds and domestic mining.

"We aspire to source only raw materials that are responsibly produced," a company spokesperson told Market Intelligence in an Oct. 1 email. "This year, we are mapping our EV battery supply chain to gain greater transparency about battery sources of cobalt, nickel and lithium. We are also conducting responsible sourcing audits for each of the actors in these relevant mineral supply chains."

Speaking at the Detroit Homecoming VIII event Sept. 25, Ford CEO Jim Farley called attention to the lack of domestic battery material options, The Detroit News reported.

"We have to bring battery production here, but the supply chain has to go all the way to the mines," Farley said. "That's where the real cost is, and people in the U.S. don't want mining in their neighborhoods. So, are we going to import lithium and pull cobalt from nation-states that have child labor and all sorts of corruption, or are we going to get serious about mining?"

Ian Lange, an economist at the Colorado School of Mines who served as an economist for both President Biden and former President Donald Trump, called Farley's statement, "one step in the right direction for domestic mining."

"It's one thing for mining firms to say, 'guys, you're going to need us,' than it is for these downstream firms, especially the ones that the [Biden] administration has been courting, [to say it]," Lange said. "It's harder to ignore Ford."

The automaker appears to hope that recycling can provide some of what it needs. In their Sept. 27 release, the automaker also touted its partnership with Nevada-based battery recycling company Redwood Materials Inc. The pair plan to orchestrate a "closed-loop battery recycling system" to localize the supply chain for Ford's battery materials, though the project would take time to ramp up.

"[W]e need to plan far ahead for the increased demand of materials that this transition will create," Redwood Materials said in a statement. "We also must manage supply chain risks carefully around lithium-ion batteries or we risk a repeat of the semiconductor production shortages causing chaos in the world today."