S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 Jul, 2022

Annual rate increases sought by Florida property insurers overshadow any savings the new state-backed reinsurance program would provide to policyholders, according to an analysis of rate filings by S&P Global Market Intelligence.

The Reinsurance to Assist Policyholders program, or RAP, was created during a special legislative session at the end of May to help Florida property insurers struggling to obtain enough reinsurance and provide some premium relief for policyholders. Under the new law, participating insurers are required to either file supplemental requests or amend pending rate filings with the state's insurance regulator to show cost savings related to the program. Any savings are then to be passed onto policyholders through lower premiums.

|

* Download a template that allows you to track new competitor rate filings using different variables. |

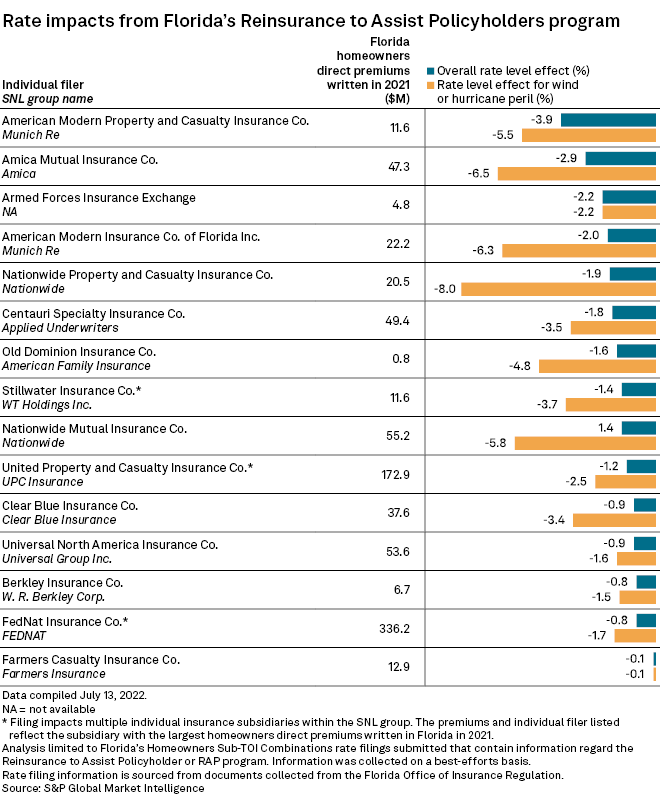

The program's savings to policyholders currently reflect low single-digit cuts on filings submitted to the regulator. But some of the same insurers participating in the program are raising, or seeking to raise, their annual rates by double digits in 2022.

Little overall savings

Any premium decreases for policyholders would be reflected in their wind or hurricane coverage. Of the filings reviewed, the median policyholder rate reduction for premiums related to hurricane protection was 3.5%. However, the median overall rate level decrease was only 1.4%.

The largest overall requested premium reduction of those filings came from Munich Re's American Modern Property & Casualty Insurance Co. at 3.9%. The smallest requested reduction of 0.1% was submitted by Farmers Casualty Insurance Co.

United Property & Casualty Insurance Co., a unit of United Insurance Holdings Corp., is seeking to pass on an overall RAP savings of 1.2% to its policyholders starting on Sept. 1. The decrease in premium from the RAP program is considerably lower than the 14.8% increase it is requesting for new and renewal business starting on July 25.

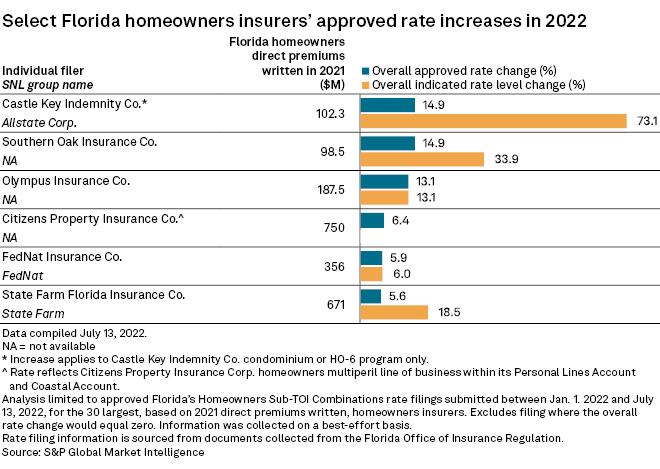

Allstate unit boosts rates by nearly 15%

A number of the largest Florida homeowners underwriters received regulatory approval to boost their annual rates by more than the reductions policyholders will receive under the assistance program.

Castle Key Indemnity Co., an The Allstate Corp. unit, made the decision to increase its rates by 14.9% in 2022, compared to its indication rate of 73.1%. The indication rate is the actuarially justifiable rate change calculated by the company. Castle Key's approved rate is the highest average increase a company may receive without having a public hearing, per state law.

Of the approved filings in this analysis, State Farm Florida Insurance Co. had the smallest increase of 5.6%, compared to the median RAP reduction of 1.4%.

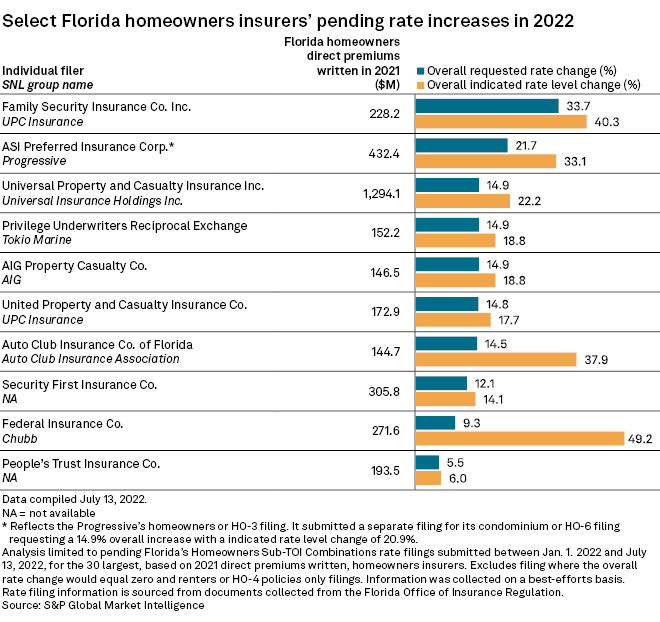

Double-digit increases awaiting approval

Pending rate filings for many of the largest Florida homeowners are much higher than the median premiums savings from the newly enacted law. The biggest such increase is from another United Insurance unit, Family Security Insurance Co. Inc., which is looking to raise its rates by 33.7%. The June 10 filing was submitted under the state's "file and use" law, which stipulates that an insurer may use a new rate without official regulatory approval if certain conditions are met.

People's Trust Insurance Co.'s requested increase of 5.5% is smallest pending rate increase among the largest insurers.