Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 May, 2022

Reinsurers are pulling back from, or raising prices in, the struggling Florida property market.

Two major global reinsurers, Munich Re and Swiss Re AG, recently reduced their Florida capacity by 50% to 80% in response to the Sunshine State's ongoing property insurance crisis. RenaissanceRe Holdings Ltd., meanwhile, has steadily shrunk its exposure to the market over the past several years and is raising rates by double digits at the June 1 renewals. The Florida's homeowners market now represents just 2.5% of RenRe's gross written premiums.

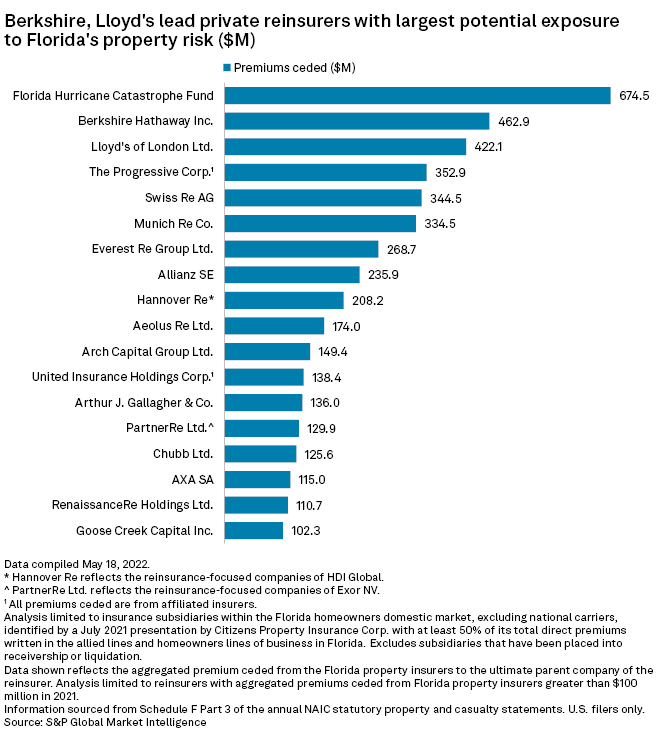

Berkshire has largest exposure to Florida property insurers

Florida insurers ceded $462.9 million in premiums to Berkshire Hathaway Inc. in 2021, the largest amount of ceded premiums for a private entity within the analysis. Berkshire's largest cedent is First Protective Insurance Co., which accounted for roughly 74% of the total premiums.

Lloyd's of London was second, having picked up $422.1 million in premiums ceded. Two Lloyd's syndicates received ceded premiums of more than $40 million in 2021. MS Amlin Underwriting Ltd. received $45 million in ceded premiums last year, while Managing Agency Partners Ltd. received $41.6 million.

Ceded premium totals for The Progressive Corp., which ranked third, as well as United Insurance Holdings Corp., were all from their own Florida affiliates.

Universal Insurance affiliate cedes most premiums in 2021

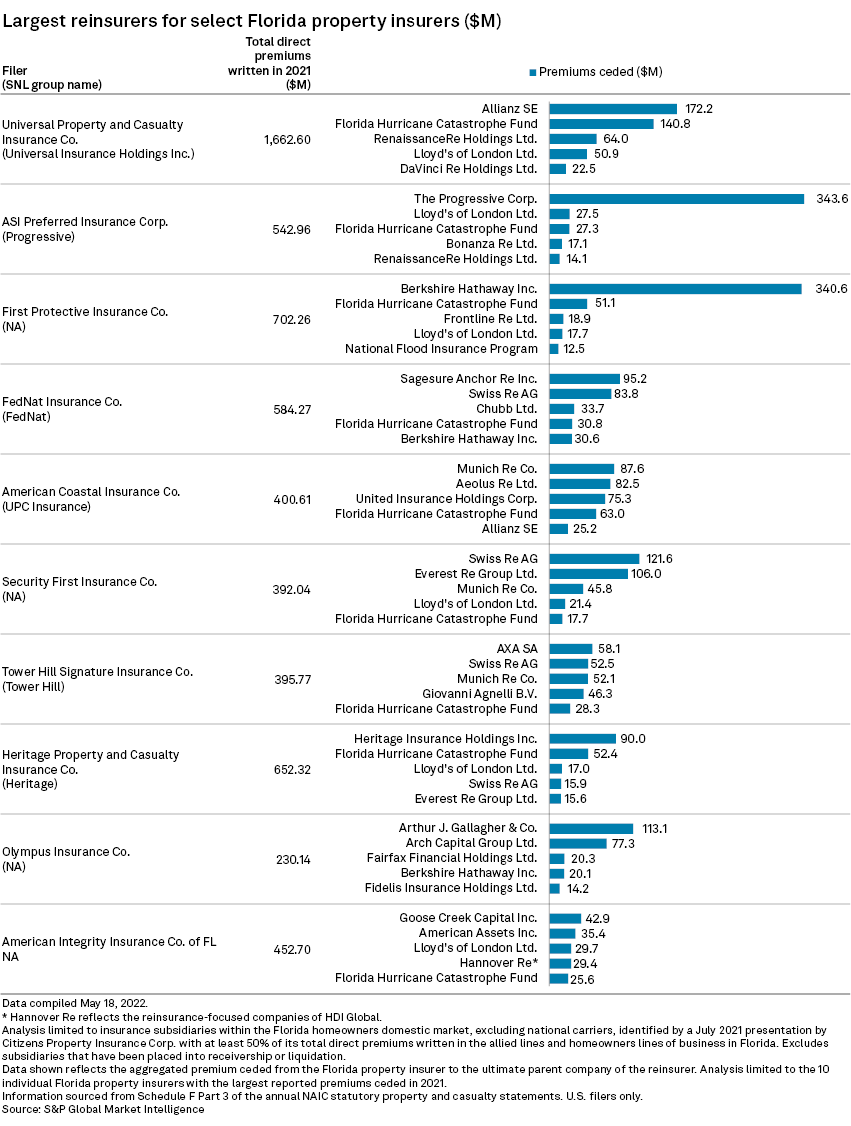

Universal Insurance Holdings Inc.'s Universal Property & Casualty Insurance Co. ceded roughly $578 million in premiums to reinsurance companies in 2021, of which $172.2 million went to Allianz SE.

As it looks to cut capacity going forward, Swiss Re was among the largest reinsurance partners for four insurers in this analysis in 2021. It was among the five largest reinsurers for Security First Insurance Co., FedNat Insurance Co., Tower Hill Signature Insurance Co., and Heritage Property & Casualty Co.

Munich Re was also among the largest reinsurers for Security First and Tower Hill Signature. It was also the biggest reinsurer for American Coastal Insurance Co. Inc.

Rating downgrade could have major impact

A recent rating downgrade for FedNat Insurance Co. will adversely affect its ability to obtain excess-of-loss reinsurance coverage at the start of this year's hurricane season. Its parent, FedNat Holding Co., recently announced that Monarch National Insurance Co., will receive a $15 million investment from Hale Partnership Capital Management LLC and will assume roughly 83,000 of the remaining FedNat Insurance policies when the transaction closes.

Monarch anticipates being able to obtain catastrophe excess of loss reinsurance coverage for the coming storm season consistent with its historical structure.

This analysis was limited to individual insurance subsidiaries of the Florida homeowners domestic market, excluding national carriers, identified by a July 2021 presentation by Citizens Property Insurance Corp. Of those operating in the Florida domestic market, insurers must have derived at least 50% of their total premiums written within allied lines or homeowners line of business in Florida during 2021 to be included. This analysis excludes insurers that have been placed into receivership, liquidation, or were merged into another company since Citizen's July 2021 report.

In total, the analysis is limited to the reinsurance relationships of 33 individual insurance subsidiaries, which collectively ceded roughly $6 billion in premiums in 2021 from the aggregate $9.26 billion in direct premiums written.