S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

11 Mar, 2021

By Declan Harty and Stefen Joshua Rasay

An unprecedented flood of blank-check companies hitting Wall Street is amplifying concerns of an IPO bubble.

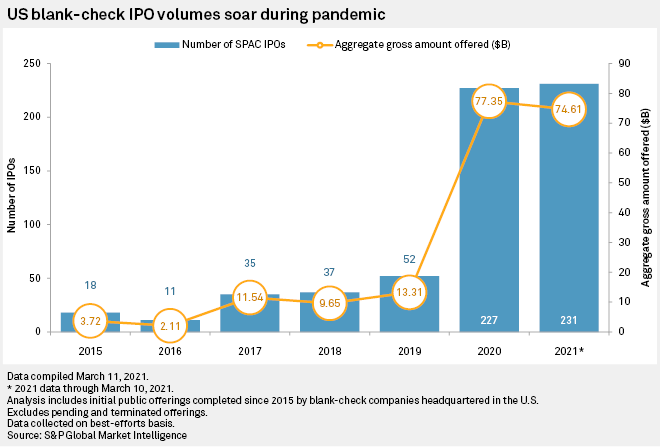

Special purpose acquisition companies have drawn widespread interest over the last year, drawing endorsements from celebrities like Colin Kaepernick and investment giants like Bill Ackman. SPACs have launched with names like Just Another Acquisition Corp. and Do It Again Corp. And now, in one of the starkest signs of the market's overexuberance, it has taken only 70 days in 2021 for the number of new U.S.-based SPAC listings to topple the annual record of 227 set in 2020, according to S&P Global Market Intelligence data.

"The pace of SPAC IPOs has been unsustainable," University of Florida finance professor Jay Ritter said in an interview. "Having hundreds of SPACs search for companies with pre-money valuations of $1 billion to $2 billion creates a huge demand from SPACs for a limited supply of operating companies."

Once viewed as a back door to the public markets, the SPAC structure has stormed back. Retooled to appeal to big and small companies, and with more investor protections in place, SPACs have struck deals with high-profile unicorns such as DraftKings Inc., United Wholesale Mortgage LLC and Social Finance Inc., giving them a faster route to a U.S. listing that proponents say offers more certainty and control than an IPO. A blank-check firm's sponsors take the shell company public to raise a lump sum of cash that, along with additional capital from themselves and other investors, is then used to buy and reverse-merge with a private company. In return, sponsors can collect north of 20% of the combined company's shares and capitalize on a deep discount on the warrants, relative to the price that public market investors pay.

While SPACs have long faced critics, the sudden acceleration of new listings, coupled with a broader sell-off in certain U.S. equities, has forced many on Wall Street to question whether the market has gotten ahead of itself.

Ritter is not alone in believing new SPAC issuances are overheating. Goldman Sachs Group Inc. Chairman and CEO David Solomon, for instance, issued a similar warning of an impending pullback in January.

Others have targeted the structure itself. Staffers in the U.S. Securities and Exchange Commission's Office of Investor Education and Advocacy have worried about the potential for SPAC sponsors to pursue a deal that is not favorable to regular investors. Charlie Munger, executive vice chairman of Berkshire Hathaway Inc., recently called the craze around SPACs "a sign of an irritating bubble." Americans for Financial Reform and the Consumer Federation of America, two powerful investor advocacy groups, wrote a letter in mid-February to congressional leaders warning that the SPAC boom is being fueled by "conflicts of interest and compensation to corporate insiders at the expense of retail investors," citing the sponsor compensation economics and the ability for SPAC targets to set forward guidance, among other issues.

"SPACs are very fertile grounds to find highly problematic companies," said Carson Block, the activist short seller behind Muddy Waters Research, in an interview. "It just has all these perverse incentives that align SPAC promoters, the shareholders of these private companies and bankers."

Block has publicly taken on at least two companies that went through SPAC deals in the last year: MultiPlan Corp. and XL Fleet Corp., both of which have pushed back Muddy Waters' research. Short sellers have been taking a harder look at the blank-check market in 2021, with SPAC short interest up more than 280% year-to-date, bringing total short interest to $2.73 billion as of March 9, according to data from S3 Partners LLC.

Even Chamath Palihapitiya, a prolific SPAC sponsor whose blank-check firms have struck deals with companies including Virgin Galactic Holdings Inc., Opendoor Technologies Inc. and SoFi, said on a podcast released March 6, "the SPAC market has taken a real beating," which, if it continues for one to two more months, could trigger "a bunch of busted IPOs."

New SPACs coming to market could run into challenges down the road in identifying and agreeing on terms with a target company, getting financed, or even retaining the attention of investors because of the glut. But Doug Ellenoff, who has worked on SPAC deals for years as a partner at Ellenoff Grossman & Schole LLP, said that does not indicate problems with the structure itself. The structure allows retail and institutional investors to reject a SPAC's proposed merger, to redeem their shares at the IPO price, and ultimately to get their money back if the SPAC liquidates, Ellenoff noted.

There is a distinction to be made between the mechanism and the market, Ellenoff said.

"Obviously, it is accelerating. And any time anything happens that quickly, one has to pause and analyze whether or not it has come too far too quickly. That doesn't mean it has. But you certainly have to reflect on it," the New York-based attorney said in an interview. "From my point of view, the SPAC market has demonstrated its utility. It has validated why it exists and why the naysayers are wrong."

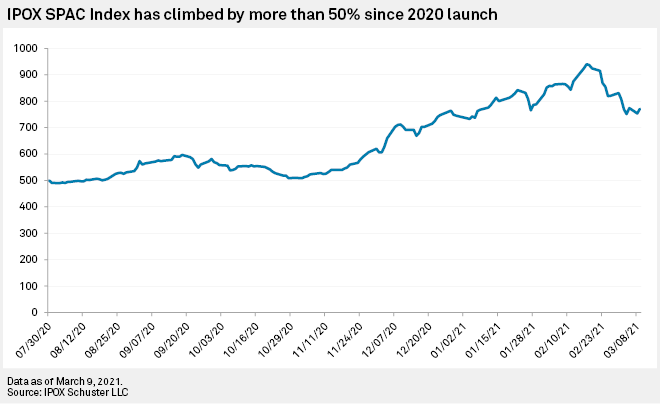

The SPAC market has come under pressure in recent weeks as part of a broader shift across the investment landscape. Expectations of a sharp economic rebound later this year have prompted bond yields to spike and put the low-interest-rate environment that helped fuel growth stocks, the broader IPO boom and newly public names, including SPACs, on notice. A popular benchmark for tracking blank-check companies, the IPOX SPAC Index, has subsequently fallen 18% from its mid-February high of 940.33, according to data from IPOX Schuster LLC. But the index is still positive on the year and remains up by more than 50% since its July 2020 launch.

Uncertainty around inflation has played a role in the decline of some SPAC stocks, as it has for much of the technology sector and other growth industries, said Kristi Marvin, founder of SPACInsider.com and a former investment banker who worked on SPACs in their pre-financial-crisis heyday.

Marvin sees the pullback as cyclical rather than the indication of a systemic concern about the model.

"SPACs will always be attractive to a certain type of company," Marvin said in an interview. "This year has been an educational process for the market. Now that the genie's out of the bottle, SPACs aren't going to go away."