Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Jun, 2021

By RJ Dumaual and Husain Rupawala

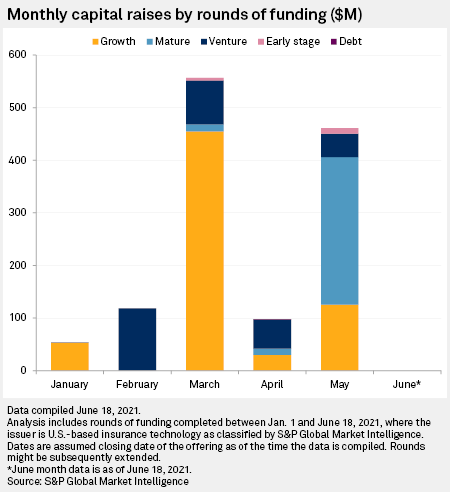

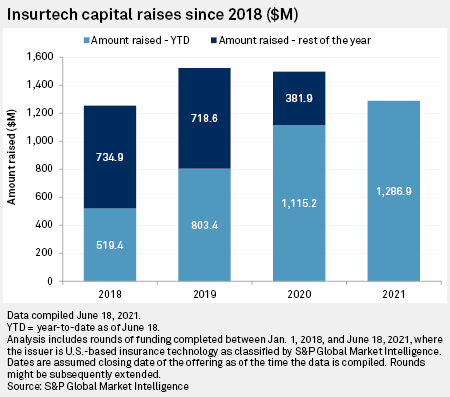

Insurtech companies on both sides of the Atlantic have turned in numerous large funding rounds thus far in 2021, enticing investors with their return potential and big addressable markets.

Online insurance provider Next Insurance Inc., cyber-focused Coalition Inc., data-driven Corvus Insurance Holdings Inc., Berlin-based digital insurance company wefox and California-based CollectiveHealth Inc. are just some of the insurtech companies that have registered funding rounds of at least $100 million.

Sam Evans, partner at Eos Venture Partners, said investors are bullish on growth prospects of insurtechs and are factoring multiple years of growth as a given in their valuations. Attractive features of such companies include targeting large underserved markets and their ability to scale into new markets with established solutions.

"We are seeing a flight to quality, where a small number of leading insurtechs are able to raise significant amounts of capital," Evans said in an email.

Kaenan Hertz, managing partner for Insurtech Advisors LLC, said insurtechs are focused on "taking out friction" in the market, primarily with consumers or small businesses whose owners are more like individuals, making "slick, simple products with easy interaction."

Lemonade Inc.'s IPO and the subsequent "meteoric rise" by its stock are probably playing a role in attracting private investment, according to Hertz. Additionally, private equity and venture capital companies need a place to make investments with government bonds yielding so little. Hertz called it a "classic case" of excessive demand in the form of capital chasing too little supply of insurtechs.

Significant return potential

Caribou Honig, partner at SemperVirens Venture Capital and chairman of InsureTech Connect, said in an email that large funding rounds "absolutely rely on growth for justification." Even for investors in relatively later-stage startups, the decision comes down to "asymmetric risk" as the upside case is logging 10x or better returns, while the worst case downside is losing the capital, Honig said. In many cases, the investment terms include additional downside protections, Honig added.

Because insurance has been "relatively slow" to incorporate the latest technology, incumbents have enormous market capitalizations and the addressable market is massive, the "sky is the limit" for insurtechs that have relevant products and a "path to growth," Honig said.

Hertz expects strong investor interest to last for at least the next three to five years unless the next round of companies to go public "flame out" like Root Inc. and Metromile Inc. As for potential IPOs, Hertz flagged Next Insurance, Pie Insurance Holdings Inc. and Bought by Many as possible candidates.

"I think the insurtechs on the life side are less likely to go public as they seem to be even less profitable than the insurtechs on the P&C side," Hertz said.

For Honig, as long as there are big exits, investor interest in the category will remain. Lessons can be gleaned from the fintech world as payments continues to see strong investor interest due to its ability to create "large, sustainable businesses" such as PayPal Holdings Inc. and Square Inc.

"The same opportunity is available in insurance," Honig said.