Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Dec, 2021

|

First Solar, whose modules were used to build the Desert Sunlight solar plant in Riverside, Calif., hopes to capitalize on efforts by the Biden administration to diversify solar supply chains away from China. |

First Solar Inc.'s plan to double its manufacturing capacity and chip away at Beijing's dominance of the solar market depends on a rare critical mineral produced largely in China.

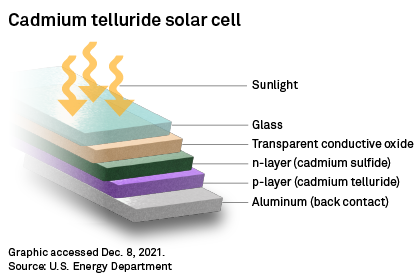

The Biden administration has held up First Solar as a model for domestic manufacturing, and the U.S. Government Accountability Office said in a November report that the company's cadmium telluride solar modules could help cut the industry's production costs. However, the technology's reliance on tellurium, a semiconductor typically produced as a byproduct of copper refining, raises concerns about raw material shortages, the agency said.

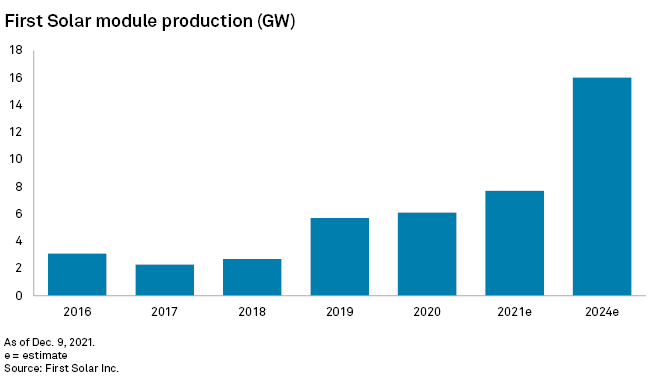

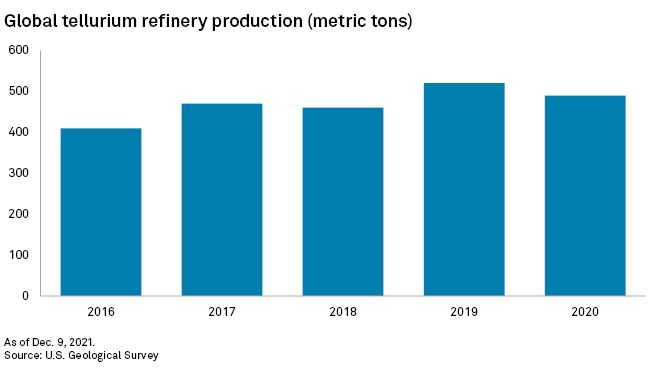

First Solar's plan to spend $1.36 billion to help increase module capacity to 16 GW by 2024 seems certain to strain the tellurium market. If the company achieves its goals, its annual demand for the mineral will exceed last year's estimated global production by up to 70%, according to data from a November report by researchers at the Institute of Environmental Science and Technology at the Autonomous University of Barcelona.

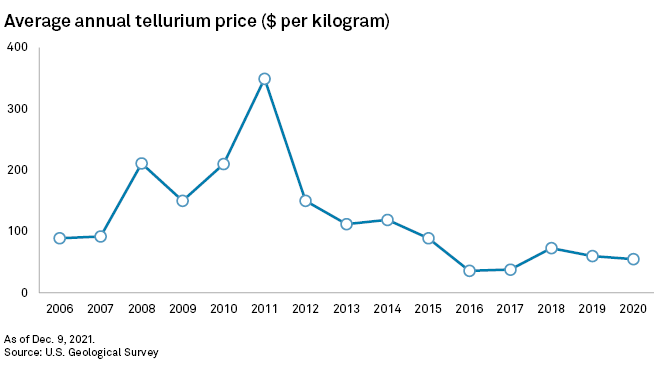

First Solar, which is headquartered in Arizona, does not disclose how much tellurium it uses. In filings to the U.S. SEC, the company has warned that "a substantial increase in tellurium prices or any limitations in the supply" could hurt its profitability and growth objectives.

The hunt for tellurium is a microcosm of challenges the energy sector faces in powering the world economy with mineral-intensive green energy resources rather than fossil fuels.

"There's going to be a supply crunch, no question about it," said Tyrone Docherty, president and CEO of First Tellurium Corp., which plans to produce tellurium at a site in Colorado that First Solar once owned.

'Decoupled' from China — to a degree

First Solar announced plans this summer to expand production in Ohio and in India as competitors were coming under growing scrutiny for dependence on the raw material polysilicon from China's Xinjiang region, where Beijing is accused of suppressing Uyghurs and other Muslim minorities, including with forced labor.

A spokesperson for the Chinese Embassy in Washington, Liu Pengyu, said labor-abuse allegations are "an out-and-out lie" that will "disrupt and undercut the stability" of international supply chains and global cooperation on climate change.

For First Solar, which does not use polysilicon, the allegations provided an opportunity to grab market share. The U.S. International Development Finance Corp. on Dec. 7 said it will lend First Solar up to $500 million for the India expansion, which will promote "better standards that align with U.S. values," the agency said, as well as provide alternative supply chains for the solar industry.

Customers value the supply chain transparency that First Solar offers, CEO Mark Widmar has said repeatedly. Having previously criticized America's "overreliance on China's solar industry," Widmar said on a November earnings call that First Solar is "completely decoupled from a Chinese supply chain."

The tellurium market is nothing if not opaque, however. One of First Solar's top suppliers of cadmium telluride, 5N Plus Inc., does not disclose how it procures tellurium. As for Widmar's claimed separation from China, a First Solar spokesperson said the CEO was referring only to Chinese supply chains linked to polysilicon.

China is among First Solar's suppliers for materials the company actually uses, the spokesperson, Reuven Proenca, said in an emailed statement.

China accounted for 61% of estimated global tellurium production in 2020 and 21% of world reserves, according to the U.S. Geological Survey. In an SEC filing on its use of conflict minerals, First Solar said one-quarter of the smelters and refineries in its supply chain last year were in China.

"Regardless of where we source our materials from, our suppliers are, without exception, required to uphold the same high social and environmental standards that we subscribe to and champion," Proenca said. "We have zero tolerance for forced labor and can confidently state that our supply chain has no exposure to Xinjiang in China, which is a level of assurance that few in the industry can offer."

'Great sign' for North American supply

When First Solar unveiled its expansion plans in June and July, efforts to boost North American tellurium supplies were already in motion.

Rio Tinto in March said it was investing $2.9 million in a plant to produce about 20 tonnes of tellurium annually, or about 4% of estimated global production last year, at its Kennecott mine near Salt Lake City. 5N Plus said in early June that it was spending $8.5 million to increase development in Canada of "critical and strategic materials, including those containing tellurium."

Docherty, the First Tellurium CEO, said Rio Tinto's investment is a "great sign" for the market. "They've had that property there in Utah for decades, and now they're deciding that tellurium's important enough to build their own recovery plant," Docherty said. "I think they see that demand is going to be there, and away we go."

A Rio Tinto spokesperson said the company's tellurium investment will provide North American customers with reliable supplies and reduce Rio Tinto's operating costs by eliminating the need to treat tellurium-containing waste. 5N Plus did not respond to messages seeking comment.

First Solar does not comment on discussions with potential suppliers, Proenca said. The company worked with suppliers to build up tellurium reserves ahead of expansion announcements this summer, and global supplies are expected to increase as copper production grows, Michael Koralewski, the chief manufacturing operations officer, said in an emailed statement.

|

Rio Tinto plans to produce about 20 tonnes of tellurium annually at its Kennecott mine in Utah. |

Cutting consumption to manage need

Access to tellurium has always been of critical importance to First Solar, which used to employ its own team of geologists to explore mineral claims. Like other manufacturers, though, First Solar faced intense competition from Chinese producers, and its strategy soon changed.

After it implemented a restructuring plan to cut costs, the company in 2013 sold property in Colorado where tellurium had been discovered to a group of investors led by John Keller, First Solar's former exploration manager for North America.

As First Solar retrenched, it focused on cutting the amount of tellurium it needs to make modules. Simon Jowitt and Brian McNulty, economic geologists at the University of Nevada, Las Vegas, estimate the tellurium intensity of cadmium telluride solar modules has fallen by more than half in the past decade.

|

"[First Solar] can puppeteer every single part of the process to make the modules more efficient," said Kelsey Goss, a solar analyst at the consulting firm Wood Mackenzie who previously worked at First Solar. "And that is something that I think they probably are doing" to manage their tellurium needs.

How far companies can cut their demand for the material is unclear, however.

"The industry will encounter fundamental mass limitations for how many solar cells it can manufacture due to basic constraints in sourcing raw material," Samuel Goodman, an analyst at the U.S. International Trade Commission, or USITC, said in a 2019 article published in the Journal of International Commerce and Economics.

"These are intensive processes," Goodman added, "whose expansion would not necessarily be economically viable unless downstream prices increased, especially for tellurium."

Koralewski said initiatives are underway to further decrease the tellurium intensity of First Solar's modules, and Widmar has told investors that the company's module recycling program someday will offer at least a partial solution to its raw-material needs. In the meantime, First Solar is in the market for new sources of supply.

Record demand for First Solar modules

In November, First Solar reported that module bookings were up more than 150% from the same period of 2020, and the company said it received its largest module order ever, from BP PLC and Lightsource BP Renewable Energy Investments Ltd.

Increased tellurium demand should encourage more production, Goodman, the USITC analyst, said in an interview.

"If [copper producers] see the financial case for it with the higher demand and the higher tellurium price because of that, then you’ll start seeing more of these capital investments," Goodman said.

Tellurium prices need to increase "very, very, very significantly," however, to attract more investment, said Michael Husakiewicz, a metal trader at Lipmann Walton & Co. Ltd.

"Tellurium is not really a metal where [copper producers] make serious money," Husakiewicz said. "If there's any possibility that it might cause any problems to the equipment, to the planning of processing, literally anything, then they're not going to bother, because what they make in copper probably in a day is way more than they would make on tellurium in a year."

Global risk: 'Uncertainty and lack of transparency'

With First Solar aggressively expanding its business, sources of new tellurium supplies will be essential "unless significant amounts are stockpiled in warehouses, which does not appear to be the case," Keller, First Solar's former exploration manager, said in a statement. First Tellurium recruited Keller in November.

New tellurium production in North America could help to provide a secure source of supply for First Solar's growing U.S. business.

"The US solar industry is at an important inflection point where it must continue the charge towards delivering 45% of our country's electricity by 2050 while addressing the risks and uncertainty posed by increasingly volatile solar panel production, pricing, and supply," Georges Antoun, First Solar's chief commercial officer, said in a statement announcing the BP contract. "This is where we come in."

But First Solar's operations stretch beyond the U.S. The company has factories in Vietnam, Malaysia and soon, it expects, in India. And a key ingredient in its technology comes from mines and refineries scattered around the globe.

"In terms of transparency, it's an entirely global supply chain," Goodman said. "And China is the largest producer of tellurium. So, I would say that there is uncertainty and lack of transparency and potential risks due to all of those factors, as you would find with any other kind of globally traded commodity."