Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Dec, 2024

By Zoe Sagalow and Hussain Shah

Illinois' restriction on interchange fees is generating national discussion, but it faces obstacles before getting rolled out in the state.

Under an Illinois law that is set to take effect in July 2025, merchants cannot charge interchange fees on taxes or gratuities. A case challenging the law is pending, and one of the federal bank regulators, the Office of the Comptroller of the Currency, has filed a brief opposing the Illinois law and saying the National Bank Act preempts it.

Similar policy ideas have been considered for years and rejected because of various downsides, Steven Rosamilia, CEO of financial technology company IMEX USA Inc., said in an interview. Ultimately, banks issuing cards would still have expenses, retailers would have expenses to change their software and equipment, and consumers would see costs passed on to them. For example, merchants might raise prices on the products they sell, and banks might reduce card rewards.

"So at the end, nobody wins," he added.

While Illinois is the first state to pass such a law, other states including Florida, Georgia and Tennessee are studying the effects of potential interchange laws. The Federal Reserve has a pending proposal that would limit debit card interchange fees, but it is different from the Illinois law. It would only apply to debit card transactions, change the components of interchange fees and likely limit the fees by more than 30%.

In 2025, states will need to take a renewed focus on consumer protection, said Patrick Woodall, managing director for policy at Americans for Financial Reform/Americans for Financial Reform Education Fund. "I think the focus is that the incoming administration and Congress is less likely to stand up for the little guy, more likely to stick it to the little guy, and as a consequence, there will be a renewed energy to protect people at the state level," Woodall said in an interview.

Interchange revenue

The Electronic Payments Coalition — an organization representing community banks, credit unions and payment card networks — estimated that the Illinois law would reduce interchange fees by $118 million and mostly benefit the largest retailers.

However, the full cost impact is difficult to determine because upgrades and modifications across the payment ecosystem would be needed in order to eliminate the collection of interchange on portions of payments, Howard Herndon, senior counsel at Womble Bond Dickinson, wrote in an alert on the topic. "Industry analysts suggest that the total costs could range from hundreds of millions to upwards of a billion dollars or more," Herndon wrote.

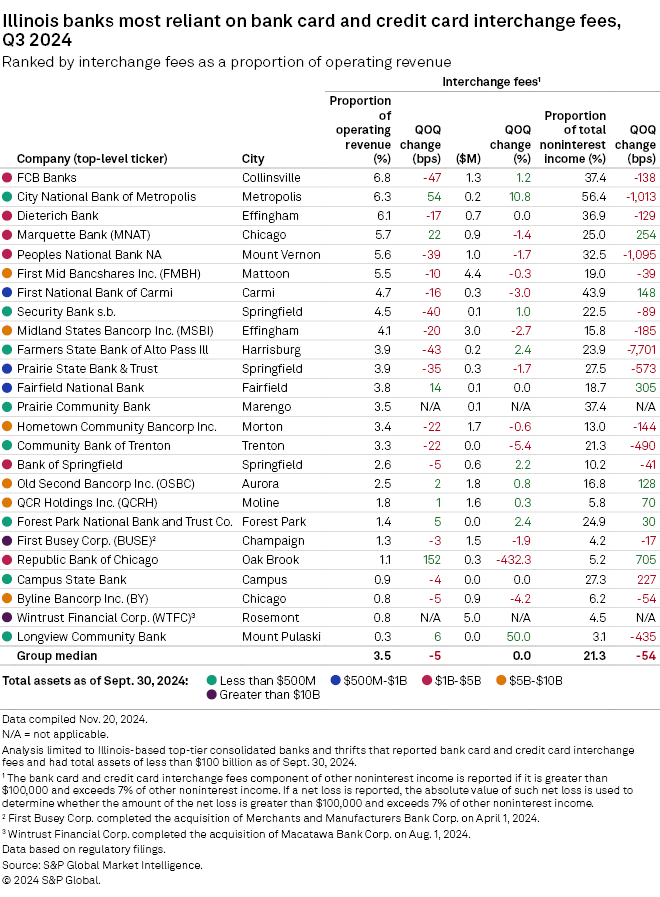

Collinsville, Illinois-based FCB Banks was the Illinois-based bank with the highest proportion of operating revenue coming from bank card and credit card interchange fees at 6.8% in the third quarter, according to an S&P Global Market Intelligence analysis of banks in the state that report the fees and have less than $100 billion in assets.

City National Bank of Metropolis had the second-highest proportion, with the fees comprising 6.3% of its operating revenue. Dieterich Bank was third, with the fees making up 6.1% of operating revenue.

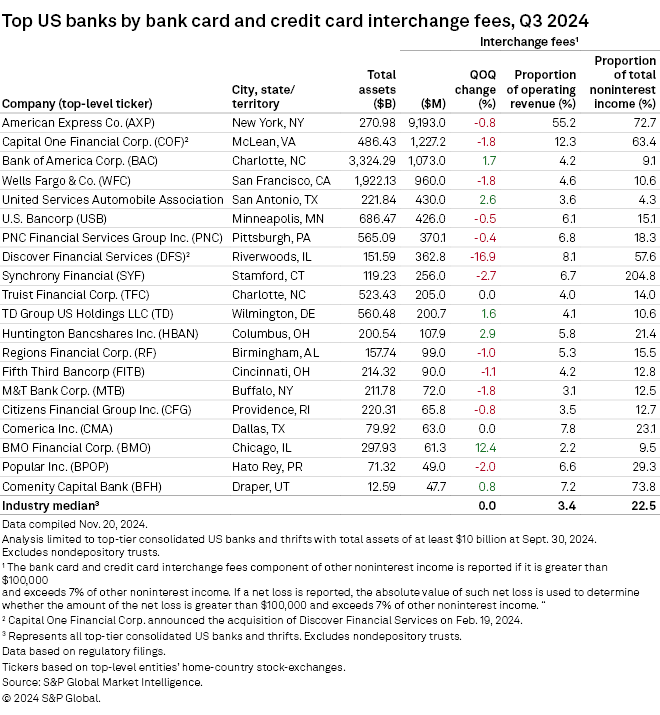

Nationwide, American Express Co. is the bank with the most bank card and credit card interchange fees, with $9.19 billion. Capital One Financial Corp. is second with $1.23 billion, and Bank of America Corp. is third with $1.07 billion in interchange fees.

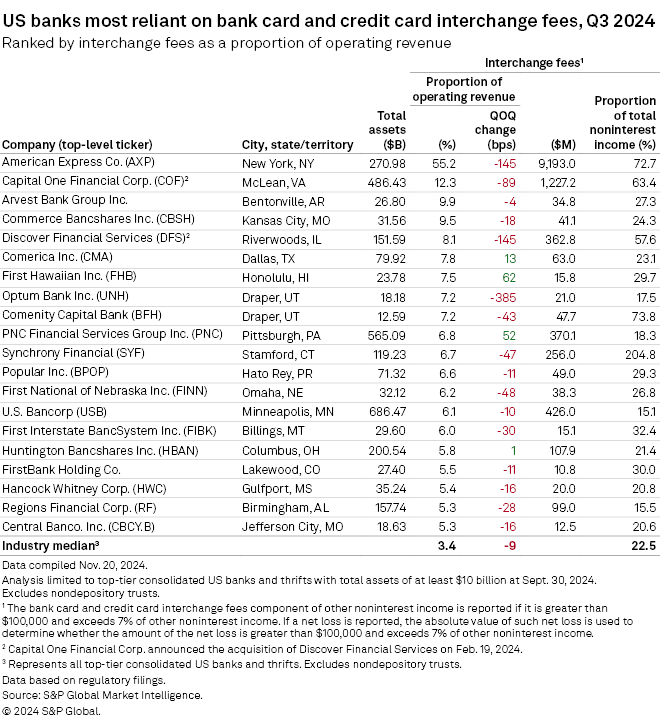

American Express, Capital One most reliant on bank card, credit interchange fees

American Express is the most reliant on bank card and credit card interchange fees at 55.2% of operating revenue, and Capital One is second-most reliant, with the fees making up 12.3% of operating revenue. Arvest Bank Group Inc. is third-most reliant, with the fees comprising 9.9% of operating revenue. The industry median is 3.4%.