Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Nov, 2022

By Rica Dela Cruz and Darakhshan Nazir

A slew of special purpose acquisition companies looking to invest in the financial technology space is having trouble finding merger partners or closing deals.

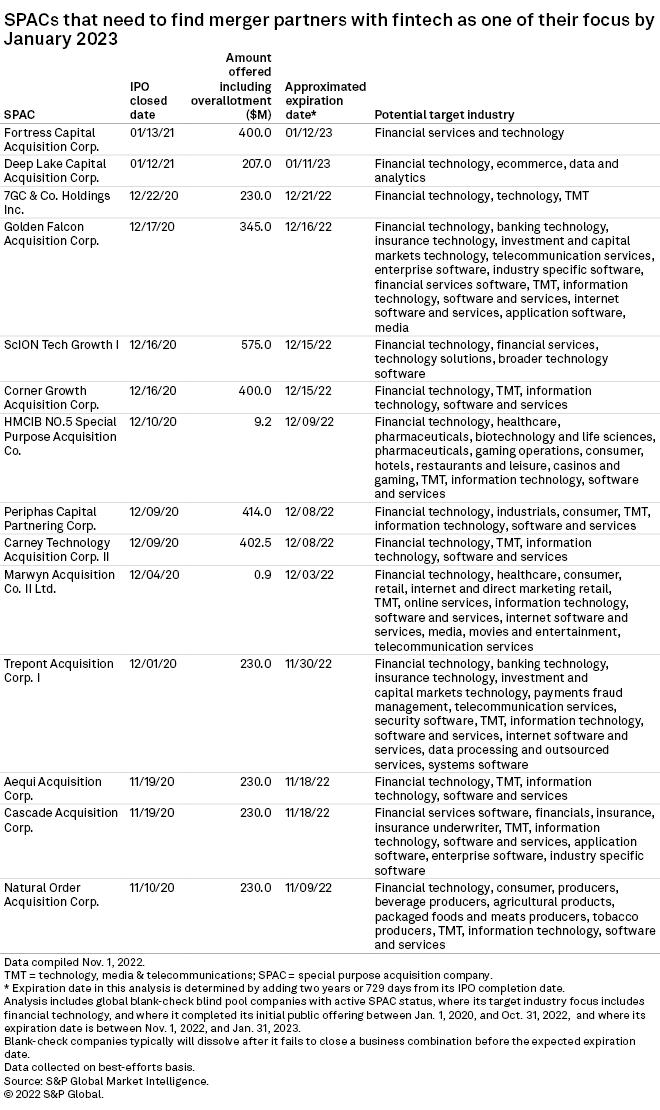

Fourteen SPACs that specified fintech as one of their targeted segments need to find merger partners before they hit expiration dates in the next few months, according to S&P Global Market Intelligence data. Those blank-check companies will dissolve if they cannot sign deals by that time unless shareholders approve extensions.

The fintech industry has been hit by sharp valuation drops in the last year, resulting in fewer companies wanting to go public. Over the past 12 months, the S&P Kensho Democratized Banking Index and S&P Kensho Alternative Finance Index, which track technology-enabled financial services companies, have slumped 51.4% and 57.3%, respectively, as of Nov. 8. The S&P Kensho Future Payments Index has tumbled 39.9% over that same period.

Officials from the U.S. Securities and Exchange Commission in April 2021 said SPACs should have been recording warrants as liabilities instead of marking them as equity on their balance sheets, which has standard practice for years. That change put a damper on new issuance and deal completions last year.

SPACs without merger partners

Among the 14 companies in this analysis, Natural Order Acquisition Corp. has the earliest expiration date with a deadline of Nov. 9. Aequi Acquisition Corp. and Cascade Acquisition Corp. follow with expiration dates of Nov. 18.

Meanwhile, Fortress Capital Acquisition Corp. still has until Jan. 12, 2023, to find a merger partner, while Deep Lake Capital Acquisition Corp. has until Jan. 11, 2023.

ScION Tech Growth I has the highest initial public offering valuation of the group at $575.0 million, followed by Periphas Capital Partnering Corp.

Delays dogging SPAC M&A

Many M&A deals in the fintech sector involving SPACs are seeing longer-than-expected closing times this year, similar to 2021 when extended regulatory reviews delayed deal closures. Only three SPACs have actually completed mergers with fintech companies in 2022, and closing those deals took about six to 10 months, Market Intelligence data showed.

Those three transactions are the EJF Acquisition Corp.-Pagaya Technologies Ltd. deal that closed June 22, the Motive Capital Corp.-Forge Global Holdings Inc. deal that closed March 21 and the VPC Impact Acquisition Holdings III Inc.-Dave Inc. deal that wrapped on Jan. 5.

The pending acquisition of Concord Acquisition Corp. by Circle Internet Financial Inc., a stablecoin issuer waiting for regulatory clarity with the pending stablecoin legislation has been expected to close in December. That deal had a valuation of $9.0 billion at announcement. Though the transaction still has an anticipated completion date of Dec. 10, Concord is planning to propose an extension to Jan. 31, 2023, at a special meeting.

Digital lender Better Mortgage Corp.'s proposed acquisition of Aurora Acquisition Corp., a SPAC expected to dissolve by March 2, 2023, at a valuation of $6.90 billion at announcement is also facing a delay. Better Mortgage was hit harshly by the shrinking mortgage market and has announced several rounds of layoffs since December 2021.

The pace of M&A slowed in the first half of 2022 in the U.S. fintech and payment sector. In the period, there were 221 total deals, compared to 258 in the first half of 2021, according to data compiled by Market Intelligence.