Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Jul, 2023

By Yizhu Wang and Gaby Villaluz

A slowdown in financial technology sector deal flow is lingering, with a wait-and-see sentiment extending into the second half of the year.

From January through June, the global fintech sector recorded 128 M&A transactions, compared to 248 in the first half of 2022 and 188 in the second half of 2022, according to data compiled by S&P Global Market Intelligence.

Many companies, while interested in exploring options, remain cautious of launching a sale process anytime soon, advisers said.

"We are talking to a lot of companies that are thinking about engaging bankers just to get prepared, but maybe launch a process late this year or early next year, or at some unforeseen time when market conditions improve," Kegan Greene, managing director in fintech investment banking at Jefferies, said in an interview.

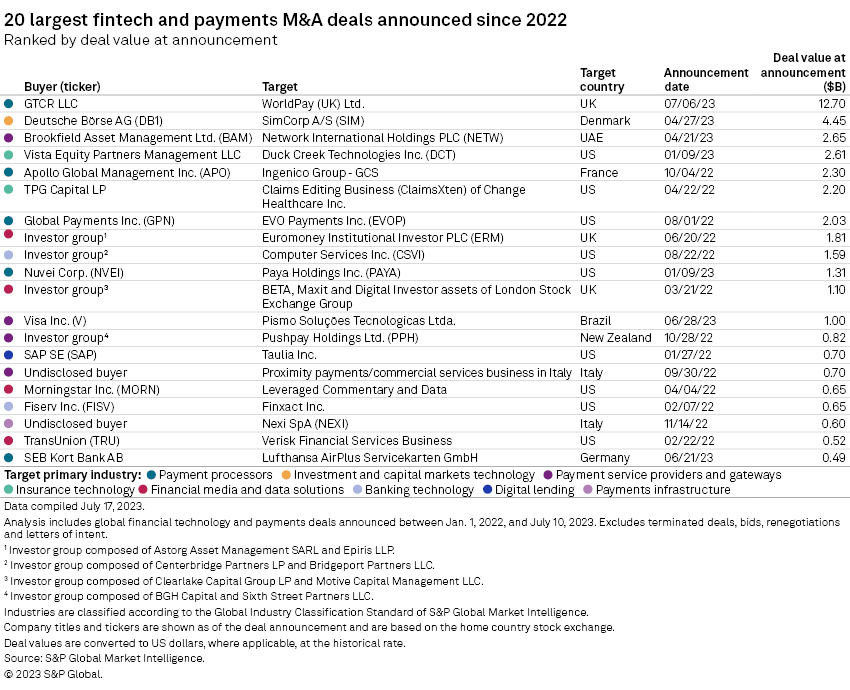

The gloomy deal market had a bright spot in July, when banking software company Fidelity National Information Services Inc. unwound its 2019 acquisition of Worldpay Group Ltd. and sold 55% of the payment processing company to GTCR LLC at an announced valuation of $12.7 billion. But the deal was a planned strategic move and does not necessarily reflect the M&A appetite in the broader market, said Moshe Katri, managing director of equity research at Wedbush Securities.

"I don't know if the FIS-GTCR deal is a change or inflection point in M&A transaction activity," Katri said. "You'll see something here and there. I think it's all going to be opportunistic."

Sellers on the sidelines

The slowdown is not a result of companies losing M&A interest, but rather a sign that the market has accumulated a backlog of companies seeking to sell or raise capital, dealmakers said. Potential sellers on the sidelines are mainly gauging the right timing, waiting for more favorable valuations.

Recent deal flow has picked up slightly from the extremely low levels of a couple of months ago, said Ganesh Rao, managing director at THL Partners. Rao leads the private equity firm's practices in financial technology and services.

Sellers are now testing the market, Rao said, "But when I say 'picked up,' it's still one-third of usual levels."

Some sellers have an incentive to explore deals to avoid a potential rush of M&A when the deal backlog clears, Jefferies' Greene said.

When COVID-19 hit the US in early 2020, the M&A market soon got quiet as companies and investors weathered the early months of the pandemic. But as soon as they gained more clarity, many sellers rushed into the market to launch processes around Labor Day of 2020, Greene said.

"The market became so crowded so quickly that for any particular company, they almost couldn't get the attention of a strategic acquirer or a private equity firm because they were getting 10 teasers a day in their inbox," Greene said.

Some sellers now fear missing out on a time window in which valuations start to increase, but not enough to make the market too competitive. It is still unclear when that window will be.

"Nor do they want to launch tomorrow, because they know they won't get the valuation they want," Greene said.

Valuation gap still large

The main complicating factor continues to be the gap in valuation expectations.

"Buyers and sellers of fintech assets are getting closer to each other on valuations, but the gap is still wide," said Roshan Punjabi, senior managing director in fintech investment banking at Guggenheim Securities.

Looking ahead, the valuation of fintech stocks in the public market is showing signs of recovery, with a higher level of confidence and M&A dialogue in the market, Punjabi said.

As of July 17, the one-year total return of the S&P Kensho Future Payments Index had climbed up to 22.7%. The index is currently close to its levels of July 2020, with a modest value drop of 1.8% on a three-year basis.

Segments with M&A interest

Corporate carve-outs, treasury management software and payments are areas particularly gaining M&A traction across fintech segments, dealmakers said.

The M&A boom from mid-2020 to mid-2022 was driven in part by corporations on acquisition sprees to take advantage of low interest rates, THL's Rao said. Many are now rethinking what is core to their business and whether it is better to simplify their company, sometimes under shareholder pressure, he added.

Payment company Fleetcor Technologies Inc. has said it is weighing a split-up of its three core business lines. NCR Corp. has filed with the SEC to split its digital banking business and ATM business.

In another area of focus, treasury management software is drawing interest because, coming out of the recent regional bank turmoil, companies are more conscious of managing risks associated with their cash, Punjabi said. That provides a growth catalyst for fintech solutions that automate tasks in the office of CFO, such as managing account payables, account receivables and other treasury functions.

In payments, card networks Visa Inc. and Mastercard Inc. could continue to use M&A to strengthen their value-added services, Wedbush's Katri said. Value-added services are features that can improve experiences around payments, such as loyalty and rewards, fraud prevention and advisory services. Both companies have been touting growth in the segment in recent years, Katri said.