S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Jun, 2021

A trend for consolidation in the payments market continued between March and June, with a flurry of sizeable deals taking place. Deluxe Corp., a financial services stalwart perhaps best-known for processing paper checks, bought global payment tech firm First American Payment Systems LP for $960 million, while Global Payments Inc. acquired real estate payments specialist Zego Inc. for $925 million, and Greek bank Piraeus Financial Holdings SA sold off its merchant acquiring business to U.S.-based payments company Euronet Worldwide Inc. for $358 million.

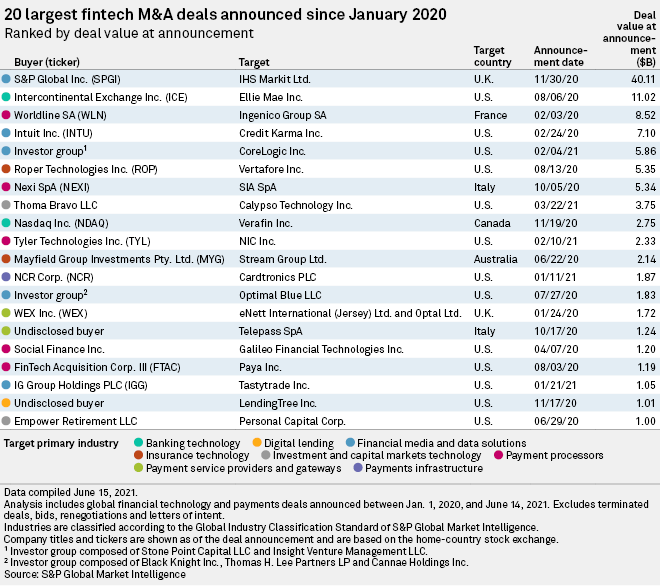

Private equity firm Thoma Bravo LLC's buyout of cloud-based financial software provider Calypso Technology Inc., agreed in March, was the only financial technology deal during the period that crossed the $1 billion mark, at $3.75 billion.

The times they are a-changin'

For Minnesota-based Deluxe Corp., founded in 1915, its acquisition of First American Payment Systems is a bid to move with the times, according to Jordan McKee, research director at 451 Research, a part of S&P Global Market Intelligence.

"[Deluxe Corp.] is a very old company, and they've been very focused on the legacy side of payments. Their bread and butter has been around check processing," McKee said in an interview.

The deal means that Deluxe Corp. can break into the merchant services market for the first time since First American Payment Systems provides online, mobile and in-store payment processing services.

The check remains a popular method of payment in the U.S., making up 8.3% of payments by number and 26.6% by value in 2018, according to the 2019 Federal Reserve Payments Study. But its share of overall payments has declined over the past two decades. In 2000, checks made up 58.8% of payments by number and 67.4% by value.

With its still important role in the day-to-day financial lives of most Americans, the check is not heading toward obsolescence any time soon, McKee said. Having said that, it makes sense for a company like Deluxe Corp. to grow its capabilities in other payment methods as consumer habits change, he added.

There are signs elsewhere of other financial institutions strategically buying up payments companies to prepare themselves for a world in which a greater share of major transactions could shift to digital, McKee said.

One example is Bank of America Corp. buying Axia Technologies LLC — which facilitates payments for the healthcare industry — in April, McKee said, while Global Payments' acquisition of Zego seems to have a similar motivation.

Real estate and healthcare are two areas where check payments have traditionally dominated, but it looks as though Bank of America and Global Payments are positioning themselves for a potential shift to digital in these particular verticals, McKee said.

Payments M&A is here to stay

The recent spate of mergers in payments follows a series of mega deals in 2020, during which Italian payments giant Nexi SpA agreed to buy local rival SIA S.p.A. in a $5.34 billion deal and to strike a deal to merge with Danish payments company Nets A/S; while Worldline SA agreed to an $8.52 billion acquisition of Ingenico Group - GCS.

The momentum for payments M&A is set to continue, according to Cyrus Pocha, partner of financial services regulatory and co-head of the global fintech group, London, at law firm Freshfields Bruckhaus Deringer.

This is partly because payments businesses thrive on scale, Pocha said.

"Their core revenue comes from taking a very small fee for each transaction they process and once you have your technology and infrastructure in place there is very little additional cost to the business in processing more transactions. So scaling up still makes a lot of sense and M&A has been shown to be and, in my view, remains the best way of achieving this," Pocha said in an email.

The coronavirus pandemic, which has been the catalyst for a rapid shift from cash to digital payments, has also made acquisitions in the payments world "more enticing" to investors, he said.

Specialist companies are particularly likely to be acquisition targets, Pocha said.

"The pandemic has also shown the dangers of being too niche," Pocha said, adding that many payments businesses are focused solely on travel or foreign exchange for retail purposes, which "have understandably struggled over the past year, emphasizing the importance of having a diverse customer base and M&A is clearly one way of achieving this."

Another driver for payments M&A in the near future could be big tech firms, which are keen to expand in the payments arena as a means of capitalizing on their large user bases and generating new data streams, he said.

Radboud Vlaar, managing partner at Finch Capital, an early stage venture capital firm, also sees more payments mergers on the horizon.

Vlaar expects two different types of M&A — consolidation among payment services providers for sector or geographical expansion, and acquisitions relating to buy now, pay later; know your customer; and related products — "to increase revenue per client and margins," he said in an email.

Finch Capital, via its company Nomu Pay, announced in April that it had agreed to buy entities belonging to German-based payments firm Wirecard AG in Hong Kong, Malaysia, Philippines and Thailand. Wirecard collapsed into insolvency in 2020 after a long-running accounting scandal. Investors continue to pick off assets from the company, with Indonesian investor PT Kreasi Teknologi Makmur buying PT. Wirecard Technologies Indonesia in April.