Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Jul, 2021

By Yizhu Wang and Ali Shayan Sikander

The SPAC frenzy has stolen the spotlight for many public market debuts in recent months, but the traditional IPO is still luring some of the highest-profile fintech companies.

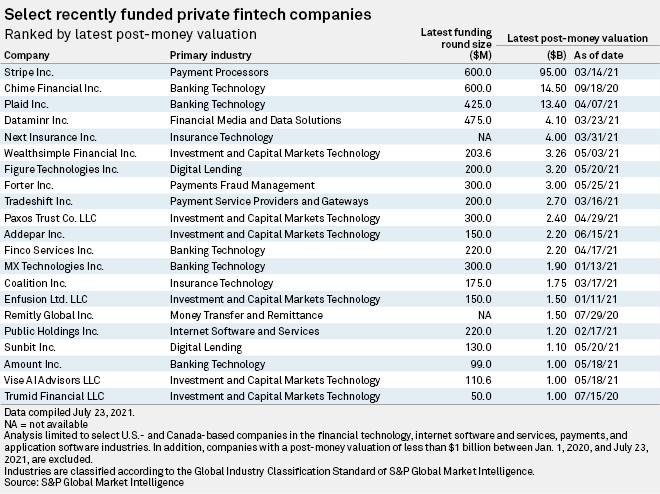

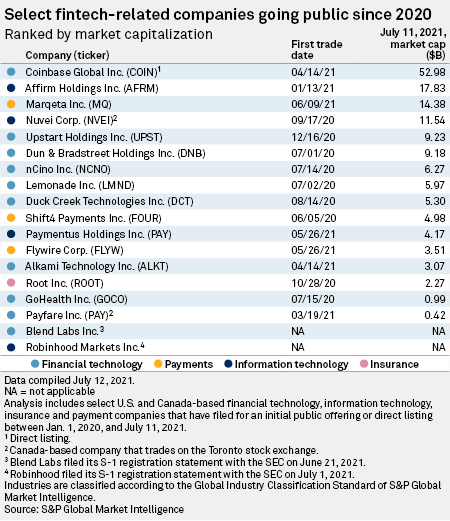

Since January 2020, 18 fintech-related companies have conducted IPOs or direct listings in the U.S. and Canada, according to data compiled by S&P Global Market Intelligence, with another — Robinhood Markets Inc. — set to begin trading July 29. Among the still-private fintech firms eyeing the public market, the largest have outgrown the "sweet spot" for a blank-check deal, industry experts said, making an IPO their best option. While special purpose acquisition companies will continue attracting fintechs valued in the $1 billion to $10 billion range, the highest-profile names seeking much larger valuations are preparing for IPOs.

Retail trading app Robinhood is aiming for a $35 billion valuation, which would make it one of the largest fintech IPOs if its offering goes to plan. Other fintechs eyeing IPOs include neobank Chime Financial Inc., consumer finance firms Credit Sesame Inc. and NerdWallet Inc., and payments technology company Stripe Inc., which completed a funding round in March that valued it at $95 billion.

|

Some companies and their owners choose the SPAC route because it lets them negotiate a price before agreeing to the deal, giving them certainty around their valuation, said Don Duffy, president of strategic communications and advisory firm ICR. In a traditional IPO process, the company gets a range of valuations pitched by investment bankers, and the exact price is revealed by the market on the IPO's launch date. But the negotiated price in a SPAC deal requires the blank-check firm to come up with the cash, which can be a challenge for the largest private targets. An IPO has no issues accommodating companies of any size.

"The question is which one of those might serve your deal better," Duffy said.

Although SPACs usually pull in more capital through a final fundraise called a private investment in public equity, or PIPE, SPAC mergers over $10 billion are still uncommon. Cryptocurrency exchange Kraken scratched out the option of a SPAC because it has grown out of the sweet spot of most SPAC vehicles, CEO Jesse Powell told Fortune in June. Kraken, owned by Payward Inc., could fetch a $20 billion valuation in a new funding round, according to press reports earlier in 2021.

As leading fintech companies navigate their path to a public listing, investors are searching for the next IPO candidates. Activity in the secondary market of pre-IPO stocks has illustrated institutional investors' willingness to bet on crypto-related businesses, according to Miami-based broker/dealer Rainmaker Securities, which facilitates trading in shares of late-stage private companies. Founded in 2004, Rainmaker started with an investor base of institutional investors, and over the years added more high-net-worth individuals, family offices and special purpose vehicles, which are pools of investment funds raised from limited partners, President Glen Anderson said in an interview.

In the blockchain space, there are multiple companies that could find an IPO a viable option in the next 12 to 24 months based on their size and growth rate, said Alan Bickerstaff, a partner at Shearman & Sterling. Although the market is nascent, some applications are more established than others, such as software solutions that analyze payment transactions on blockchain for governance and compliance purposes, or blockchain infrastructures for stock transfers and faster settlement of trades, Bickerstaff said.

Adding software revenue streams on top of payment processing capabilities has been part of the success of several high-growth companies in the public market, such as Square Inc., Adyen NV and Shopify Inc., said Andrew Atherton, managing director at boutique investment bank Union Square Advisors. For decades, legacy payment processors have used aggressive M&A to break the bottlenecks in organic growth and achieve scale. The new generation of payments technology companies instead is working toward exponential growth by expanding beyond payments and penetrating into specific verticals, such as Square in small business, and Adyen and Shopify in e-commerce.

Among recently listed companies in this category, card issuing platform Marqeta Inc. made its stock market debut on Nasdaq on June 9 through an IPO, while cross-border payments company Payoneer Global Inc. began trading June 28 after completing a merger with blank-check firm FTAC Olympus Acquisition Corp.

High valuations across the tech space, such as Stripe's, have raised concern among some investors that a bubble like that of the dot-com era is forming. But to TSX, the backbone of the current IPO market is composed of well established companies with significant revenue and growth, unlike the dot-com bust where companies offered nothing but the hype of the internet, Lipkin said.

"People compare it to the bubble just because of the nature and volume of companies going public," Lipkin said. "The interest in the tech market is quite different from 20 years ago."