S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Mar, 2023

Corporate bankruptcy filings in the financial sector are on the upswing in 2023.

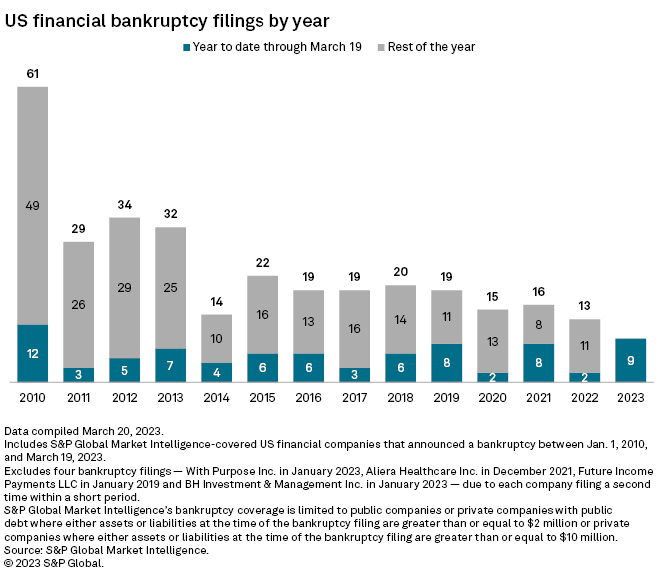

SVB Financial Group's Chapter 11 bankruptcy filing March 17 marked the ninth corporate bankruptcy filing in the financial sector in 2023, the highest level since 2010 for the first two-and-a-half months of the year, according to S&P Global Market Intelligence data.

Bankruptcies overall have escalated from low numbers in recent years as companies face higher borrowing costs amid a jump in interest rates and stubbornly high inflation. The overwhelming majority of bankruptcy filings in 2023 have come in the form of Chapter 11 filings, structured toward reorganization.

SVB bankruptcy filing includes more than $3.3 billion of unsecured claims

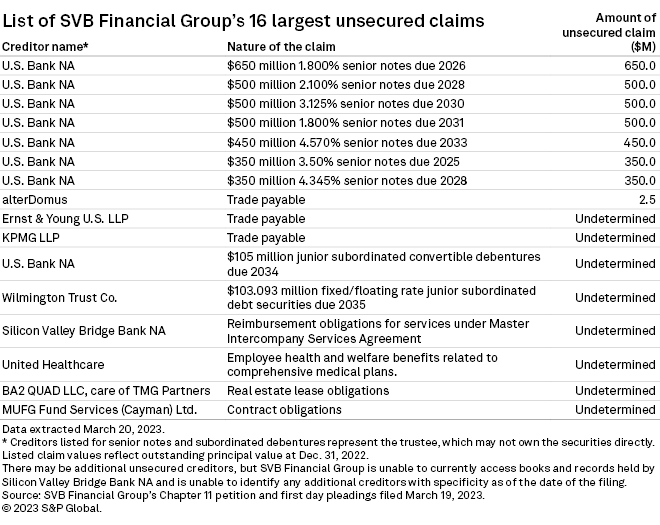

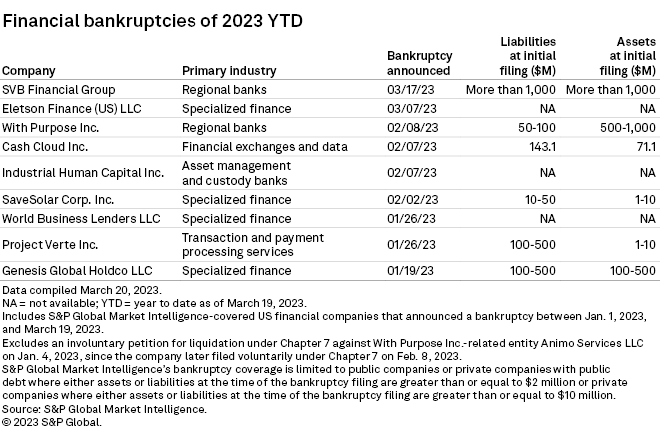

SVB Financial's filing marks the largest corporate bankruptcy filing for the financial sector year-to-date, listing both assets and liabilities at more than $1 billion.

The regional bank's largest unsecured claims came as senior notes, with U.S. Bank NA listed as the trustee on each. The senior note claims totaled $3.30 billion.

|

* For more bankruptcy analysis, check out the monthly bankruptcy series * For retail-specific bankruptcy data, check out the monthly Retail Market series. |

With Purpose Inc., which does business as GloriFi, is the other regional bank bankruptcy in 2023, listing liabilities in the range of $50 million and $100 million, with assets between $500 million and $1 billion.

Other notable bankruptcies in the financial sector include cryptocurrency lender Genesis Global Holdco LLC, which listed both assets and liabilities between $100 million and $500 million.

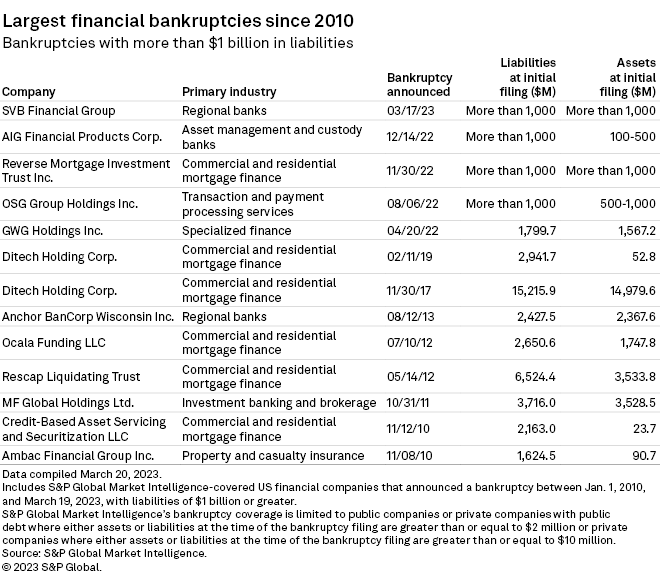

13 billion-dollar financial filings since 2010

Since 2010, Market Intelligence recorded 13 financial bankruptcies with more than $1 billion in liabilities at the time of filing.

There were four bankruptcies in 2022 with liabilities over $1 billion — AIG Financial Products Corp., Reverse Mortgage Investment Trust Inc., OSG Group Holdings Inc. and GWG Holdings Inc.

Mortgage loan originator Ditech Holding Corp.'s Chapter 11 filing on Nov. 30, 2017, marked the largest financial bankruptcy filing since 2010, with $15.22 billion in liabilities. The company later filed for bankruptcy again on Feb. 11, 2019, listing liabilities of $2.94 billion at the time.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. S&P Global Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.