Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Oct, 2021

| The Federal Energy Regulatory Commission is contemplating far-reaching changes to its electric transmission policies. Source: Yelantsevv/Getty Creative via Getty Images |

This article is the first of a two-part series on the cost allocation and generator interconnection aspects of FERC's advanced notice of proposed rulemaking. The second part can be found here.

The Federal Energy Regulatory Commission received a flood of comments in response to pivotal electric transmission rulemaking that could eventually require grid planners to proactively account for expected growth in renewable generation.

Launched in July, the far-reaching advanced notice of proposed rulemaking (RM21-17) seeks comment on a host of issues, including whether regional grid operators and transmission owners should plan a future grid build-out with an eye toward accommodating more renewable energy sources sited in remote locations.

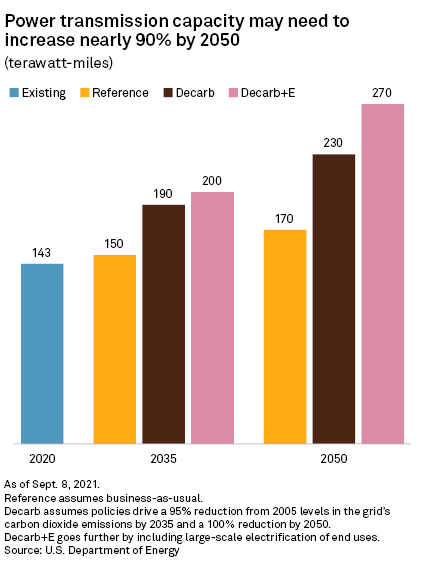

Various academic and federally funded studies have estimated the U.S. will need to roughly double or even triple its electric transmission capacity by midcentury to avoid the worst effects of climate change. That will require major new investments in large-scale, interregional transmission projects that enable neighboring regions to share variable renewable generation based on system conditions.

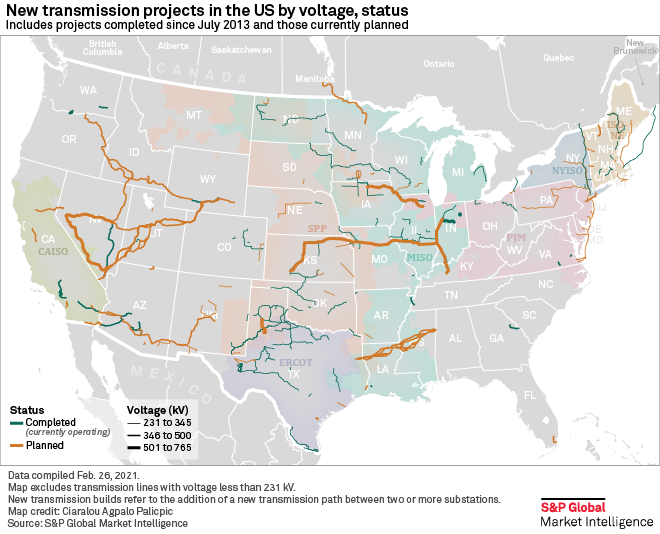

In its notice, FERC cited the Competitive Renewable Energy Zones in Texas, the Midcontinent ISO's series of multi-value transmission projects, and an effort led by the California ISO as success stories where new power lines were built in geographic areas with high renewable energy potential.

With those examples in mind, FERC asked commenters to weigh in on whether the agency should require transmission providers in each U.S. planning region to similarly identify renewable energy zones as part of their planning processes.

'Functionally nonexistent'

Environmental groups and academic institutions stressed to FERC that the agency's last major transmission planning rule, Order 1000, has failed to produce the desired results. Order 1000, which took effect in 2013, encouraged interregional transmission planning among FERC-jurisdictional grid operators but stopped short of requiring it.

No significant interregional transmission projects have been completed since the issuance of that rule, a coalition of groups led by the Natural Resources Defense Council's Sustainable FERC Project noted. And regional planning in areas that are not part of a regional transmission organization, such as much of the vertically integrated U.S. West and Southeast, "is functionally nonexistent," the groups said.

The New York University School of Law's Institute for Policy Integrity claimed that existing ties between neighboring systems operated by MISO and the Southwest Power Pool demonstrated the value of interregional transmission during a deadly mid-February cold weather event. Those ties allowed customers in the MISO and SPP footprints to avoid widespread blackouts, while the siloed grid operated by the Electric Reliability Council Of Texas Inc. flirted with complete collapse.

"Consumers located in areas hit repeatedly by extreme events end up paying more or experiencing more frequent outages (or both) than they would if additional increments of transmission capacity connected them to neighboring regions," Policy Integrity said.

'Minimum amount of interregional capacity'

Americans for a Clean Energy Grid, a pro-transmission trade group, urged FERC to adopt a final rule requiring grid operators and transmission providers to develop plans based on anticipated generation mix, utilities' integrated resource plans, public policy directives, and expected customer demand over the lifespan of a transmission investment.

The group also said FERC should require "a minimum amount of interregional capacity among power systems to protect against a variety of risks that can cause local generation shortfalls," noting that Europe is already implementing such an approach.

The American Clean Power Association and Energy Storage Association jointly urged FERC to require neighboring planning regions to use "a single joint model to analyze alternative ways to meet multiple regions' goals together rather than independently."

WIRES, another pro-transmission trade group, said its members support more holistic transmission planning that incorporates expected future generation. The group also supports the concept of renewable resource development zones but said planning entities should have sufficient flexibility in identifying those zones.

'Already working toward a more integrated approach'

Sponsors of the Southeast Regional Transmission Planning Process — a utility coalition featuring Duke Energy Corp., Southern Co. and the Tennessee Valley Authority, among others — warned FERC against "unlawfully intruding" into state-led planning processes or "seeking to force substantive outcomes."

But the coalition said it could build on its "bottom-up" transmission planning process by spearheading additional studies to identify potential clean energy zones.

"While these studies would not result in a top-down mandate to construct a set of transmission projects, they could result in the identification of a portfolio of additional transmission projects that state regulators and stakeholders recognize as being needed and appropriate for funding," the coalition said.

Transmission owners in the MISO footprint said the 15-state grid operator is already planning for anticipated renewable generation with its "MISO Futures" studies developed in collaboration with stakeholders.

"MISO's tariff requires MISO to engage in long-term transmission planning, and MISO, in conjunction with its stakeholders, has developed its futures to contemplate several different scenarios, including a future with 80% carbon reduction and at least 50% renewable penetration," the transmission owners said. "There is no need for the commission to impose requirements on MISO to do things that MISO is already doing."

The Transmission Access Policy Study Group, an association of transmission-dependent utilities in 35 states, said a one-size-fits-all approach will not work.

"Substantial changes — and more prescriptive commission directives — may be needed in non-RTO regions where [transmission owners] have designed and run their planning processes in a way that all but ensures projects will never be selected for regional cost allocation," the group said. "Greater flexibility may be appropriate in RTO regions, some of which are already working toward a more integrated approach."

Planning timelines

Industry entities had various perspectives on the ideal timeline for transmission planning processes. The PJM Interconnection called on FERC to develop "enhanced long-term planning processes" with a 15-year forward "master plan." That plan would include considerations of customers' needs and "probabilistic planning," the grid operator said.

American Electric Power Co. Inc. said FERC should require regional grid operators to conduct long-term evaluations of regional transmission planning processes every three years and incorporate those results into such plans. Forcing grid operators to evaluate those processes at the same time could also help ensure stronger regional comparisons, AEP said.

However, the Electric Power Supply Association said processes involving a longer forward period could threaten generator interconnection and regional planning processes.

"Plans that result in the identification of a zone of potentially low-cost energy supplies (or where generators requesting interconnection indicate such a zone) that would result in lower system costs should lead to an open season process to match customers with transmission capacity," the association said.

Ellie Potter is a reporter with S&P Global Platts. S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.