Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Jan, 2022

By Allison Good

Some power sector equity analysts expect utility stocks to underperform the broader market in 2022, but also acknowledged that the fate of the $1.7 trillion Build Back Better package could impact valuations if parts of the legislation pass in a standalone bill.

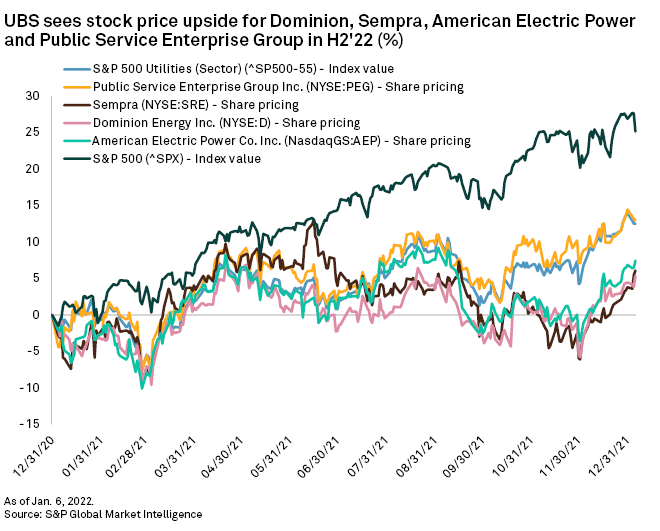

Utilities overall will continue to underperform during the first half of 2022, according to UBS, given a "short-sighted view by the market to the rate base growth potential of the clean energy transition and the electrification of the end-use BTUs of the economy."

During the second half of the year, however, utilities with attractive rate base growth, constructive regulatory environments, strong balance sheets and bill headroom should see valuations rise, particularly in light of prospective interest rate hikes. Those factors should highlight American Electric Power Co. Inc., Dominion Energy Inc., Public Service Enterprise Group Inc. and Sempra as "buying opportunities," UBS analysts wrote.

In its own 2022 outlook for utilities, BofA Global Research said it remains "fairly neutral" on the sector and does not anticipate the share price gains expected from energy, leisure and technology segments as the U.S. economy reopens amid continuing remote work trends. Although utilities could see a "glimmer of hope" if the Build Back Better Act passes or some other form of federal support emerges, BofA added.

Sen. Joe Manchin, D-W.Va., recently ended Democrats' hopes for passing the Build Back Better package in its current form, but federal tax credits for nuclear and hydrogen production as well as standalone storage could still have enough bipartisan support to pass in a separate piece of legislation.

While UBS expects such legislation to become law in the spring, some power providers' share prices could experience less stability until a resolution is reached.

"Whatever form legislation takes we believe it will catalyze stocks more directly impacted via nuclear fleets or large unregulated renewable/storage development subsidiaries: AES Corp., Exelon Corp., and [NextEra Energy Inc.]," UBS told clients Jan. 5. "But, it could be a volatile period for shares of these companies until passage."

BofA analysts, however, are more skeptical that "a slimmed down version" of Build Back Better will pass, particularly as federal midterm elections approach, which dampens the overall outlook for utilities in 2022.

"We are not bearish on utilities but we see a volatile path for relative outperformance in 2022," they wrote. "With Build Back Better Act (BBB) or similar legislative subsidies to invigorate climate efforts off the table, we see many of the 'upside surprises' as off the table."

BofA also sees companies transitioning to pure-play structures and those taking advantage of marginal renewables opportunities as stock price leaders in 2022, continuing a 2021 trend that saw PSEG, Exelon, DTE Energy Co. and CenterPoint Energy Inc. "shedding" the conglomerate business model.

Wells Fargo Securities analysts told clients in December that pressure to decarbonize is prompting companies to "race" toward accelerated coal generation retirement. UBS agreed that "focus will likely shift to those companies capable of transitioning their generation fleet or cleaning their natural gas molecule stream, and continue to include those that can deploy and develop unregulated renewables."

However, sustainability benchmarking groups such as the World Benchmarking Alliance warned that the vast majority of the world's 50 leading utilities, including 10 U.S. power companies, are still exceeding their carbon budgets and falling behind the climate goals of the Paris Agreement. In its November assessment, Dominion, Southern Co. and Vistra Corp. earned a "C," while AES earned a "D."

BofA also urged investors to look beyond a likely renewables development decline in 2022 to a potential boom in 2023. Solar investment tax credits are scheduled to remain at 26% through 2022 without the Build Back Better package, falling to 22% in 2023 and expiring in 2024 unless Congress renews it.

"While 22% should last a couple more years, we see the rush to capture the full extent of legacy [investment tax credits] should drive a banner year for renewable additions," the analysts said.

Despite the rise in inflation and projected federal interest rate hikes, BofA does not expect regulators to grant utilities higher allowed returns on equity in rate cases any time soon. "Allowed ROEs tend to be sticky, declining less and slower than expected and we expect the opposite to be true as well," BofA analysts wrote, noting that "the specter of inflation will lead to less disposable income for ratepayers."

But a rising interest rate environment could help utilities with underfunded pension obligations, like Dominion, Entergy Corp. and FirstEnergy Corp., according to BofA.

Location

Segment