S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Feb, 2021

The Federal Reserve's move to tailor the oversight of four European Global Systemically Important Banks, or G-SIBs, operating in the U.S. will level the playing field and boost their competitiveness in the markets, industry representatives and observers said.

In early 2020, the Fed signaled its intention to adjust supervision of UBS Group AG, Barclays PLC, Credit Suisse Group AG and Deutsche Bank AG owing to their reduced risk profile and total assets in the U.S. since the global financial crisis. The banks were subsequently removed from the portfolio overseen by the Fed's Large Institution Supervision Coordinating Committee, or LISCC, which now only includes the eight U.S.-based G-SIBs.

Level playing field

Their exclusion from LISCC supervision allows the foreign banks to operate on an equal footing with similarly situated domestic banks in the U.S., Keith A. Noreika, a Washington-based partner at law firm Simpson Thacher & Bartlett, said in an interview.

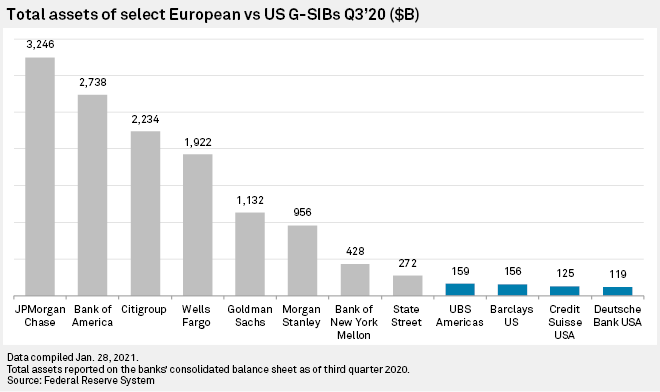

"It does not really make a lot of sense to regulate a much scaled-down version of, say, UBS or Credit Suisse, as if it were JP Morgan Chase & Co.," said Noreika, who served as the acting comptroller of the currency — the administrator of the federal banking system in the U.S. — from May to November 2017.

Sector associations have welcomed the Fed's measure that recognizes the reduced risk European G-SIBs pose to the U.S. financial system. "The current systemic footprint of the LISCC international banks is extraordinarily small compared to the other members of the LISCC program," the Securities Industry and Financial Markets Association, the Institute of International Bankers, the Bank Policy Institute and the American Bankers Association said in a letter to the Fed in December 2020.

UBS was moved to the Fed's Large and Foreign Banking Organization supervision portfolio from the LISCC portfolio in March 2020 and Barclays', Credit Suisse's and Deutsche Bank's transfer was announced in November last year. The current LISCC supervision group includes JP Morgan Chase, Bank of America Corp., Bank of New York Mellon Corp., Citigroup Inc., Goldman Sachs Group Inc., Morgan Stanley, State Street Corp., Wells Fargo & Co..

'Right balance'

Aligning supervision of the institutions with others with the same risk profile is important because the more the regulatory requirements fit the risk, the more efficiently the foreign banks can deploy capital, and the better the environment is for them to grow in the U.S. market, Briget Polichene, CEO of the Institute of International Bankers, said in an interview.

"For all of our members the U.S. remains an incredibly attractive and important market. That is why it is so important to get the right balance in supervision and regulation," Polichene said.

Fed data shows the combined U.S. assets of the LISCC international banks have nearly halved and their current assets at broker-dealers have dropped by 80% from a $1.9 billion peak in 2008.

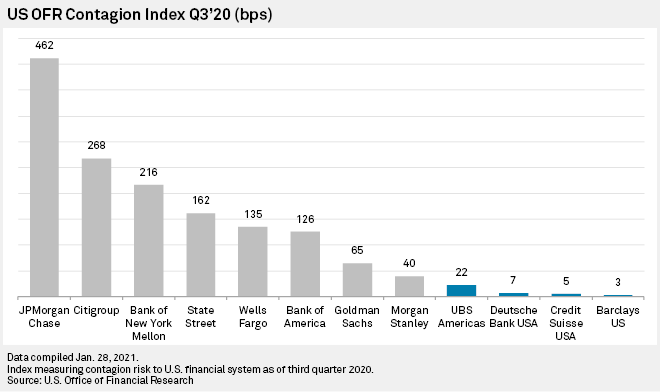

Compared to the U.S.-based members of the LISCC portfolio, the contagion risk to the U.S. system from a potential default of the local subsidiaries of the four European G-SIBs looks negligible. In the third quarter of 2020, UBS Americas Holding LLC scored only 22.43 basis points in the Contagion Risk Index of the U.S. Office of Financial Research versus JP Morgan Chase's score of 462 bps. The respective scores of the U.S.-based arms of Deutsche Bank, Credit Suisse and Barclays were 7 bps, 5 bps and 3 bps on the index that measures the spillover loss to the rest of the financial system if a bank were to default.

More competition

The tailoring of the Fed's supervision of foreign banks' U.S. operations will hopefully foster more competition in the U.S. financial markets, Noreika said. "The U.S. arguably has the most vibrant capital markets in the world and there is a recognition by the U.S. authorities that they would like to have the foreign banks here," he said.

"What we had seen, certainly when I was a regulator, was that the heavy regulatory burden was affecting the competitive market by enhancing the dominance of the large U.S. players vis-à-vis their historical competitors in the U.S. capital markets that were owned by a foreign parent," Noreika said. There was a real concern that the number of large players in the U.S. financial markets was shifting from fairly diffuse to just a handful of institutions. This combined with the active de-risking of big European banks in the U.S., diminished their competitive position versus big U.S. banks on Wall Street, he said.

In December 2020, the Fed also finalized new resolution planning guidance for foreign banks, including Barclays, Credit Suisse and Deutsche Bank, taking into account their current U.S. footprint. "The foreign banks have home regulators that have imposed similar resolution requirements and therefore the U.S. authorities needed to give some credit to that given the banks' reduced risk profile," Noreika said.