Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Jun, 2021

By Brian Scheid

A hawkish turn by Federal Reserve officials has boosted U.S. Treasury yields as anticipation of sooner-than-expected rate hikes rattled the government bond market.

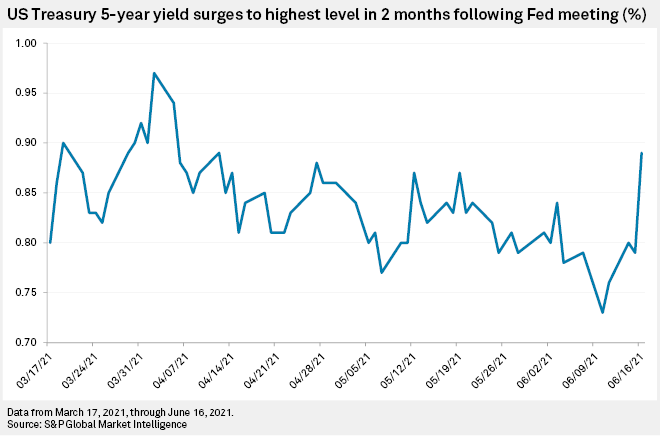

After the Federal Reserve's latest forecast on June 16 showed that most Federal Open Market Committee members expect two rate hikes by the end of 2023, the U.S. Treasury two-year yield closed at 0.21%, its highest settlement in more than a year. The five-year yield closed June 16 at 0.89%, its highest settlement since April 12.

While Fed Chairman Jerome Powell downplayed the forecasts from members for these rate hikes, the new views forced a repricing of the rough middle, or "belly," of the Treasury yield curve.

"While I don't think the message or the move is in any way removing accommodation, but simply getting more in line with the economic fundamentals, the bond market needed to reprice, and indeed it did," said Patrick Leary, chief market strategist and senior trader with Incapital, in an interview. "With a Fed that has been as dovish as they have been, the hawkish tilt took the market by surprise."

The biggest impact of the Fed's potential shift on rates will continue to be on the belly of the curve, said Kathy Jones, senior vice president and chief fixed-income strategist for the Schwab Center for Financial Research.

"That's the area of the curve that will need to reprice for a more hawkish Fed," Jones said in an interview.

The Fed's new forecast, with the market now looking at the increasing likelihood of rate hikes within two to three years, has triggered a discount in the two-year to five-year area of the Treasury yield curve, Jones said.

"Standard theory is that long-term interest rates are a function of the expected path of short-term rates plus a risk premium," Jones said. "If the expected path of short-term changes, it will have the biggest impact on other maturities that are closest to the rate that is changing. So, the impact will ripple out from short-term rates."

Whether the rally in yields is sustained depends on the economic data, Jones said.

"If the employment and growth numbers continue to be positive — pointing to above-trend GDP growth and falling unemployment — then the market will probably build on these expectations and price in more rate hikes," Jones said. "If the numbers falter, then the yield curve would flatten."

In a July 16 note, Jan Hatzius, Goldman Sachs' chief economist, said the investment bank now expects the first rate hike in the third quarter of 2023. It had previously seen the first hike in the first quarter of 2024.

"However, we see the odds of a hike by the end of 2023 as only modestly better than 50% because liftoff could easily be derailed by lower-than-expected inflation or a sharper deceleration in growth as fiscal support fades," Hatzius wrote.

The yield on the benchmark U.S. Treasury 10-year bond closed at 1.57% following the June 16 Fed meeting, up 12 basis points from June 10 but unchanged from June 7. The 10-year yield was trading below 1.50% on June 17.

Rising bond yields tend to correlate with a strong dollar. The hawkish turn from the Fed pushed the Dow Jones FXCM Dollar Index to its highest level since April 12. The index, which measures the U.S. dollar against a basket of four currencies — the euro, British pound, Japanese yen and Australian dollar — is up about 1.3% since May 20.

Longer-dated bond yields were kept in check by the Fed's continued support of its $120 billion in securities purchases, including $80 billion in Treasurys and $40 billion in mortgage-backed securities, and Fed officials easing fears of runaway inflation, Leary with Incapital said.

The Fed's new possible timing on rate hikes, along with uncertainty over whether inflation is transitory, will offer some "upside" to yields through this summer, said Arne Lohmann Rasmussen, chief analyst with Danske Bank, in a June 17 note.

Rasmussen expects the 10-year yield to climb to 2% in about six months and then hit 2.2% within a year.

The five-year break-even inflation rate, the market's view of near-term inflation expectations, closed at 2.41% on June 16, down from the recent peak of 2.72% on May 18, the highest rate since 2008. In its new forecast, the Fed now sees the Core Personal Consumption expenditure measure, its preferred measure of inflation, averaging 3% this year, up from its previous forecast of 2.2%.

"The market has even more confidence that the Fed won't let inflation get out of hand," wrote Win Thin, global head of currency strategy with Brown Brothers Harriman, in a June 17 note.