S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Jul, 2021

By Brian Scheid

Inflation is soaring and unemployment rates are falling to pre-pandemic levels, but analysts believe that Federal Reserve officials have moved their labor and price stability goalposts, potentially extending the timeframe for its ultra-loose monetary policy well beyond expectations.

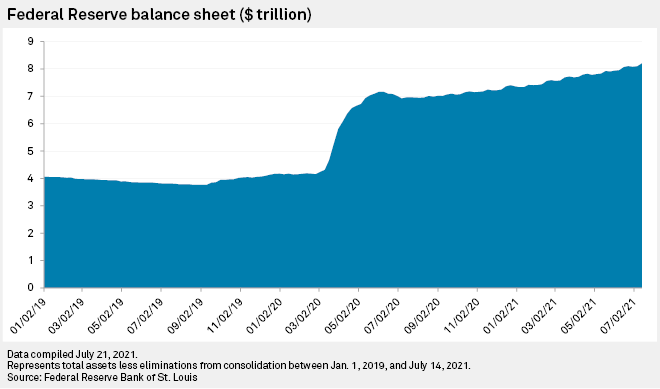

The shift has boosted uncertainty over just when the Fed will start tapering its monthly purchases of $80 billion in Treasury securities and $40 billion in mortgage-backed securities — two measures the central bank began in June 2020 to help stabilize the U.S. economy during the coronavirus pandemic.

"That's certainly the $120 billion-dollar question," said Gennadiy Goldberg, a senior U.S. rates strategist with TD Securities.

The Fed's support programs have occurred as equities have soared to record highs and government bond yields were pulled from recent lows, while growing the central bank's assets to record levels. Analysts are offering differing views of the potential time frame for the Fed's tapering plans because the central bank appears to have moved beyond its original targets for employment to rebound to pre-pandemic levels and inflation to run above 2% for some time.

Goldberg believes that the Fed could announce its tapering plan at its December meeting and could begin easing off bond purchases in January, ending the bond-buying program within roughly 10 months.

But other analysts disagree on the timing of a tapering announcement and just how long it will take for the Fed to fully end the program.

Phil Orlando, chief equity market strategist at investment manager Federated Hermes, believes the Fed will announce its plans in September, begin tapering purchases by $10 billion per month in January and conclude the program by the end of 2022.

James Knightley, chief international economist with ING, sees a tapering announcement in December, but forecasts the Fed will stop purchasing all securities within six months.

"When it comes to it, I think it will be a relatively swift taper that is concluded before the end of June 2022 with rate hikes coming through in late 2022," Knightley said.

Changing goals

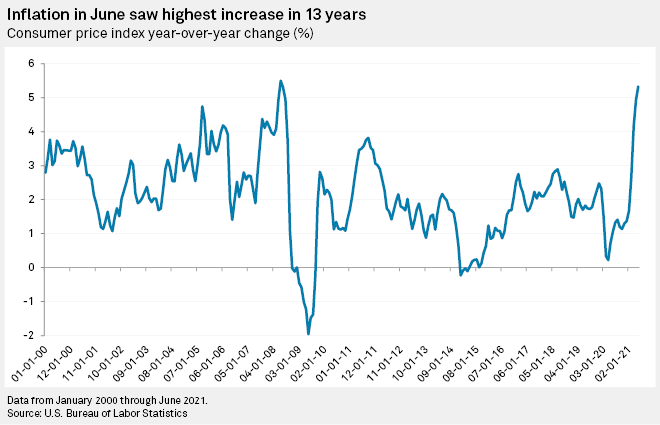

In spite of indications of a recent, hawkish turn within the Fed's ranks, central bank leaders have indicated their comfort with letting inflation run well above an initial 2% goal and keeping policy accommodative until some historic disparities in the domestic job market have been eased.

During a July 14 House hearing, Fed Chairman Jerome Powell said the central bank will keep buying $120 billion in bonds "at least at the current pace until substantial further progress has been made toward our maximum employment and price stability goals."

But Powell has yet to define any of those terms, leaving investors to guess what may trigger a pullback in bond buying.

"The ambiguity seems like a deliberate attempt to keep their options open so that they can define it as necessary as we move closer to the end of the year," said Michael Crook, deputy chief investment officer at Mill Creek Capital Advisors.

Knightley with ING said the Fed likely has already met its price stability goals as he expects inflation to run well above the Fed's 2% target, potentially for years.

While Fed officials appear comfortable keeping the accommodative policy in place as inflation soars, its jobs goals have evolved as well.

Fed officials are particularly focused on the labor market's participation rate, which fell from 63.3% in February 2019 to a nearly 50-year-low of 60.2% in April 2020. That rate, which measures the employment of working-age Americans, has recovered only slightly to 61.6% in June 2021. The rate has failed to recover to pre-pandemic levels due to a "surge in retirements, heightened caregiving responsibilities, and individuals' fears of contracting COVID-19," the Fed wrote in its July 9 monetary policy report.

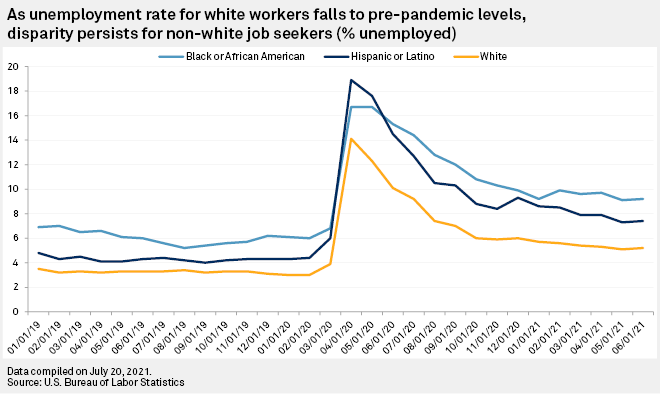

One metric the Fed is watching closely is the discrepancy in joblessness between white Americans and minority communities. Analysts said that the Fed may not begin to taper its billions in bond purchases until the employment gap between white and minority Americans begins to close.

The unemployment rate for white Americans, which fell as low as 3% pre-pandemic and surged to over 14% in April 2020, fell to 5.2% in June 2021, below the national unemployment average of 5.9%, according to the latest data from the U.S. Bureau of Labor Statistics. The national unemployment rate was 3.5% in February 2020, before any COVID-19 restrictions were put in place.

Meanwhile, the bureau said the unemployment rate for Black or African American workers remained at 9.2% in June, below its peak of 16.7% in April and May 2020, but still well above a pre-pandemic level of 6%.

Hispanic or Latino Americans have fared little better, with 7.4% unemployment in June, down from the peak of 18.9%, but up from the pre-pandemic low of 4.3%.

"The Fed wants this economic recovery to be very inclusive and include all Americans," said Ed Moya, a senior market analyst with financial services company OANDA. "If the unemployment rates for African Americans and Hispanics don't improve closer to the national average, they will hesitate removing accommodation."

Skilled labor gap

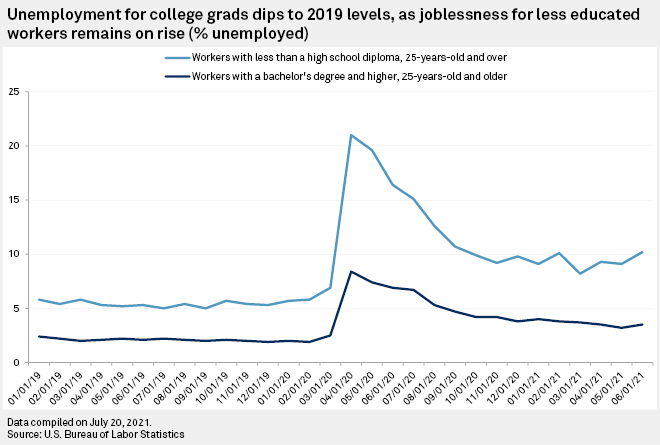

In addition, unemployment gaps between college-educated workers and workers without a high school diploma have been exacerbated by the pandemic.

According to the latest government data, the unemployment rate among workers without a high school diploma surged to 21% in April 2020 and fell to 8.2% in May, but then rose to 10.2% in June. Orlando with Federated Hermes attributed the rise to lower-paid workers staying on better-paying unemployment benefits, rather than returning to the workforce.

The unemployment rate for workers with at least a college degree has fallen from its peak of 8.4% in April 2020 to 3.5% in June. While still above the pre-pandemic unemployment rate for college graduates of 1.9%, that 3.5% rate is still well below the 10.2% unemployment rate for workers without a high school diploma. Orlando said Fed officials want to see that gap close before tapering begins.

"Powell wants to see the low-wage cohort recover more forcefully, before he tapers or hikes rates," Orlando said.

Still, the ambiguity in the Fed's public policy goals gives Powell and other officials lots of leeway over the future path of bond purchases, said Michael Hewson, chief market analyst with CMC Markets. As the circumstances change, so may the Fed's plans for its asset purchases.

"I think central bankers are flying by the seats of their pants," Hewson said.