Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 Dec, 2024

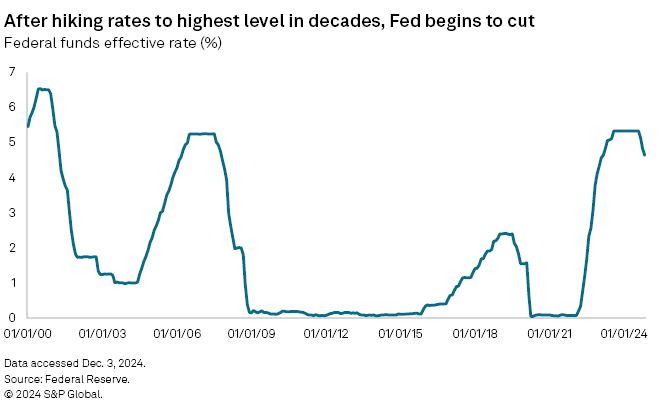

The US Federal Reserve appears likely to lower benchmark interest rates again later this month after cutting interest rates at its previous two meetings. The central bank's plans for rates in 2025 are anyone's guess.

The Fed is due to update its quarterly economic projections at its next meeting Dec. 17–18. In their latest quarterly projections, released in September, members of the rate-setting Federal Open Market Committee held a median view of the central bank's benchmark rate ending 2025 at 3.4%, or 125 bps of cuts from current levels.

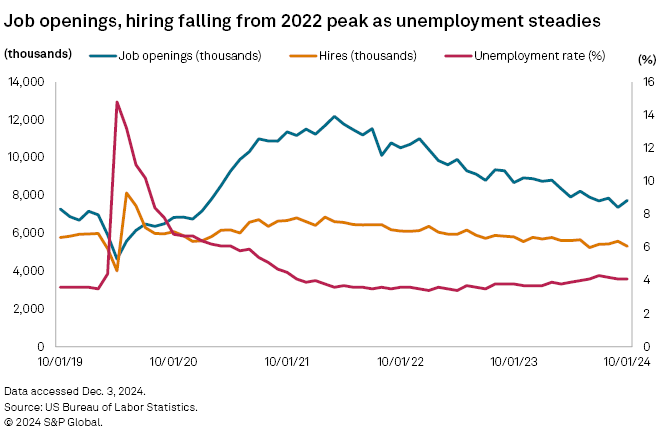

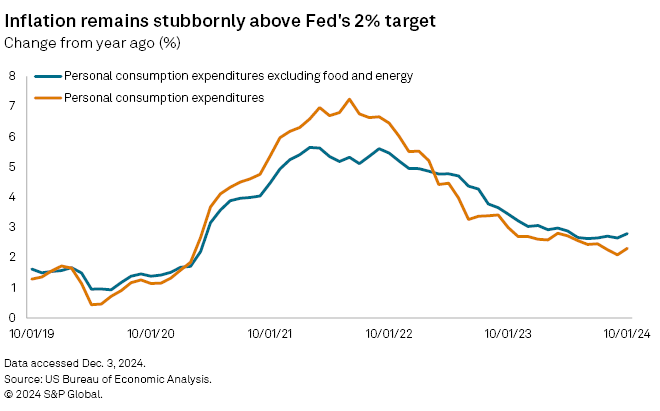

Yet that view has become more clouded with inflation remaining stubbornly above target, the jobs market showing few cracks and a new administration moving into the White House. Market watchers expect the forthcoming projections will show a view of higher rates for longer as inflation has proven more resilient than expected, and while hiring is slowing and job openings are trending downward, joblessness remains steady.

"The balance of risks is shifting toward less rate cuts next year," said Oren Klachkin, a financial market economist with Nationwide. "They'll be navigating a bit in the dark, so we think they'll take it slowly."

Economists at Nationwide recently lowered their predictions for rate cuts in 2025 from 125 basis points to 75 bps, with cuts likely on hold until the spring, Klachkin said.

Unemployment has averaged 4% since the start of the year and has fallen since July. And while job openings are down about 4.4 million from their peak in March 2022, they remain 455,000 above where they were pre-pandemic, the US Bureau of Labor Statistics reported Dec. 3.

At the same time, personal consumption expenditures excluding food and energy, also known as core PCE, rose to 2.8% from October 2023 to October 2024, its largest annual increase since April. The Fed wants that growth closer to 2%.

"The last mile was always going to be the longest," said Satyam Panday, a senior economist in the global economics and research group at S&P Global Ratings. "Potential policies on the horizon mean the risk is that the last mile is not just going to be a drawn out one, but the ride is also going to be extra bumpy."

The odds of another 25-bps cut at this month's Fed meeting was nearly 75% on Dec. 3, according to the CME FedWatch Tool.

Those odds could plunge if there is a strong labor market report Dec. 6 and the inflation numbers in the November consumer price index tick up when released Dec. 11, said Michael Hewson, an independent analyst.

The central bank is likely to pause its rate plans through at least the first quarter of 2025 as President-elect Donald Trump's tariff plans, widely viewed as stoking inflation, become more clear. Despite the changes, the Fed is unlikely to shift its monetary policy goal away from bringing inflation down to 2%, Hewson said.

"There is little prospect of the Fed moving away from its 2% inflation target even if it is stubborn," Hewson said. "Moving the goalposts is never a good look for a central bank, and they are unlikely to start now, especially if inflation starts to show signs of picking up again, which it could well do heading into 2025."

The Fed's path forward will largely depend on what policies the Trump administration moves on first and how they are implemented, said Panday with S&P Global Ratings.

"Protectionist policies seem to be on the docket first, so next year in such a scenario, the Fed will be forced to balance sticky above-target inflation with lower growth," Panday said. "Our sense is that a prolonged pause with rates may be the more likely outcome. They will consider hikes if inflation expectations begin to drift up in a material way."