S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Mar, 2021

By Anna Duquiatan

The average price of natural gas for day-ahead delivery in February grew many hundredfold from the prior month in most regions of the U.S., in the wake of an Arctic blast in the middle of the month that triggered an energy crisis in the central and southern parts of the nation.

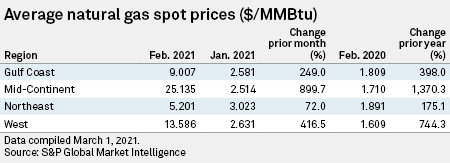

Compared to January prices, the spot gas index for February was up by 899.7% at $25.135/MMBtu at the Midcontinent, by 416.5% at $13.586/MMBtu in the West and by 249.0% at $9.007/MMBtu on the Gulf Coast.

Day-ahead gas prices at individual hubs were at their highest levels in the week of the extreme cold snap that curtailed gas availability amid supply disruptions. A U.S. Department of Energy situation report on Feb. 16 attributes a 6.3 Bcf/d decline in U.S. South Central Region gas output to wellhead freeze-offs and natural gas processing plant outages.

On Feb. 16, cash gas prices soared to $145.862/MMBtu at the Chicago hub and to $136.341/MMBtu at SoCal Citygate. On Feb. 17 spot gas values jumped to $338.750/MMBtu at the Katy hub.

In terms of demand, U.S. National Oceanic and Atmospheric Administration data for the week of Feb. 14 through Feb. 20 show that there were 83 to 184 more gas home heating customer-weighted heating degree days across the central U.S. regions than last year.

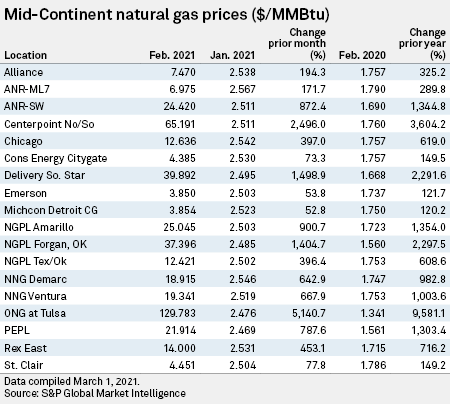

Among the highest-valued spot gas offerings at the hub level for the month were observed in the Midcontinent. From the $2.50s/MMBtu in January, spot gas values jumped to $129.783/MMBtu in February at ONG at Tulsa and to $65.191/MMBtu at Centerpoint North/South. At the Chicago hub, the spot gas index rose from $2.542/MMBtu in January to $12.636/MMBtu in February.

Market prices and included industry data are current as of the time of publication and are subject to change. For more detailed market data, including power and natural gas index prices, as well as forwards and futures, visit our Commodities pages.