S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Mar, 2023

The collapse of two regional banks and worries about the potential for widespread economic damage have tanked market expectations for the Federal Reserve to hike benchmark interest rates further and raised the possibility of a near-term pause and earlier cuts.

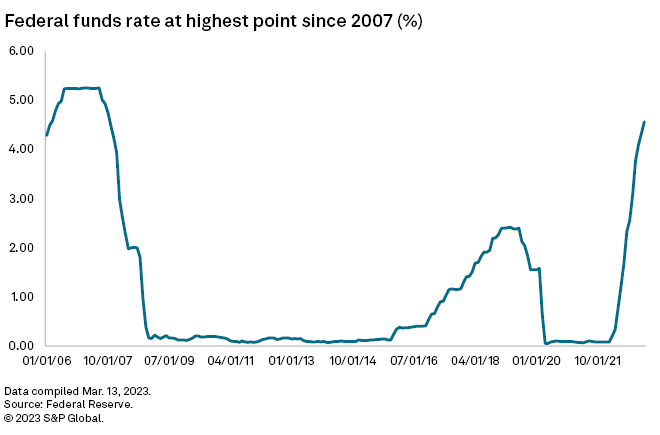

The odds that the Fed would not raise rates at its next meeting, to be held March 21 and 22, jumped to 33% on March 13, up from 0% on March 10, according to the CME FedWatch Tool, which measures investor sentiment in the fed funds futures market. Investors also placed no chance on a 50-basis-point increase and bet that rates will fall by the end of this year.

The moves are a sharp reversal from just a week ago, when Chairman Jerome Powell indicated that Fed officials may accelerate its rate hike plans if inflation and jobs data continue to show a persistently hot economy. The failure of Silicon Valley Bank and the closure of Signature Bank have stoked concerns of a widespread banking crisis.

"This definitely takes a 50-basis-point hike off the table," said Oren Klachkin, lead U.S. economist with Oxford Economics. "SVB's collapse is a sign that the Fed's rate hikes are starting to break parts of the economy."

'The Fed is done'

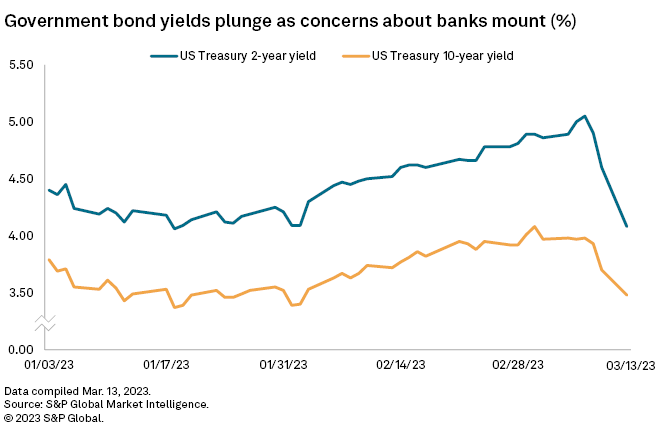

Government bond yields, which move opposite prices, plummeted March 13 on speculation that the Fed would keep interest rates unchanged at its upcoming meeting. The Fed has raised rates at each of its last eight meetings.

The U.S. Treasury two-year yield, which tends to reflect the market's near-term rate expectations, fell to nearly 4% on March 13, a decline of nearly 60 basis points in a single trading day.

Longer term, most of the futures market on March 13 expected rates at the end of the year will drop by at least 25 basis points from the current range of 4.50%-4.75%, reversing earlier expectations that rates would rise by as much as 100 basis points by December, according to the FedWatch Tool.

The fall of SVB and other lenders could be enough to entirely upend the Fed's plan to chill inflation through higher rates, said Andrew Brenner, head of international fixed income at National Alliance Securities.

"There will be no rate hikes next week and the Fed is done … and I mean done," Brenner said.

Combating inflation

The Fed was likely to not raise rates for at least one meeting in order to prevent any potential fallout from the banking sector, Jan Hatzius, chief economist with Goldman Sachs, wrote in a March 13 note.

"While we agree that more tightening will likely be needed to address the inflation problem if financial stability concerns abate, we think Fed officials are likely to prioritize financial stability for now, viewing it as the immediate problem and high inflation as a medium-term problem," Hatzius wrote.

While the Fed is focused on combating inflation, it will likely put that mission on pause, at least temporarily, in order to avoid a deeper economic disaster, said Sonu Varghese, a global macro strategist with Carson Group.

"I think their priority is to prevent a financial crisis," Varghese said. "And since the meeting is less than 10 days away, I think they hold off on raising rates."

Still, Fed Chairman Jerome Powell and other Fed officials have repeatedly called the fight against inflation their top priority. On March 14, the Commerce Department's consumer price index for February, the latest inflation data, will be released. Economists expect the report to show an annual increase of 6%, according to Econoday. If inflation proves to be hotter than expected, however, the Fed could ultimately go forward with a 50-bps hike after all.

"If we see sustained inflation in [the February] CPI number, it could force the Fed to forge ahead with hikes," said Callie Cox, a U.S. investment analyst at eToro.