Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Jul, 2021

By Brian Scheid

A bright economic outlook and extremely accommodative monetary policy have created one of the longest, uninterrupted rallies in U.S. equity market history, but risks from coronavirus variants, a sudden monetary policy shift and hot inflation have raised concerns for some investors about a correction.

"Equities are in for a sizable correction," said Peter Cecchini, director of research at Axonic Capital. "It won't take much to topple this applecart."

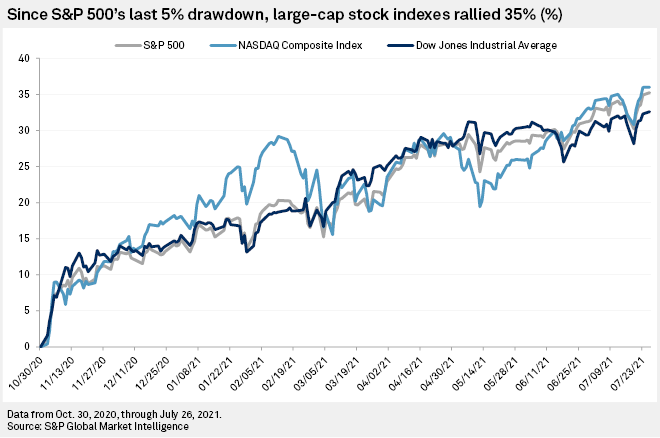

Bolstered by strong investor inflows and record-low bond yields, the S&P 500, Nasdaq Composite Index and the Dow Jones Industrial Average have increased an average of 35% since early November, shortly after the last time the S&P 500 fell more than 5% in a short time. But analysts said the market may soon run into the effects of surprisingly high inflation and the coronavirus delta variant, either of which could derail the post-pandemic recovery.

"Certainly, renewed lockdowns and travel restrictions are a tail risk, as is inflation that runs too hot for too long," said Matt Peron, director of research at Janus Henderson Investors. "The market is rightly very focused on the duration of this inflationary impulse as the biggest risk to the economic cycle, and hence the market overall."

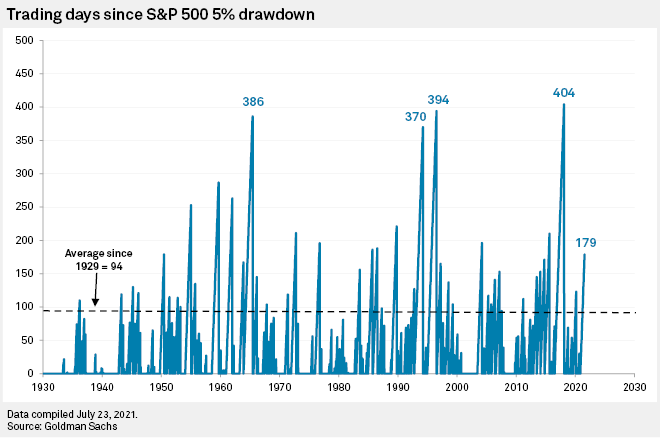

The current run on equities, which has lasted more than 180 trading days, is one of the 15 longest stretches in history that the market has not had a 5% correction, according to Goldman Sachs' research. The longest stretch was 404 days, a run that ended in February 2018.

An increase in household net worth coupled with skyrocketing personal savings have drawn investors to stocks and a commitment by the Federal Reserve to keep rates near zero and continue buying $120 billion each month in bonds have prevented a significant decline in equities, said Josh Jamner, an investment strategy analyst at ClearBridge Investments in New York.

"Taken together, the strong growth environment and supportive policy have buoyed markets in recent months, and dry powder on the part of both individuals and corporations appears to be being deployed during recent periods of stock market weakness," Jamner said.

U.S. household net worth jumped nearly 24% from the first quarter of 2020 to the first quarter of 2021, according to Federal Reserve data, while the personal savings rate stood at 12.4% in May, well above the 6.1% average from 2000 through 2019, according to the latest U.S. Bureau of Economic Analysis data.

Households purchased a net of $172 billion in stocks in the first quarter of 2021, representing the largest source of equity demand, according to Goldman Sachs research. Households allocated about 44% of their assets to equities, according to Goldman, which also forecast up to $400 billion in net stock-buying by households in 2021.

In a July 23 note, a team led by Goldman Chief U.S. Equity Strategist David Kostin dismissed the potential impact of the delta variant on the stock market, claiming it "should not pose a major market risk."

"Vaccinations, equity demand from households and corporations, and attractive relative valuations will support equity inflows and prices," Kostin's team wrote.

Low yields

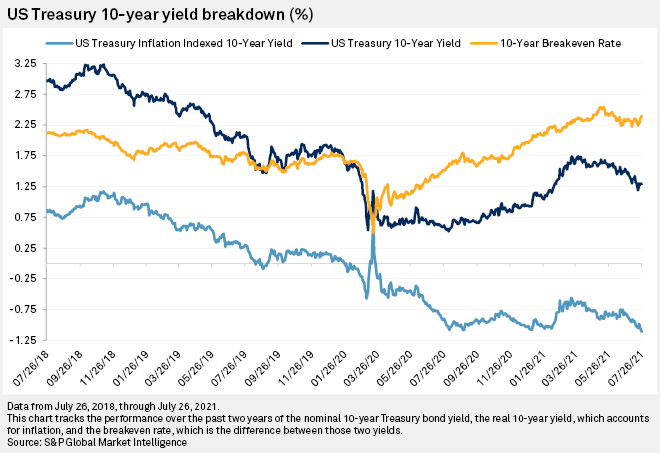

Fears of the delta variant's economic effects, along with rising inflation, have led to a surge in demand for government bonds.

The yield on the 10-year Treasury Inflation-Protected Securities bond, also known as the "real yield," settled at -1.11% on July 26, a record low. Negative real yields imply a losing investment in the Treasury market when accounting for inflationary effects and have been more common in Japanese and European bond markets before the pandemic than in the U.S. The 10-year real yield has been in negative territory since March 2020. The yield, which moves inversely to prices, has dropped 54 basis points since its most recent high on March 19.

The benchmark 10-year yield settled at 1.29% on July 26, down 45 basis points from its March 19 high.

"This dynamic is likely to ease in the second half as Treasury issuance resumes and potentially accelerates and as Fed purchases begin to slow, actions which could lead to upward pressure on both nominal and real yields," said Jamner with ClearBridge.

The decline in yields has been a boon for stocks, especially for "longer-duration growth equities where the valuation is very sensitive to rates," said Peron with Janus Henderson.

Markets are bracing for the impact of an end to both the Fed's accommodative monetary policy and the U.S. government's fiscal policy, which pumped trillions of dollars into the pandemic-battered economy.

"The number one risk that will eventually likely create a major correction will be the monetary and/or fiscal policy cliffs when trillions of both are not so readily available," said Michael O'Rourke, chief market strategist at JonesTrading.