Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Sep, 2022

By Zoe Sagalow

The U.S. Department of Justice's opinion on the Federal Deposit Insurance Corp.'s December 2021 dispute could have a lasting effect by allowing board majorities to prevail over chairpersons.

The DOJ's Office of Legal Counsel, or OLC, in its July 29 opinion sided with the Democratic majority of the FDIC board by saying that the chairperson of the agency does not have the authority to prevent a majority of the board from presenting items for votes and decisions.

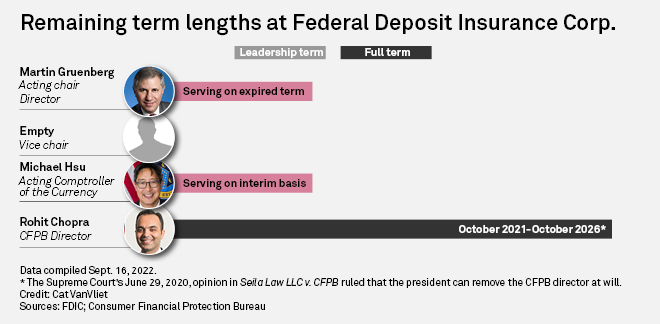

The decision was related to a clash late in 2021 in which Martin Gruenberg and fellow Democrat Rohit Chopra, director of the Consumer Financial Protection Bureau, co-authored a joint statement seeking public comment on bank merger rules. They published their request without prior approval from Jelena McWilliams, who was FDIC chair at the time.

At a minimum, the opinion is likely to apply to future FDIC chairs and boards, while the broader impact on other regulatory agencies remains to be seen.

"It goes against something that I've seen in other agencies, which is that chairs are becoming more important," David Zaring, a professor of legal studies and business ethics at The Wharton School at The University of Pennsylvania, said in an interview. "This opinion sort of says, 'Maybe we should hold off on giving the chair too much power.'"

Future impacts on FDIC

The FDIC's decision to seek an opinion from the OLC was "somewhat unusual" since the FDIC considers itself an independent agency and the OLC advises executive branch agencies, Geoffrey Parsons Miller, professor and director of the Center for Financial Institutions at New York University School of Law, wrote in an email.

Miller believes politics was involved in the agency's decision to seek the opinion. The FDIC's general counsel requested the opinion in March, after Acting Chairman Gruenberg took over in February.

"The current majority of the FDIC is seeking political cover for what they believe to be the best interpretation of their governing statute," Miller wrote. "They presented the issue to OLC together with the promise to follow whatever opinion OLC provided, but [were] confident that OLC would tell them what they wanted to hear."

In its request, the FDIC said it "will conform its conduct on this matter to the OLC's conclusion." As such, in the future the opinion could end up benefitting a different majority made up of Republican members.

"Some may see this as being a decision by a Democratic-run Justice Department supporting a Democratic majority on the FDIC, and that's technically correct," Ian Katz, managing director at Capital Alpha Partners, said in an interview. "But what the opinion does is it gives authority to whoever's in the majority."

"You could have a situation a few years down the road, or anytime in the future, where the roles are reversed. You have a Democratic chair of the FDIC, and that chair's view or wishes are overruled by a Republican majority on the board," Katz added.

President Joe Biden on Sept. 20 nominated two Republicans to the two open seats on the FDIC board. Biden will also announce a nomination for chairman, a White House official told Politico. Gruenberg is currently in that role on an acting basis. Under federal law, the FDIC's five-person board can have no more than three members of a single political party.

Chairperson vs. board majority at other regulatory agencies

The OLC's opinion answered a key question for the FDIC following the December 2021 dispute, but it remains to be seen if the opinion will have ripple effects on other agencies. While the FDIC currently has a Democratic chair and a majority Democratic board, Zaring noted that the National Credit Union Administration has a Democratic chair and two Republican board members.

While the OLC's opinions are "merely advisory" when it comes to independent regulatory agencies, "this opinion is likely to be cited for the proposition that the chair of a regulatory commission does not have the power to set the agency's agenda over [or] against the wishes of a majority of the members," Miller wrote.

Others were unsure whether the opinion could extend to agencies involved in similar situations.

Given that the OLC interpreted the FDIC's bylaws to reach its conclusion, it is unclear whether this opinion could be used as precedent for future cases involving other agencies, said Todd Phillips, former nonresident fellow at the now-inactive Global Financial Markets Center at Duke University School of Law and a progressive policy advocate on bank regulation. Other agencies could distinguish this opinion from themselves on the basis that it was rooted in the FDIC statute, Phillips said.

"Whether this opinion has precedential value on other governmental agencies will depend on how closely their enabling statutes, bylaws, and governance structures resemble those of the FDIC," John Geiringer, a partner in the Financial Institutions Group at Barack Ferrazzano Kirschbaum & Nagelberg LLP, wrote in an email.