S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Oct, 2023

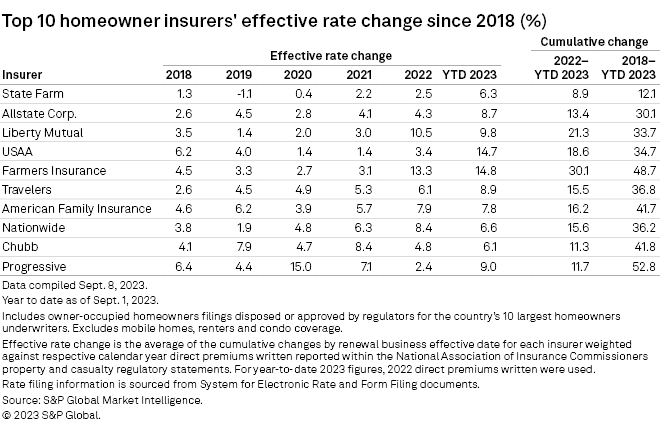

Farmers Insurance Group of Cos. and United Services Automobile Association led the pack among the largest US homeowner insurers increasing premium rates in 2023.

Both of the insurers' year-to-date calculated effective rate change on their owner-occupied homeowner policies were up by double-digits through Sept. 1, with Farmers' 14.8% increase only slightly higher than United Services Automobile Association (USAA)'s 14.7% gain, according to S&P Global Market Intelligence's RateWatch application.

The rate information is sourced from disposed owner-occupied homeowner rate filings collected by S&P Global Market Intelligence that are submitted to the Department of Insurance in various states. The analysis is limited to rate filings of each state's 10 largest homeowners underwriters based on 2022 direct premiums written plus any of the country's 10 largest homeowner underwriters outside the state's top 10.

The effective rate change is the average of the cumulative changes by renewal business effective date for each insurer weighted against respective calendar year direct premiums written reported within the National Association of Insurance Commissioners property and casualty regulatory statements. For year-to-date 2023 figures, 2022 direct premiums written were used. Read more about S&P Global Market Intelligence's RateWatch.

So far, Farmers has received approval by state regulators to boost its rates across 43 states, with 28 of them having a calculated weighted average change of greater than 10%. The California-based insurer's three largest effective rate increases occurred in Illinois, Texas and Tennessee, at 25.3%, 25.1%, and 23.8%, respectively.

USAA raised rates in 44 states through the first eight months of 2023, with about 60% having a double-digit calculated effective rate increase. The 36.6% effective rate change in Arizona is the largest for the Texas-based insurer. The insurer raised rates by over 30% in two other states — Colorado's effective rate change was 34.7% and Tennessee's was 30.1%.

The Progressive Corp. has the largest year-to-date effective rate change in any state among the country's largest homeowner writers. An overall rate change of about 57% in North Carolina went into effect on June 19 for its renewal business. The insurer also received a notable increase in the battered California market when the state's regulator approved a 25% weighted average increase. The filing was approved Aug. 9 and impacts about 41,600 policyholders.

The Ohio-based insurer's countrywide calculated rate increase is 9% so far in 2023. Done

Done

|

– Download a document with the top homeowner insurers' year-to-date 2023 effective rate change by state. |

Arizona rises above the rest

The largest homeowner insurers in Arizona have collectively boosted their rates by a weighted average of 18.4% through Sept. 1, the highest calculated increase in the US. A 16.4% change in Texas was the second-largest increase, followed by a 16.3% rise in Illinois. In total, 12 other states have seen a double-digit increase in their homeowner rates.

The states with the lowest weighted average increase so far in 2023 are Hawaii, Vermont and New Jersey at 1.8%, 2.5% and 2.8%, respectively. The District of Columbia is also at the low end of the spectrum with a 2.3% calculated increase.

2023 rise in rates continues from prior year

Macroeconomic conditions continue to plague US personal lines-focused insurers as the past two years have seen a higher-than-average rise in homeowners' insurance rates. Between 2018 and 2021, the countrywide yearly average change was in the 3% range but jumped to about 6% in 2022. Through roughly the first eight months of 2023, the national average rise in homeowners' premium rates was 8.8%.