S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 May, 2023

By Harry Terris and Syed Muhammad Ghaznavi

Banks face further deposit outflows and stiffer competition after the turmoil in March, even as an end to Federal Reserve interest rate hikes comes into view and absolute increases in funding costs moderate.

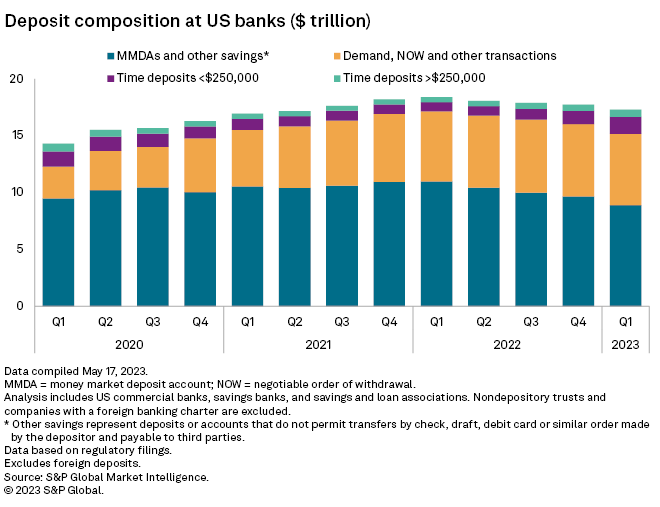

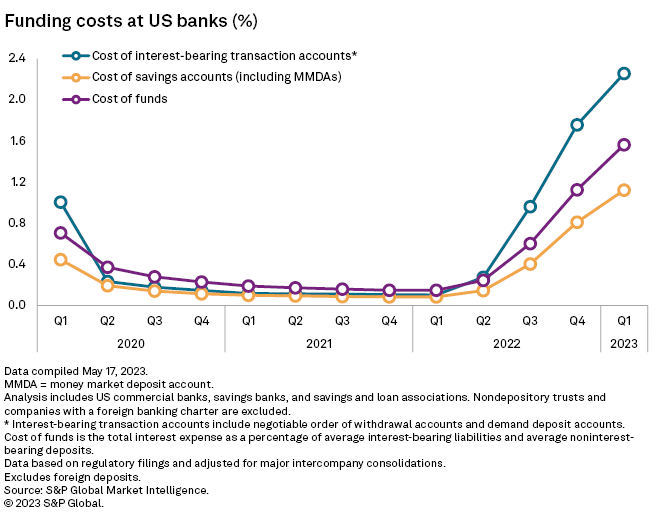

Deposits across US banks fell sequentially by 2.4%, or $421.40 billion, in the first quarter, according to S&P Global Market Intelligence data. Banks' cost of funds increased 44 basis points to 1.56%, less than the increase of 52 basis points in the 2022 fourth quarter, as the pace of Fed hikes slowed.

The concern for banks has shifted to how much deposit prices will catch up to underlying rates amid market expectations for a turn in Fed policy this year, a process that is expected to generally compress net interest margins after bank asset yields rose faster early in the cycle. Now, three large failures triggered by deposit runs have put a premium on defending funding bases, and moves by commercial depositors to diversify cash holdings across multiple banks and instruments have helped to shape a landscape of heightened competition and even greater velocity of money flows.

"There's going to be increased churn," said Peter Serene, director of commercial banking at Curinos, a consulting and data firm. "All of that sets banks up for a more difficult profitability environment going forward."

|

– Set email alerts for future data dispatch articles.

– Download a template to generate a bank's regulatory profile.

– Download a template to compare a bank's financials to industry aggregate totals.

Bad outflows, worse mix

The 2.4% sequential drop in industrywide deposits was the biggest since deposits started declining in the 2022 second quarter. Deposit levels are subject to significant seasonal factors such as tax payments, and seasonally adjusted data from the Fed has generally shown accelerating outflows since the central bank started raising interest rates.

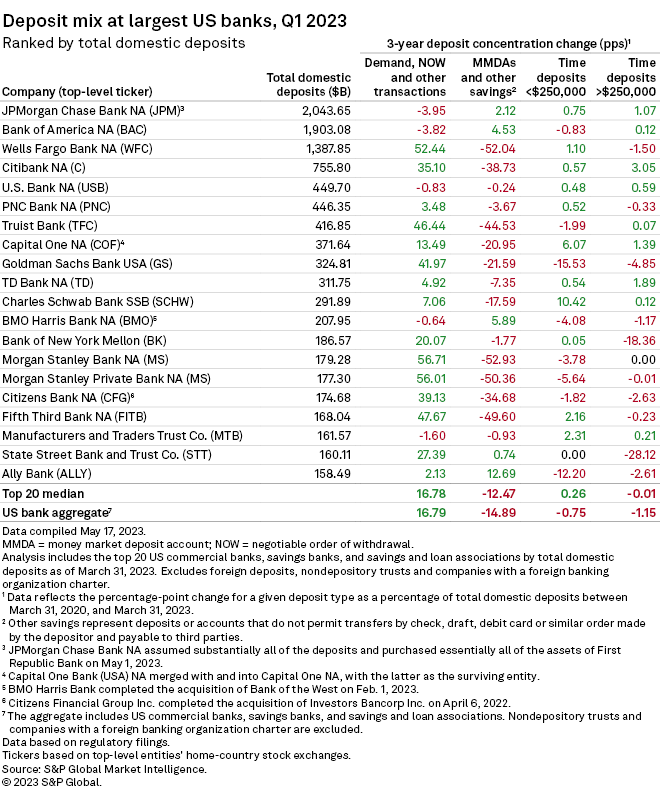

Banks have also been forced to defend funding by turning to high-cost deposit products. In the first quarter, a 7.9%, or $766.46 billion, sequential decline in savings deposits was partially offset by a 24.8%, or $424.42 billion, increase in time deposits.

There is room for more money to leave the system as a pandemic surge in deposits continues to unwind, said Matt Pieniazek, president and CEO of Darling Consulting Group. Pieniazek's firm estimates that about 60% of pandemic surge deposits remains with banks and that another 60% of that amount will ultimately leave.

Data shows that flows have moderated since the most acute phase of the turbulence in March. But simultaneous inflows and outflows that individual banks like Truist Financial Corp. and Citizens Financial Group Inc. have reported as commercial depositors diversify are ongoing, Serene said.

Clients that were most concerned about the safety of their banks moved funds immediately, but others will generally take some time with the often difficult task of evaluating new institutions and changing operating relationships.

"You've probably looked at your banking relationships. You've probably made a plan to spend some time thinking about adding another bank," Serene said.

He emphasized that the churn simultaneously creates opportunities for banks. Overall, however, Curinos now expects commercial deposits to decline 10% to 14% in 2023, more than the 6% to 10% it anticipated before March.

"That's driven mostly by a behavioral change with a little bit more money going into money market mutual funds," Serene said.

Curinos expects a slight increase in consumer deposits in 2023 with a big shift toward direct banks that pay high rates.

|

Intense price competition

The 44-basis-point sequential increase in banks' cost of funds in the first quarter came as the Fed increased its target for the federal funds rate by 50 basis points during the period, and the average overnight interbank borrowing rate increased 87 basis points to 4.52%. That compares with a 52-basis-point increase in banks' cost of funds in the 2022 fourth quarter when the Fed hiked rates by 125 basis points and the interbank rate increased by 146 basis points.

The data shows that a smaller increase in underlying rates can translate to a smaller absolute increase in banks' funding costs but that funding costs tend to catch up even when increases in underlying rates moderate. The sequential beta, or the ratio between the change in funding costs and the change in the interbank rate, rose from 36% in the 2022 fourth quarter to 50% in the 2023 first quarter.

"If the Fed pauses, we're going to see deposit costs continuing to cycle up because of [certificates of deposit], because of mix changes," Pieniazek said.

Even if the Fed cuts, it will take time for deposit costs to turn around, Pieniazek predicted, citing a reluctance among banks "to be the first kid on the block to lower deposit rates given the environment that we're in." He said it could take more than 100 basis points of cuts before average total deposit costs across the industry start to decline.