S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Nov, 2021

Facebook's recent rebranding to Meta Platforms Inc. is similar in some ways to Google LLC's change to Alphabet Inc. in 2015. In other ways, though, the differences are quite pronounced.

As part of its Connect Conference last week, CEO Mark Zuckerberg announced Facebook's new company name and its vision for the metaverse. The company will start trading under the ticker MVRS beginning Dec. 1 as a parent company for Facebook's suite of apps, including WhatsApp Inc. and Instagram, LLC as well as its virtual reality division, Facebook Technologies LLC.

The move can be compared to Google's change to Alphabet several years ago as in both cases, the companies moved from the name of their historical core product to a name signifying wider future ambitions. But differences in publicity, product offerings and financials indicate that Meta plans to go in a different direction than Alphabet.

Wall Street reacts

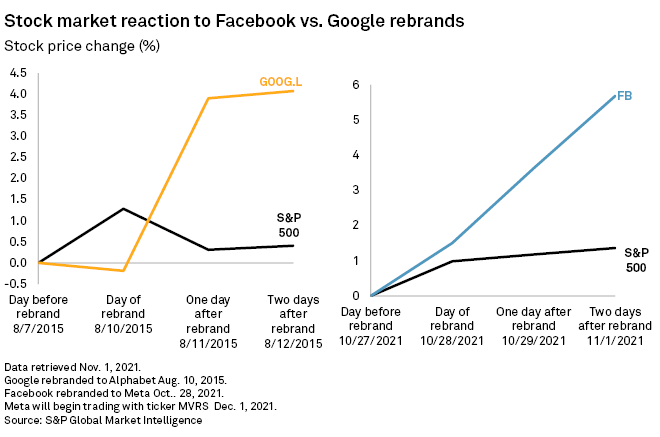

One similarity between the two rebrandings, for certain, is the stock market's positive response.

Google, which revealed its rebranding as Alphabet in an evening blog post Aug. 10, 2015, saw gains of 5% within two days of the announcement. Facebook similarly saw gains of nearly 6% by market close Nov. 1 after revealing its new name on Oct. 28 during its Connect Conference.

Segmented results

A positive element to Meta's rebrand lies in its new financial reporting structure, said Angelo Zino, senior equity analyst at CFRA Research. In its fourth-quarter results, Meta will implement a new reporting structure that separates Facebook Reality Labs, or FRL, from what will be known as its Family of Apps.

The former is set to focus on just Meta's virtual and augmented reality offerings, many of which are still in nascent stages.

"The FRL business will show significant growth given it is coming from an extremely low base, which could be viewed as a positive growth engine for the company when extrapolated over the next decade," Zino wrote in an email to S&P Global Market Intelligence.

The segmentation will also allow Meta to highlight its core advertising business, even as it invests in the new metaverse space. Meta, with its Facebook and Instagram applications, has historically made most of its returns through ad dollars.

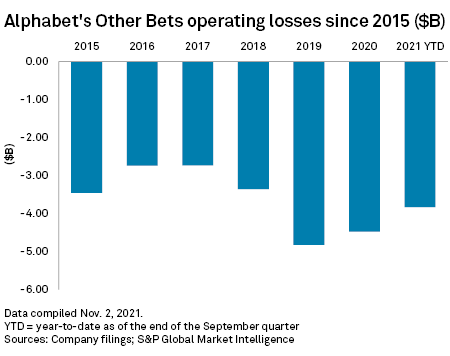

Alphabet did something similar, breaking out its subsidiaries that work on projects ranging from self-driving cars to cancer cures in a segment called "Other Bets." This segmentation separated Google's core search and YouTube businesses from its high-risk, high-investment ventures.

Since 2015, Google Bets has consistently reported billions of dollars in operating losses each year. Its operating loss came in at $3.46 billion in 2015, peaked in 2019 at $4.82 billion, and stands at $3.83 billion for the first three quarters of 2021.

Other similarities

Leading up to their name changes, both Meta and Alphabet offered well-known, legacy products to consumers for free.

Alphabet, then-Google, offered its Google Search feature several years before rebranding. Google Search, the most popular search engine in the world, originally launched in the late 1990s. As Alphabet, it now offers a suite of tools such as Gmail, cloud services, YouTube and Google Nest, among others.

Facebook, launched in 2004, initially offered a single Facebook platform for users to connect with each other but has since branched into messaging and photo blogging through its acquisitions of WhatsApp and Instagram, deals that are under contention with the U.S. Federal Trade Commission.

The differences

The clearest difference between both rebrands is arguably the public perception of each company. During its rebrand, Google was not facing any publicity problems and instead opted to rename to better highlight growth opportunities among its other businesses. "Our company is operating well today, but we think we can make it cleaner and more accountable," then-CEO Larry Page wrote in its renaming announcement.

The same cannot be said for Meta, whose publicity problems reached a tipping point last week amid revelations from "The Facebook Papers" series, which have highlighted the company's struggles in tackling misinformation, mental health, hate speech and user retainment, among other issues.

CFRA's Zino said that Meta's new face is not "pure coincidence" given that media coverage centered around the company's previous name paints the brand in a negative light. Additionally, Facebook's rebrand was telegraphed in advance, after The Verge reported on renaming rumors a week prior to the announcement, while Google's Alphabet came as a surprise.

Each company's leadership structure during their rebranding process is also distinct. Larry Page was made CEO of Alphabet, with founding partner, Sergey Brin as its president. Sundar Pichai, then Google's product chief, was named CEO of Google. Pichai is now CEO of Alphabet.

Zuckerberg of Meta continues to be CEO after rebranding. He is also chairman of the company, a dual position that will face renewed calls for separation next year given ongoing public and regulatory scrutiny it is facing.

Analysts previously told Market Intelligence that Facebook's rebrand will not carry much meaning until more details are known about the metaverse, and it also will not make the company's ongoing publicity problems go away.

Zuckerberg, during the company's recent earnings call, said it would take time before the metaverse becomes a significant profit driver. "Later in this decade is when we would sort of expect this to be more of a real business story," he said. Meta announced earlier this month that it will be hiring some 10,000 people in Europe over the next decade to help build metaverse infrastructure.