S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 May, 2021

By Dyna Mariel Bade

Robust international demand for liquefied petroleum gas drove a sharp spike in realized prices during the first quarter, boosting the NGL revenues of some U.S. shale producers more than 100% above the prior-year period.

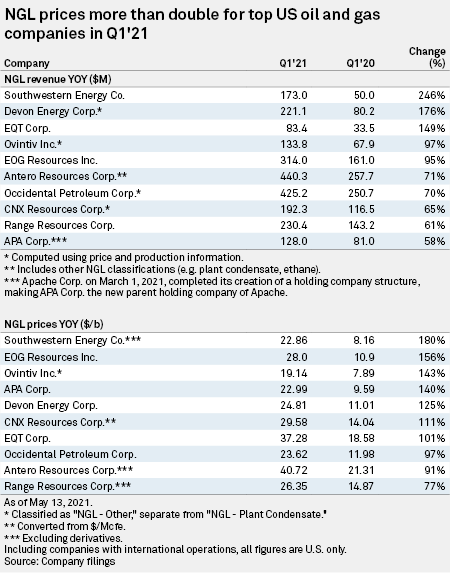

The 10 largest shale producers covered by S&P Global Market Intelligence recorded year-over-year gains in realized NGL prices of 77% to as much as 180% during the quarter.

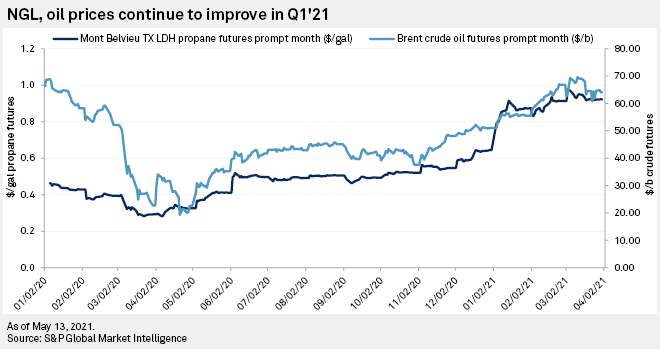

Both oil and NGL prices improved from the same period a year earlier and even from fourth-quarter 2020 levels. The average Brent crude oil futures prompt month contract gained 22% from the year-ago period, while the average Mont Belvieu NGL spot price grew more than 130%.

Executives at Appalachian NGL producer Southwestern Energy Co., which posted the highest year-over-year increases in both NGL prices and revenues, said they expect NGL and oil prices to remain strong.

"The 2021 [West Texas Intermediate] strip price has improved over $8 per barrel since we set our guidance in February, with transportation demand improving and OPEC+ compliance shaping supply increases to better match demand recovery," Southwestern Energy President and CEO William Way said during the company's quarterly earnings call. "The NGL landscape also remains promising, with low propane storage levels and increased global demand for both ethane and propane."

Unsurprising upswing

Antero Resources Corp., the country's third-largest natural gas producer and Appalachia's biggest NGL producer, also discussed the "welcomed, but not at all surprising" improved NGL prices on its earnings call. Antero said a major driver of first-quarter free cash flow was increasing commodity prices — particularly C3+ NGL prices, which averaged more than $40/b during the quarter.

Analysts from Northland Capital Markets said in a May 12 note that they anticipate Antero's net realizations will generate $300 million to $400 million of free cash flow through year-end, as Asian and European LPG prices stay high. "Summer exports, fall harvest season and winter weather are all on deck to sustain propane prices above the forward curve," the analysts said.

The second-largest NGL producer in Appalachia, Range Resources Corp., attributed the quarter's improved NGL and condensate prices to "strong demand in a market that saw decreased supply." Range posted a pre-hedge NGL price realization of $26.35/b, its highest since late 2018, and an NGL premium of $1.52/b to Mont Belvieu.

"Preliminary results for U.S. propane and butane, or LPG, revealed that Q1 2021 domestic demand was 13% higher year on year, while supply decreased by 4%," Range Senior Vice President and COO Dennis Degner said during an earnings call. "Looking forward, we see propane and butane market prices, as storage balances of these NGLs are much tighter relative to last year."

Not budging yet

Range said it anticipates propane prices will reach or exceed 60% of WTI crude prices in the upcoming fall and winter due to "the strong international demand that we are seeing with new chemical capacity coming online and recovering global economies."

Range's shipping capacity on the Mariner East pipeline increased by 5,000 barrels per day in April, and Degner said new LPG export-related contracts that took effect April 1 are expected to "add flexibility, reduce costs, and further enhance realized propane and butane prices, and continue the momentum of achieving strong export premiums."

Still, Range executives said the company will not budge from its 2021 low-cost maintenance drilling plan unless it sees a structural change in the forward commodity price curves for its oil, gas and liquids products.

Meanwhile, shale gas giant EQT Corp. said it on an earnings call that it responded to the export-driven "sharp rise in NGL pricing" by locking in a "significant number of hedges" to its portfolio. The producer said it is about 62% hedged for the remainder of 2021 and has boosted the floor price of its overall liquids portfolio hedges by 26 cents per gallon. EQT's NGL price realization and revenue both increased more than 100% year over year in the first quarter.