S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Mar, 2021

As electric and gas utilities contemplate investing in low-carbon hydrogen and the technology to produce it, the high price of today's supplies and equipment — and the potential for cost declines — are major considerations.

At the CERAWeek by IHS Markit conference, hydrogen experts and stakeholders expressed confidence that the cost curve will indeed bend in the coming years. The March 2 panel on low-carbon hydrogen production and technologies offered a detailed breakdown of the forces behind the price trend.

|

In a sign of an industry scaling up, North America's largest proton exchange membrane electrolyzer facility in Quebec will soon be dwarfed by units under development around the world. |

Norwegian electrolyzer-maker Nel ASA in January announced a goal of producing green hydrogen at $1.50 per kilogram by 2025. Malaysian oil and gas giant Petroliam Nasional Bhd., or Petronas, is targeting hydrogen production costs from the nation's hydropower and solar resources in a range of $1/kg to $2/kg, Petronas Technology Ventures CEO Mahpuzah Abai said during the panel.

"Those are levels that are very important because they would allow us to really have low-carbon hydrogen compete with the traditional forms of hydrogen that are not low-carbon," said Soufien Taamallah, director for energy technologies and hydrogen research at IHS Markit.

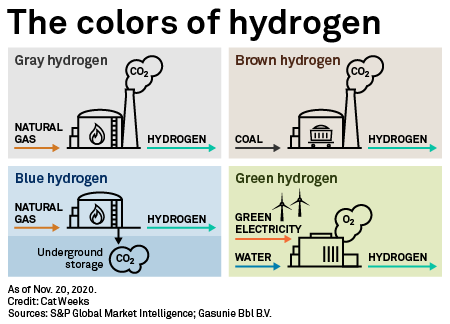

Green hydrogen produced with renewable resources costs between about $3/kg and $6.55/kg, according to the European Commission's July 2020 hydrogen strategy. Fossil-based hydrogen costs about $1.80/kg, and the commission estimated the cost of blue hydrogen, which pairs carbon capture with steam methane reformation of natural gas, at about $2.40/kg.

Achieving green hydrogen cost parity

Many companies are now focused on using renewable electric power to produce green hydrogen through electrolysis, the process of splitting water into hydrogen and oxygen. They are often installing proton exchange membrane electrolyzers, an alternative to the alkaline units that have dominated the electrolysis market for decades.

MIT Energy Initiative research scientist Dharik Mallapragada chalked up hydrogen technology cost declines to a factor that is familiar to the utility industry: the vast cost decreases for wind and solar resources that paved the way for large deployments in electric power systems, enhancing opportunities for low-carbon and marginal-cost generation.

Access to low-cost renewable electricity will be the most important factor in driving green hydrogen costs down to $1.50/kg, according to Everett Anderson, vice president for advanced product development at NEL Hydrogen AS.

The electric power price is by far the biggest variable cost when breaking down capital versus operating expenses for electrolyzers, Anderson said. Companies can achieve very high efficiency by operating electrolyzers at reduced capacity, but that will drive up capital costs, he explained. For that reason, companies should consider the total cost of owning an electrolyzer, Anderson said.

He also stressed that electrolyzer operators not only need access to low-cost renewable energy but high capacity factors — in other words, a steady supply of wind, sun or water flow. "You need the highest capacity factor possible in order to amortize that capital," Anderson said.

Electrolyzer cost declines, new applications

Declining electrolyzer technology costs partly explain the surge in hydrogen interest, Mallapragada said. With new players entering the market, the supply chain has broadened to include established companies involved in other synergistic industries, which are now focusing their product development efforts into green hydrogen, Anderson added. That industry-level scaling has helped to drive down costs further, he noted.

At a lower level, design improvements have also led to more efficient use of materials, which in turn improves electrolyzer efficiency, Anderson noted. On the manufacturing side, costs have come down as plants scale up to larger capacity and adopt automation and continuous manufacturing processes, he said.

Beyond more mature low-temperature electrolysis processes, researchers are on the cusp of overcoming challenges presented by high-temperature electrolysis, Mallapragada said. By using thermal energy as an input, high-temperature electrolysis systems present a value proposition in reducing electrical energy requirements. Nuclear power plant operators see this process as a way to transform their high-heat facilities into hydrogen production hubs. Mallapragada said the process could also present synergies with high-temperature processing applications in the industrial sector.

Finally, Mallapragada noted that methane pyrolysis is attracting attention and investment. The hydrogen production process involves decomposing methane at high temperatures to produce solid carbon rather than carbon dioxide. It could allow for hydrogen production at nodes between natural gas transmission lines and distribution systems, he said.

IHS Markit is subject to a merger with S&P Global pending regulatory and other customary approvals.