Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Mar, 2022

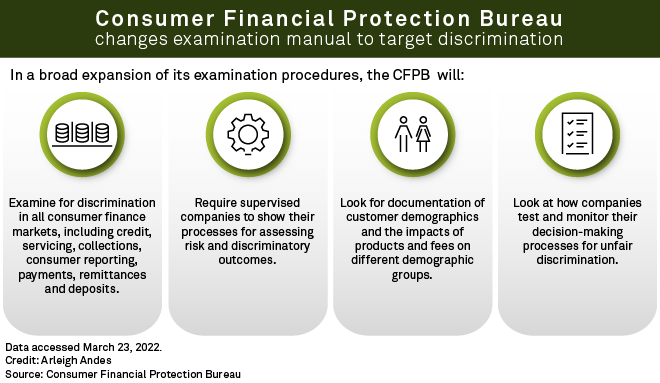

Banks are scrambling to comply with heightened anti-discrimination standards across a range of financial services after the federal consumer watchdog agency issued new guidelines without industry input.

Currently, the government requires specific anti-discrimination policies in issuing credit, but the Consumer Financial Protection Bureau now will be looking for discrimination in all consumer finance markets, including credit, servicing, collections, consumer payments, remittances and deposits. In unveiling the changes March 16, the CFPB said it "will closely examine financial institutions' decision-making in advertising, pricing, and other areas to ensure that companies are appropriately testing for and eliminating illegal discrimination."

Financial advocacy groups praised the CFPB's decision as creating equitable treatment for consumers. Industry experts said it would create a tough new environment for banks that may not have the immediate tools to comply.

Tough road ahead?

Gathering the information for testing and monitoring for potential discrimination "poses some real compliance challenges for institutions," said Tori Shinohara, a partner in Mayer Brown's Washington office and a member of its Consumer Financial Services group.

"In the noncredit context, it's much more difficult to test for that information and to come to an understanding of what the correct framework for testing is going to be," Shinohara said. "It's opening Pandora's box."

Conversely, an official with the Center for Responsible Lending, or CRL, an advocacy group, said the agency action creates a needed stepping-stone toward fairness.

The group applauded CFPB Director Rohit Chopra "for making clear that when financial companies treat consumers inequitably based on factors such as their race and gender, those companies won't be let off the hook just because their actions aren't prohibited by fair lending laws," said Taylor Roberson, CRL federal policy counsel, in a statement provided to S&P Global Market Intelligence.

Calling the development "a giant change," Chris Willis, a partner with Troutman Pepper, said banks can expect the CFPB to try to find cases of discrimination by looking at policies and procedures, as well as the types of analysis banks do.

The agency will be taking what banks think of as fair lending analysis and applying it to non-ending products, said Willis, co-leader of Troutman Pepper's Consumer Financial Services regulatory practice.

"My message is, you can like this or not like this, but it's the CFPB's position," Willis said. "Banks need to examine their operations and see where the risks are so that they can avoid an enforcement action."

Details seen lacking

One of the challenges for banks is that the agency did not provide much detail on what it would deem "unfair," according to Jeff Naimon, a partner at law firm Buckley LLP who represents financial services companies before the CFPB, the Federal Trade Commission, and other federal and state regulators.

Federal anti-discrimination laws, such as the Equal Credit Opportunity Act and the Fair Housing Act, more specifically describe the prohibited conduct as well as which individuals or groups are meant to be protected, Naimon said.

"Under this new formulation there are no specifics, so the bureau can attempt to use it very flexibly, and companies that make huge investments in order to comply with existing anti-discrimination laws still will have little clarity as to what to expect," Naimon told Market Intelligence.

The CFPB's new guidelines note that discrimination may meet the criteria for "unfairness" by causing substantial harm to consumers that they cannot reasonably avoid, where that harm is not outweighed by countervailing benefits to consumers or competition.

"Consumers can be harmed by discrimination regardless of whether it is intentional," the agency said.

Beyond Congress

An approach that goes beyond what Congress has done should be reconsidered, according to Ori Lev, a partner in Mayer Brown's Washington office who has served as deputy enforcement director of the CFPB.

An argument could be made that where Congress has acted with respect to an issue, "the CFPB's general authority to prohibit unfair practices should not be read to allow the imposition of broader, industry-wide requirements," Lev said.

Lev noted that the CFPB may have taken overly swift action in updating its guidelines with little warning to the financial community.

"In general, the Dodd-Frank Act allows for notice-and-comment rulemaking," said Lev. "This seems to be an end run around that process."

The American Bankers Association declined to comment on the CFPB action, while the Independent Community Bankers of America said it is a good time for banks to take stock of their operations.

Most community banks are not likely to be subject to the new examination procedures since the CFPB only supervises banks of $10 billion or more, said Mickey Marshall, Independent Community Bankers of America's director of regulatory legal affairs.

However, "it's a good time to review and make sure you're offering products in a non-discriminatory way," Marshall said in an interview.