Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Jun, 2021

By Allison Good

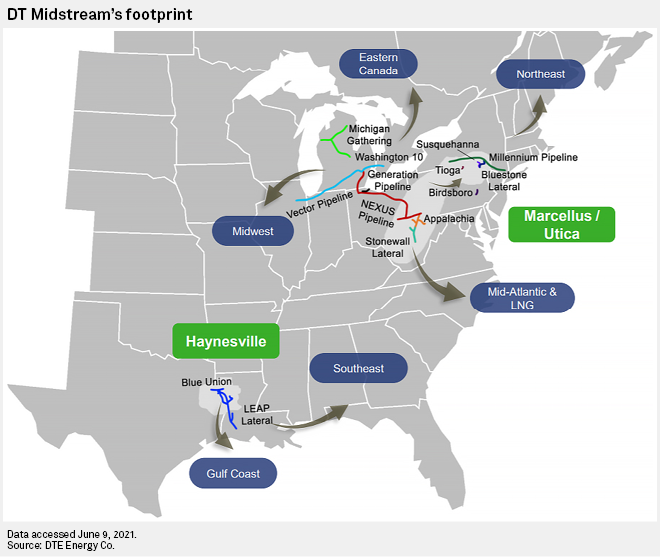

DTE Midstream is positioning itself as a best-in-class gas pipeline operator with solid contracts and a commitment to net-zero carbon emissions by 2050 ahead of a spinoff from Michigan utility DTE Energy Co.

Incoming President and CEO David Slater noted during a June 9 conference call that 90% of the new midstream entity's gathering and transportation contracts are backed by long-term take-or-pay agreements with a "remaining average life of approximately nine years," while incoming CFO Jeff Jewell reassured analysts and investors that the gathering segment would continue to sell available capacity.

"The vast majority of our gathering assets are situated and designed specifically for the customer and the acreage that's dedicated to those assets," Jewell said about the midstream business, which will be named DT Midstream. "So ... when you do approach contract renewals, you're somewhat married, and it's just a matter of working through the new commercial arrangement."

Southwestern Energy Co. will be DT Midstream's biggest customer once the Appalachian shale driller completes its merger with private equity-backed Indigo Natural Resources LLC, according to Slater.

Jewell said the company expects to see between $710 million and $750 million of adjusted EBITDA for 2021 and anticipates that metric growing 5%-7% in 2022 as DT Midstream takes advantage of strong drilling activity in Louisiana's Haynesville shale. On the credit side, DT Midstream forecast achieving investment-grade ratings once it reaches "that $1 billion EBITDA neighborhood."

When it comes to growth projects, expanding and bringing new third-party customers onto the Louisiana Energy Access Project and Blue Union gathering systems will be "priority number one" for the new entity. Building out lateral pipelines will also be a major focus.

"We're connecting large industrial load and power generation load to the network," Slater said. "We continue to see strong interest in that space."

In terms of equity value, the incoming CEO is optimistic that DT Midstream will "see a strong multiple" when it begins trading publicly and is encouraged by the $1.23 billion Kinder Morgan Inc. recently agreed to pay for Crestwood Equity Partners LP and Consolidated Edison Inc.'s Stagecoach Gas Services LLC.

Aiming to achieve net-zero greenhouse gas emissions by 2050, Slater emphasized DT Midstream's lines of sight on hydrogen blending and the carbon capture value chain. "We have a pure form of CO2 inside our portfolio today, which is one of the key ingredients for a successful carbon capture and sequestration program," the CEO said. "I view that as ... sort of a third leg that could mature fairly quickly."

DT Midstream will also target electrifying its existing compression fleet and continue to reduce methane emissions, according to Slater.