Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Sep, 2021

|

Fast-evolving electric vehicles require special planning. |

This is the finale of a four-part series exploring the rise of electric vehicles and their impacts on the global economy, from the auto and power industries to oil and mining sectors.

The millions of new grid-connected cars, vans, trucks and other electric vehicles hitting the road each year will not get far without ample charge for their increasingly powerful lithium-ion batteries.

|

EVs could require between 525 TWh and 860 TWh of electricity globally in 2030, up from 80 TWh last year, according to the International Energy Agency. While that would equal just a small share of global electricity consumption — including an estimated 2% to 5% in the U.S. — EVs could require more than three times the power currently consumed by California, the world's fifth-largest economy.

Electric utilities and their equipment suppliers stand to benefit from this effort to decarbonize transportation if they can overcome the substantial challenges and risks. Chief among them are an insufficient number of charging stations for mass EV adoption, as well as charging habits that may not align with optimal grid operations. Dense concentrations of EVs could strain local electric infrastructure or exacerbate the need for expensive grid and resource investments, including into fossil fuels, to meet peak demand.

"The infrastructure indicators for this market have lagged," John DeBoer, head of engineering giant Siemens AG's eMobility Solutions and Future Grid Business in North America, said in an interview. "Back in 2010, there was this chicken-or-egg thing that got talked about all the time: Would the vehicle come first, or would the charger? And in the U.S., there was no question how that answer played out. The vehicles came, they grew ... and the infrastructure wasn't built."

Siemens recently announced its intention to produce more than 1 million EV chargers in the next four years for U.S. homes and businesses, building on the roughly 75,000 chargers the company has supplied over the past decade.

Siemens based its decision to ramp up production partly on the $1 trillion infrastructure bill awaiting a vote in the House of Representatives. The measure would authorize $7.5 billion for alternative fuel corridors and to construct a nationwide network of EV charging stations.

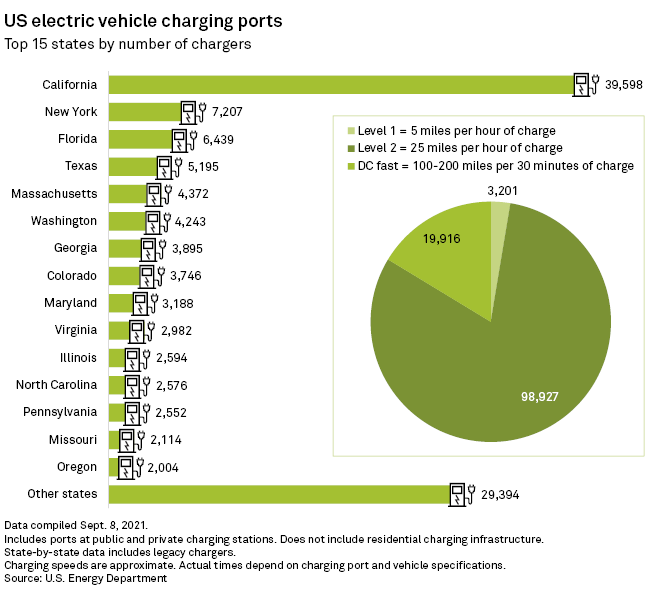

Those funds will help to realize President Joe Biden's target of building 500,000 chargers across the country, DeBoer said. As of Sept. 21, there were approximately 122,550 charging ports at more than 47,000 public and private stations, according to the U.S. Department of Energy's Alternative Fuels Data Center.

|

White House Climate Adviser Gina McCarthy and |

Those volumes, however, only scratch the surface of the anticipated need for charging infrastructure, said Joel Levin, executive director of EV advocacy group Plug-In America.

"Imagine how comfortable you'd feel driving with gasoline if we took out two-thirds of the gas stations," Levin said in an email.

Biden's initial $15 billion federal funding proposal for EV charging, part of a $174 billion package of envisioned EV investments, is more in line with the kind of moonshot required to launch EVs, Levin said.

"The current Senate investment will barely take us over the rooftops and certainly won't get us where we need to go," the executive director said.

A group of 28 members of Congress has urged their colleagues to include more federal funding. "By making an $85 billion investment in zero-emission charging infrastructure that will last decades, we can employ tens of thousands of Americans, all while supporting the massive adoption of clean transportation options," the group said in August.

The Edison Electric Institute, a Washington, D.C.-based utility trade group, estimates some 9.6 million charge points will be needed in the U.S. by the end of the decade to support an estimated 18.7 million EVs on the road.

Charging on sunshine

With an ambitious goal to stop selling new petroleum-powered passenger cars by 2035, California is emerging as a global laboratory at the intersection of vehicle-grid integration. Initiatives are ramping up to ensure EVs do not overwhelm the state's power system, which hosts 44% of the roughly 2.1 million all-electric and plug-in hybrid vehicles in the nation through the first half of 2021, according to the California Energy Commission.

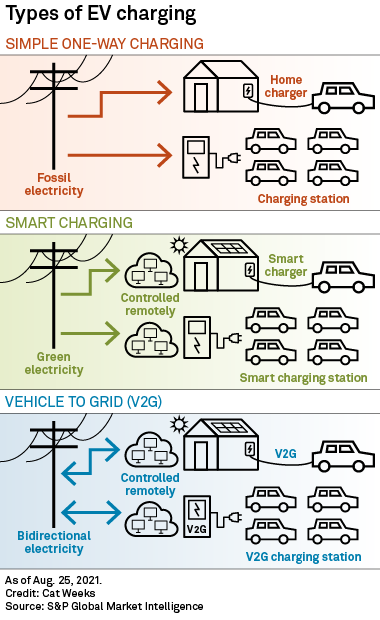

Southern California Edison Co., or SCE, is tackling America's most extensive utility-led rollout of charging infrastructure. The Edison International subsidiary this summer opened its state-approved $436 million program to add some 38,000 electric car chargers at businesses, public agencies and multifamily properties over the next five years. The program is synchronized with time-of-use electric rates to influence charging patterns — a basic example of managed charging, also known as smart charging, that gives EV owners a price signal on when to juice up.

"We are encouraging our customers to charge during the day, when solar energy is most abundant," said Chanel Parson, principal manager of electric mobility operations at SCE. "It's the [cleanest] type of energy, and it's most available on our system right between 8 a.m. to 4 p.m. And that's when energy is cheapest, as well, because there's so much on the system."

A separate $356 million charging program for medium- and heavy-duty electric vehicles started last year.

Pacific Gas and Electric Co., or PG&E, is working with BMW AG on a similar project seeking to incentivize approximately 3,000 EV drivers in the San Francisco Bay area to charge on renewable energy. This scaled-up version of a pilot initiative will help the PG&E Corp. utility identify barriers and test solutions for potential expansion.

"EVs participating in this program will be able to act as a flexible grid resource to support the overall reliability of the electric grid," Maria Sanz, PG&E's product manager for vehicle-grid-integration programs, said in an email.

A recent Energy Commission report estimated California will require nearly 1.2 million public and shared private chargers to support 8 million EVs in 2030, but it flagged the state's current scarcity. The biggest gap is in Level 2 ports, often used in workplaces or shopping centers. California is also behind schedule installing direct current fast chargers, critical for fleets and long-distance travel.

Regulators also identified the need for more charging funds; the emergence of a "self-sustaining private market"; an equitable deployment of stations that reach heavily polluted, lower-income areas; and standardization of hardware and software to support a "massive scale" of vehicle-grid integration.

Longer term, California's need for charging infrastructure may grow aggressively, heightening such challenges and adding new ones. In its vision for how the state can reach carbon neutrality by 2045, SCE foresees the need for more than 20 million light-duty EVs and 900,000 medium- to heavy-duty EVs, along with unprecedented new levels of charging infrastructure and demands on the grid.

Cross-sector collaborators

While efforts to accelerate the infrastructure build-out continue, cross-sector collaborations are accumulating to advance EV-grid integration efforts.

Among the new alliances, Ford Motor Co. in June acquired Electriphi Inc., a Silicon Valley-based developer of commercial charging and fleet monitoring software. The addition aligns with the automaker's forthcoming launch of two all-electric commercial vehicles, the E-Transit cargo van and the F-150 Lightning pickup truck, as well as the creation of Ford Pro, a commercial charging business.

The move mirrors a wave of mergers and acquisitions in recent years involving smart-charging and fleet electrification startups, many of which were incubated in the Golden State. Other deals include last December's sale of eIQ Mobility Inc., an upstart in EV charging software and electric fleet planning, to NextEra Energy Resources LLC, a renewable energy and storage affiliate of Florida-based utility giant NextEra Energy Inc.; and Royal Dutch Shell PLC's purchase of Greenlots in 2019.

|

In a different approach, U.S. residential solar heavyweight Sunrun Inc. is working with Ford to sell the F-150 to homeowners in a package that includes a charging station, integration system and optional solar array. The truck can power an entire home during utility outages for up to three days on a fully charged battery, according to Ford. That capability could appeal to Americans experiencing an increase in power outages amid wildfires, heatwaves and hurricanes.

"We can expect households that adopt electric vehicles to consume approximately double the amount of electricity," said Nick Smallwood, vice president of business development at San Francisco-headquartered Sunrun. "Home solar and battery systems are the answer to meeting this increased strain on the electric system."

The partnership could set the stage for deeper integration of EVs with the grid. The F-150 Lightning is one of the few vehicles either on the road or planned to launch in the next year that is equipped with bidirectional charging capabilities required to power a home or business, or even someday participate in electricity markets.

"We see electric vehicles as an asset to the grid long term, reducing pressure during peak usage times, while unlocking additional financial benefits for consumers," Smallwood said.

So does Nuvve Holding Corp., a San Diego-based vehicle-to-grid, or V2G, software specialist that listed on the Nasdaq in March through a merger with a special purpose acquisition company. Nuvve is seeking early inroads with fleet operators and other customers in California and in Europe, where it is part of a V2G joint venture with French power giant EDF Group, which supplied venture funding for Nuvve in 2017.

"We are really the bridge between the electric system and electric vehicles," Nuvve CEO Gregory Poilasne said in an interview. "I think there's a world of application here that we have very little idea about how it's going to shape up. I look at it in the same way we could have looked at the internet in the '90s, and see [what] it became today."