S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 Sep, 2021

This is the first of a four-part series exploring the rise of electric vehicles and their impacts on the global economy, from the auto and power industries to the oil and mining sectors.

If it seems like electric vehicles are proliferating in unprecedented volume and variety, it's because they are — and they're gradually changing the world around them.

|

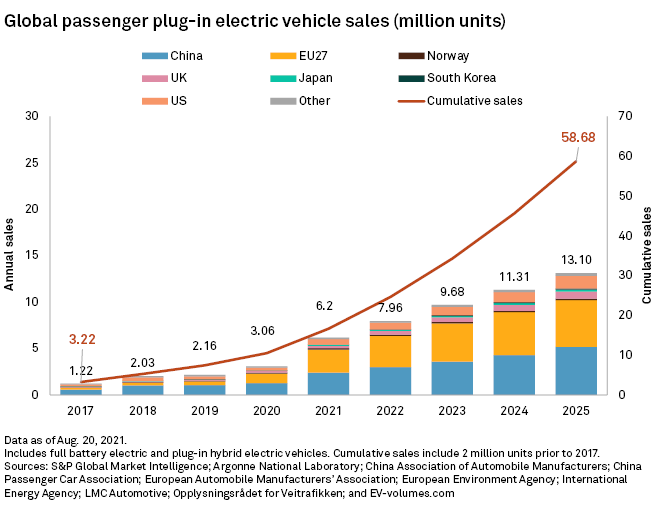

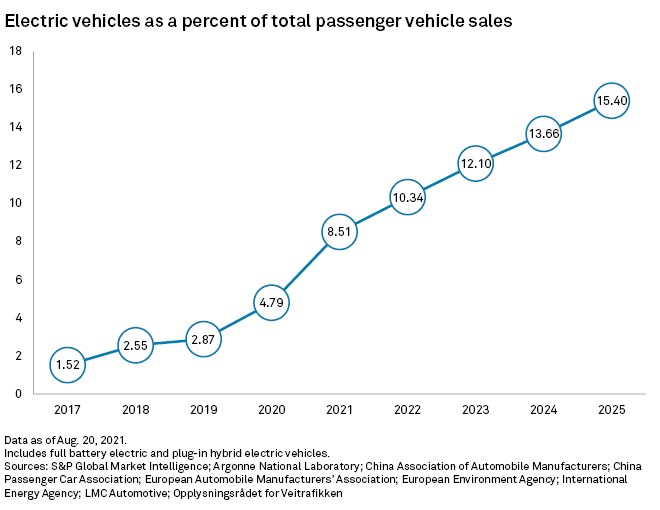

Fueled by skyrocketing demand in Europe, China and the U.S., sales of pure electric and plug-in hybrid passenger vehicles in 2021 are on pace to more than double to a record 6.2 million units, according to S&P Global Market Intelligence data. At nearly 9% of the global passenger vehicle market, up from less than 3% just two years ago, this marks an emphatic finish to a long ascent to commercial relevance.

Automakers and their suppliers are grappling with shortages of lithium-ion batteries and semiconductor chips. Safety-related recalls have been expensive. Yet this year's surge in EV sales sets the stage for a new phase of cross-sector innovation and development as grids reshape when and how they deliver power, and the oil and gas industry starts to lose its grip on transportation.

"This is one of the biggest transformations since the industrial revolution, and it's not just transforming what powers the car," said Josh Boone, executive director of EV advocacy group Veloz, which is backed by California's largest electric utilities, several of the world's largest automakers and a charging affiliate of an oil major migrating aggressively into electricity.

"It is a seismic shift in how the energy sector and the transportation sector interact," Boone said.

Veloz is part of the National EV Charging Initiative, a coalition of U.S. business and labor groups, state energy regulators and environmental organizations seeking to harness the capital necessary to launch coast-to-coast construction of charging stations — a critical missing link in the push for EV ubiquity. The coalition believes federal government funding is necessary to augment the billions of dollars the private sector is spending to create a charging experience that matches the ease of filling up on gasoline. Advocates see the bipartisan infrastructure bill, which awaits a House of Representatives vote, as a start; it includes $7.5 billion in funds for alternative fuel corridors and a nationwide network of EV charging stations.

"We are at a really important moment," Colleen Quinn, president of eMobility Advisors and organizer of the National EV Charging Initiative, said in an interview. "This is historic and critical to accelerate adoption, address climate [change] and support jobs."

Automakers, utilities and charging equipment vendors are working with regulators and EV advocates to overcome obstacles to their ambitious agenda, which include developing domestic manufacturing and recycling, and ending unethical practices in the extraction of lithium-ion battery metals.

"We're looking at how to clean up the electricity that powers these electric cars. We're looking at, how do we get more [miles] in our electric cars? We're looking at, how do we clean and decarbonize the manufacturing process of electric cars?" Boone said.

"This kind of effort requires shooting for the stars."

Battle for EV trillions

EVs could exceed 15% of the annual auto market in four years, with a total stock of almost 60 million increasingly cost-competitive, long-range electric passenger vehicles silently whizzing down the roadways, Market Intelligence estimates. EVs are on track to rise to 20% of China's total market by 2025, up from 6% in 2020, and to 37% in the EU, from 11% last year. In the U.S., they are forecast to reach 10% by 2025.

"The rise in penetration rates globally is driven by policy incentives for consumers and 'sticks' compelling automakers to reduce emissions and improve fuel economies," said Alice Yu, a senior research analyst at Market Intelligence. EV models are multiplying as automakers embrace the transition to electric, Yu said.

Assuming an average EV sticker price of $40,000, global revenues could break $1.9 trillion between 2021 and 2025. If prices mostly fall below their petroleum-powered counterparts during that time, as many analysts predict, revenues could top $1 trillion per year by the end of this decade. Electricity sales and charging services represent additional pools of revenue.

|

Volkswagen's electric mobility metamorphosis is showing signs of progress. |

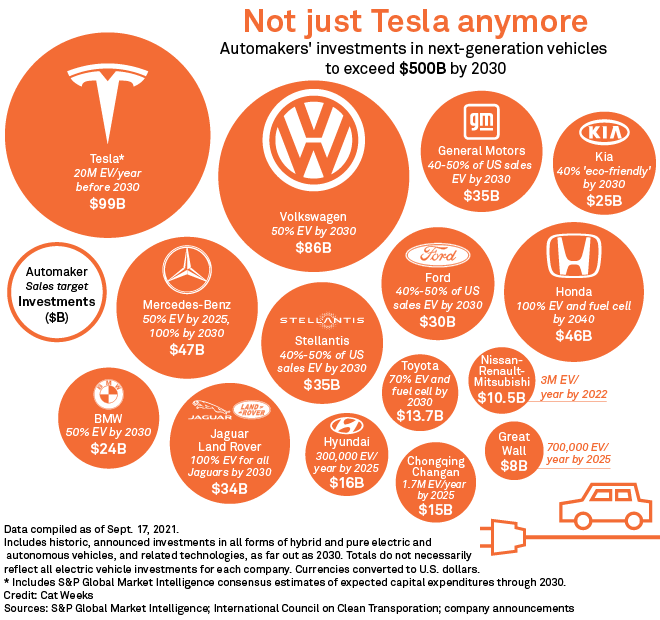

These opportunities explain why the largest auto manufacturers joined trendsetter Tesla Inc. in betting hundreds of billions on EVs. Much of the money is directed at a massive scale-up of battery and auto manufacturing, charging infrastructure and research and development.

After years of absorbing losses, Tesla CEO Elon Musk has delivered a road map for the future of transportation. With a stock market valuation of more than $750 billion, the Palo Alto., Calif.-based company is worth more than Toyota Motor Corp., Volkswagen AG, Daimler AG, BMW AG, General Motors Co. and Honda Motor Co. Ltd. combined.

Tesla is on its way to a third consecutive profitable year, netting more than $1.1 billion in income in the second quarter of 2021 with just four sleek, all-electric cars. Most investment experts covering Tesla see profits and revenues rapidly expanding for years to come.

Others have been catching up. Volkswagen was the only carmaker other than Tesla to deliver more than 300,000 EVs in the first six months of 2021, according to research group EV-volumes.com. About half were full battery electrics.

GM has been charging hard. Through its Chevrolet division in the U.S. and partnerships in the burgeoning Chinese EV market, GM sold more than 200,000 pure battery EVs in the first half, according to the research group. That was before the carmaker disclosed an approximately $1 billion recall of Bolt electric vehicles in August. It was GM's third such recall for the model over fire-related safety concerns linked to lithium-ion batteries supplied by LG Chem Ltd.

Stephen Chan, a credit analyst at S&P Global Ratings, does not see battery issues derailing EV expansion plans, at least not yet. "Given the battery sector is still experimenting with a complex technology, industry players will face increasing product liability risks, but their liabilities are still manageable so far," Chan said.

'Tipping point'

One area where Tesla trails is heavy-duty vehicles. Since the company unveiled its semi-tractor-truck concept to huge fanfare in 2017, traditional truck manufacturers have stolen the show.

Daimler Trucks North America LLC and Volvo Trucks North America Inc. inked deals to provide Southern California fleet operators with 100 fully electric Class 8 trucks, classified as having a gross axle weight rating exceeding 33,000 pounds. The state is partly funding the $74 million initiative to help launch heavy-duty trucks commercially and to reduce pollution along congested delivery routes leading to the ports of Los Angeles and Long Beach, the two largest in the U.S.

"It's the tipping point," Steve Mignardi, a vice president at Daimler Trucks, said in an interview. "It's not a dream anymore; it's not a vision; it's not a test. We are scaling up."

|

Daimler is scaling up its production of electric semitrucks in Portland, Ore. |

Electrify America LLC, a Volkswagen affiliate, is supplying fleet operator NFI Industries Inc. with a large-scale, solar-powered charging station, equipped with energy storage, at its facility in Ontario, Calif. The 34-port site is the largest of the over 700 direct-current fast-charging stations Electrify America has installed as part of a $2 billion national infrastructure commitment, initiated through a settlement related to its parent company's diesel emissions scandal.

As with passenger cars, the up-front price tag for an electric truck is higher than for a conventional one, with batteries as the largest cost element. Factoring in total cost of ownership over a vehicle's life, including fuel and maintenance costs, can often turn the tables on the cost comparison.

"The opportunity is huge right now for cost savings, to say nothing of cleaner air and the resulting carbon emission reductions," said Scott Fisher, vice president of fleets and original equipment manufacturer solutions at EV charging software specialist Greenlots, which was acquired by Royal Dutch Shell PLC in 2019.

Norway's window into the future

In the first six months of 2021, EVs accounted for 15% of new passenger vehicle registrations in the U.K., 23% in Germany, 40% in Sweden and an astonishing 83% in Norway, according to Berlin-based Schmidt Automotive Research.

Norway's accelerated EV adoption, driven partly by tax incentives, offers a unique look into the electrified future that larger economies may one day experience. Relying on Europe's most decarbonized electric grid, made up almost entirely of hydropower and wind energy, the Nordic nation — a major oil and gas exporter — plans to purge pollution from domestic transport. Its strategy includes phasing out sales of new gasoline and diesel passenger cars and light vans in four years, the most ambitious timeline among more than 20 countries with similar policies.

"Norway is interesting," said Roman Kramarchuk, head of energy scenarios, policy and technology analytics at S&P Global Platts. "Sales are part of the story. A separate question is what is happening with the existing fleet — how many older cars actually retire?"

Because slow turnover of older vehicles lags the new car market, Platts energy transition analysts estimate EVs will account for just 18% of Norway's total light-duty vehicle stock this year and 32% in 2025.

Another uncertainty is driving patterns. "Are EVs driven as much as [internal combustion engine] vehicles or only used more sporadically for short hauls?" Kramarchuk asked.

Efforts are under way to make Norway into a production hub for lithium-ion cells, following in the footsteps of Sweden, where Northvolt AB is developing a battery base that it calls "the most sustainable in the world."

"We believe Norway offers as good, if not better, parameters and characteristics for battery cell production," said Tom Jensen, CEO and co-founder of Freyr Battery.

Freyr plans to take a shortcut to mass manufacturing by licensing technology from Massachusetts-based developer 24M Technologies Inc. rather than creating its own unique chemistry. In addition to planning factories in Norway, Freyr is in advanced talks with an unnamed "global industrial conglomerate" to build battery production in the U.S., Jensen said.

U.S. President Joe Biden's policies could steer the country to mirror Norway's bold moves to integrate power with transportation and open opportunities to scale up American battery production capacity, Jensen added.

"We do believe that we can replicate [our approach] also in the U.S. market, which, of course, has a fundamental need for decarbonizing both its power generation sector as well as its automotive sector," he said.

S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.