S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Sep, 2021

By Allison Good

|

|

This is the third piece of a four-part series exploring the rise of electric vehicles and their impacts on the global economy, from the auto and power industries to oil and mining sectors.

The love affair between cars and oil is losing its spark.

The surging popularity of electric vehicles stands to rattle fossil fuel markets, with energy experts anticipating an erosion of oil demand for transportation around the globe. At the same time, the electric vehicle revolution has the potential to generate additional demand for natural gas as a power source for plug in cars.

.

|

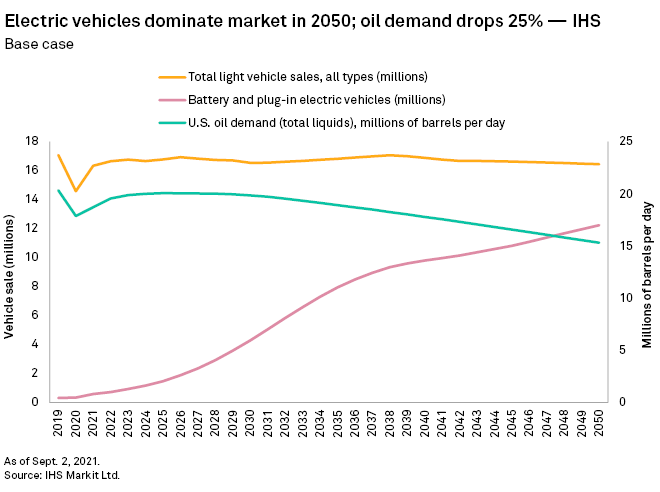

Under one scenario, U.S. oil and liquids demand could drop by about 25% from 2019's 20.3 million barrels per day — before the COVID pandemic — to an estimated 15.3 million b/d in 2050, according to an "Inflections" base case from IHS Markit research. The Inflections case projects that global oil demand peaks in 2036 and then declines slowly.The outcomes for both oil and gas depend heavily on government policies and EV incentive schemes, according to observers. That uncertainty around the pace of electric vehicle adoption is reflected in the wide-ranging estimates from researchers and market participants.

"We see that as a potential outcome depending on how strong policies are to decarbonize," Jim Burkhard, IHS's head of research for oil markets, energy and mobility said. "It's all policies."

Aggressive EV adoption would eat into oil demand

Both independent and oil company forecasters expect that aggressive electric vehicle adoption would cause oil use for transportation to crumble.

IHS's low-carbon policy scenario projects that U.S. oil demand for transportation could drop to 7 million b/d in 2050.

"We see that as a potential outcome depending on how strong policies are to decarbonize," Burkhard said. "You have voters and consumers, powering the heavy hand of government to retire fossil fuel equipment ... to retire before the end of its useful life, in order to decarbonize. That's the difference."

The timeline over which a government-driven push towards EVs remains highly uncertain, though, Burkhard noted. "Is the U.S. government going to say you cannot use an oil-powered car in 2040? Or, you cannot sell an oil-powered car in 2033?" Burkhard asked. "We're not there yet. Could we be? It's a possibility."

There are some key catalysts Burkhard sees potentially driving an accelerated transition. For instance, devastating storms with significant humanitarian consequences could alter the public' cost-benefit analysis.

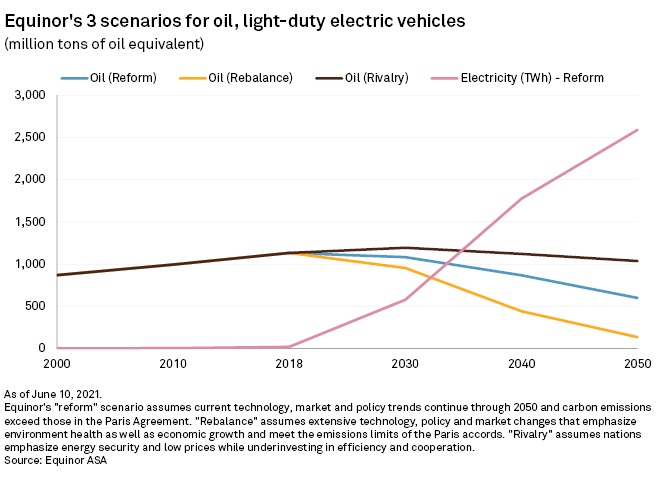

Norway's Equinor ASA sees an aggressive drop-off in oil demand. Assuming current trends play out, Equinor predicts global demand for oil for transportation will drop 47% between 2018 and 2050 due to improvements in fuel efficiency and electric vehicles.

Equinor sees current moves toward electric vehicles as reflective of a combination of car manufacturers' efforts to meet emissions standards and technological advancements improving the vehicles themselves. The company said earlier this year that it expects electric vehicles to ultimately become competitive on costs without subsidies.

EVs not a silver bullet for cutting oil use

In the IHS base case, national interests take priority over international climate change cooperation on greenhouse gas emissions and growth in the developing world offsets climate change efforts by the developed economies. That said, this Inflections scenario still projects a "remarkable" electrification of transport around the world, although acknowledges that challenges around developing "ever larger battery supply chains" temper the transition pace.

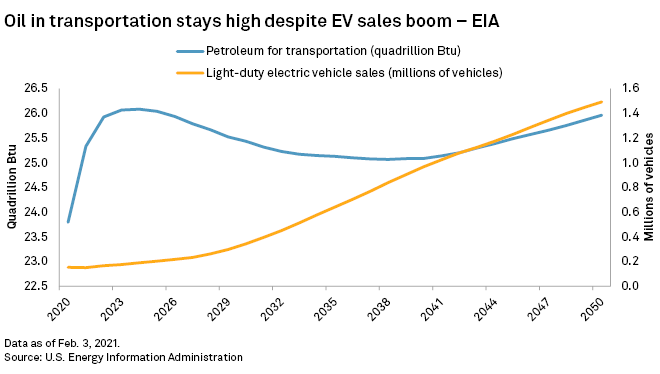

The EIA, too, sees electric vehicle sales only nibbling away at gasoline as a fuel for cars and trucks, and fuel efficiency standards playing an equal or greater role in cutting U.S. demand for oil for transportation over the next decade. EIA's latest annual energy forecast reference case, which assumes no major political or technological changes, predicts 9% more oil will be consumed by the U.S. transportation sector in 2050 than in 2020, even as electric vehicle sales explode.

In the near term, the effect of electric vehicles on the U.S. fossil fuel markets appears negligible, according to Joshua Linn, a senior fellow at the energy think tank Resources for the Future. Electric vehicle additions may — because of the way federal fuel standards are calculated using fleet averages — even increase oil and gasoline demand, Linn said.

"We have the federal [Corporate Average Fuel Economy, or] CAFE and greenhouse gas standards that are determining the overall emissions rate of vehicles," Linn said. "If you sell more electrics, that means you can sell more gas-consuming SUVs."

Even if electric vehicles come to entirely dominate the transportation space, Exxon Mobil Corp. is expecting little change in global oil use. The oil major predicts that oil use for transportation will decline slowly but overall oil demand will continue to rise as crude is needed for industry and petrochemicals. "If every car sold in 2025 was an EV, leading to every single passenger vehicle in the world being an EV by 2040, the global demand for oil and gas would be the same as it was in 2010," Exxon spokesman Casey Norton said, citing Exxon's 2018 energy outlook.

Gas producers, pipelines could see opportunity amid transition

A transformation in the transportation sector stands to benefit natural gas, albeit not directly as a transportation fuel.

The decades-old dream of the late Chesapeake Energy Corp. CEO Aubrey McClendon and his fellow shale gas revolutionaries that natural gas would be a widely used transportation fuel will probably not come true. Even though the U.S. Energy Information Administration expects that natural gas use for transportation in the U.S. will increase steadily over the first half of the century, the fuel's direct role in the segment ultimately remain at "relatively low levels."

But natural gas will benefit from any transition to electric vehicles as gas is part of the electric power dispatch stack, according to analysts at credit research firm CreditSights.

Increasing electric vehicle adoption "will drive higher grid demand for power. This results in higher natural gas demand in the near and medium term," CreditSights said in a note to clients, calculating that if new car sales by 2030 are EVs in the U.S., that would translate to about a roughly 2-3%, or 72 TWh, rise in grid demand. CreditSights' projected that that increase would translate to about 0.7 Bcf/d in incremental gas demand, under the assumption that half of that power demand would be met with gas and a 7,000 heat rate new-build plant.

With that, natural gas pipeline operators and processors will be insulated from any shift brought on by electric vehicles, CreditSights wrote. Long-term contracts protect their businesses through this decade, and further out there remain relatively few replacements for the natural gas liquids that they produce and sell to industry, according to the research firm.

"Natural gas pipelines, LNG export infrastructure and NGL assets appear best positioned for the energy transition," CreditSights said. "Natural gas will continue to be a fossil fuel that is complementary to the energy transition for a very long time, and while replacements like electric vehicles are positioned to impact gasoline/diesel demand, replacements for NGLs and the petchem process to make plastics simply aren't viable."

Even still, some midstream and downstream oil and gas companies are gearing up to respond to a changing market, with a few operators already making investments to capture parts of the EV value chain.

Days after U.S. President Joe Biden signed an executive order calling for all-electric cars to make up 50% of new sales in the country by 2030, refiner Phillips 66 announced plans Aug. 9 to purchase a 16% stake in Novonix Ltd., which supplies materials for lithium-ion batteries. Phillips 66 will feed its existing business into Novonix's synthetic graphite manufacturing facility and expand that plant's capacity.

Analysts at energy investment bank Tudor Pickering Holt & Co. flagged the electric vehicle potential in this move immediately, representing a possible avenue for oil and gas companies to find new niches: Phillips 66 produces specialty coke, which is used to make anode material for batteries, putting the company in a position that "supports the development of a fully domestic supply chain for sales into the rapidly growing U.S. EV market."

IHS Markit is subject to a merger with S&P Global pending regulatory and other customary approvals.