Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Sep, 2021

|

|

A worker connects cables in a Volkswagen ID.3 electric car on the assembly line at a production facility in Dresden, Germany, on June 8, 2021. Electric vehicle manufacturers are trying to get ahead of an anticipated battery metal supply crunch by innovating their batteries. |

This is the second of a four-part series exploring the rise of electric vehicles and their impacts on the global economy, from the auto and power industries to oil and mining sectors.

Bracing for a rapid rise in battery metal demand, EV-makers are shaking up the supply chain with new technologies.

.

|

As electric vehicle sales ramp up around the globe, key battery metals such as lithium, cobalt and nickel are already facing supply chain constraints. EV-makers are feverishly innovating, attempting to bring down raw material costs and charging times. They are also working to boost the range and safety of their EV batteries to keep ahead of anticipated battery metal shortages.

Battery- and EV-makers, from Chinese battery giant Contemporary Amperex Technology Co. Ltd. to U.S. automakers Ford Motor Co. and Tesla Inc., have ambitious ideas. Some have sought to slash cobalt from battery chemistries, develop solid-state technology or switch to sodium-ion batteries.

"Over the long term, there could be new technologies disrupting the market if they are proven to be more energy and cost effective and more sustainable in supply," Stephen Chan, associate director at S&P Global Ratings, said in an email. "Many market players are focusing on emerging technologies."

Metals supply crunch

With EV sales expected to surge, global battery demand could increase over fivefold between 2020 and 2025, according to S&P Global Market Intelligence data. EVs require roughly six times more minerals than cars with internal combustion engines. That means EV-makers will eat up an increasing share of the world's lithium, cobalt, nickel and other metals needed to make batteries.

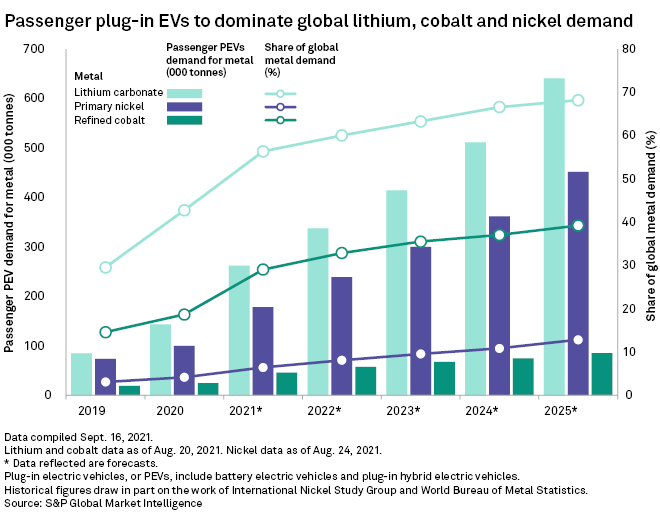

Already, the proportion of these metals dedicated to the EV market is growing, threatening to trigger a shortage. Passenger plug-in EVs will be responsible for an estimated 68.2% of global lithium demand and 39.3% of cobalt demand by 2025, according to Market Intelligence data. Approximately 12.8% of primary nickel demand will come from passenger EV-makers by 2025.

Market Intelligence analysts forecast a lithium and cobalt shortage surfacing by 2025. Primary nickel is expected to fall into a deficit in 2021. In addition, volatile costs, sustainability concerns and a lack of new mine growth for nickel have some automakers worried. Lithium demand could increase by more than 40 times in the next two decades, while graphite, cobalt and nickel demand could climb by 20 to 25 times, if the world meets the climate targets set by the Paris Agreement on climate change, according to the International Energy Agency.

"We're seeing fairly big shifts even year on year and much faster growth over the last two years in EVs than anyone probably would have expected," said Harry Fisher, senior analyst for battery metals at CRU Group.

'The biggest unknown'

New battery technologies could help automakers and battery producers avoid those looming shortages.

"The evolution of battery chemistry is the biggest unknown in many ways," said Chris Berry, an independent battery metals analyst and president of House Mountain Partners.

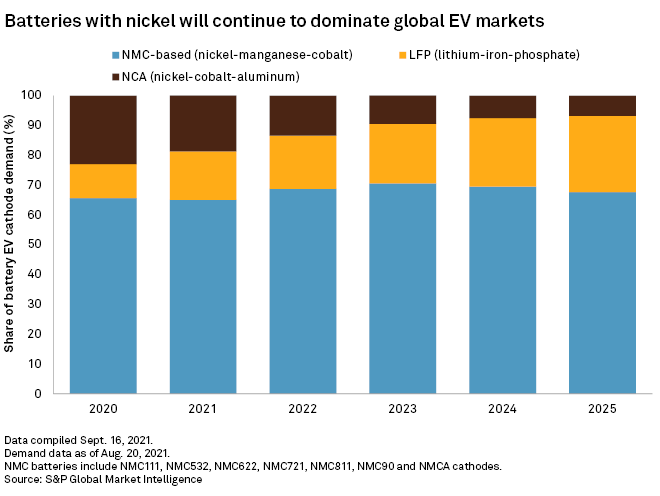

Nickel-containing batteries dominate the pure battery electric vehicle market. In 2020, nickel-manganese-cobalt batteries made up over 65% of the market because they offer higher energy density compared with batteries without nickel and are a good fit for larger EVs going longer distances. However, battery-makers in South Korea and China have been developing a battery that uses more nickel and reduces demand for cobalt, according to Market Intelligence analysts. The shift could mark an improvement in technology and ease consumer pressure to cut production of a metal tangled with accusations of human rights abuses.

Lithium demand would be relatively unaffected by the market's preference for nickel-rich batteries, though demand for the white metal coming from EVs is expected to skyrocket, increasing as much as fourfold between 2020 and 2025, according to Market Intelligence.

Nickel producers should not rest on their laurels

Manufacturers' hunger for battery-grade nickel is increasing, and a market deficit for primary nickel will emerge this year, Market Intelligence analysts said.

But major EV-makers such as Tesla believe that they can cut costs and avoid other supply constraints by replacing the nickel in their batteries with other materials, such as iron. The technology has found applications in EVs in China, but Tesla and other automakers believe that lithium-iron-phosphate, or LFP, batteries will find their way into more EVs in Europe and the U.S. Volkswagen AG recently announced it will use LFP batteries in some of its global EV models, and Tesla expanded its relationship with LFP-maker CATL. Volkswagen declined to comment for this story, and Tesla did not respond to a request for comments.

LFP batteries allow automakers to sell lower-cost, entry-level vehicles, even if they have less range. LFP batteries are also more durable and less combustible than traditional battery chemistries. And while the nickel batteries require less cobalt, LFPs require none, allowing companies to duck supply chain constraints, human rights issues and high costs.

"The resurgence of LFP technology, which is improving and getting better, is something that I think is going to continue," Berry said.

LFP cathodes still only accounted for 10.4% of the market in 2020, but they have a sturdy foothold in China.

CATL, 2021's biggest battery-maker in terms of capacity, is commercializing a low-cost iron-based battery that would help EVs drive more miles before needing a charge. CATL did not respond to a request for comment. The second-largest battery-maker, BYD Co. Ltd., is also researching ways to innovate LFP batteries. The Chinese automaker announced updates to its Blade LFP battery in April, saying it offered a cruising range equivalent to nickel-manganese-cobalt batteries, a BYD spokesperson said.

If these companies can achieve commercial breakthroughs in LFP batteries, the low-cost technology could "fully displace" some varieties of nickel batteries, according to Market Intelligence analysts Alice Yu and Jason Sappor.

The battery sector's great hope

Solid-state batteries have captured battery-makers' and automakers'

"By simplifying the design of solid-state versus lithium-ion batteries, we'll be able to increase vehicle range, improve interior space and cargo volume and ultimately deliver lower costs and better value for customers," Ted Miller, Ford's manager of electrification subsystems and power supply research, said in a statement.

Overall, the materials in solid-state batteries would mirror those used in conventional lithium-ion batteries.

"Adoption of solid-state cells could boost demand for lithium metal — often the anode of choice for solid-state — while partially muting graphite demand growth, which is used as an anode in nearly all EVs produced today," said Alla Kolesnikova, head of data and analytics at Adamas Intelligence.

Some solid-state electrolyte formulations under testing would require additional materials such as lanthanum, a rare earth element, or germanium, niobium, tantalum or zirconium. Solid-state batteries would also likely eliminate the use of graphite typically used in today's rechargeables.

"The rare earth elements are probably where I think most of the supply chain challenges would arise," said Rebecca Ciez, an assistant professor of mechanical engineering at Purdue University.

If solid-state technology achieves commercialization, it could drive down the cost of a battery unit below $100/kWh, to as low as $50/kWh to $80/kWh by 2030, according to S&P Global Ratings analysts.

U.S. company Solid Power Inc. has advanced a silicon, all-solid-state battery to production lines in Colorado as part of a wider effort to eventually supply new lines of EVs. Automaker Ford invested in the Colorado-based startup beginning in 2019, and Ford, along with Bayerische Motoren Werke AG put another $130 million into the company in May.

|

|

CATL, one of the world's largest battery-makers, has debuted a next-generation battery that does not require lithium. |

Some automakers have set mid-decade goals for deployment.

Lithium is safe — for now

Lithium will continue to be a key ingredient in EV batteries for the foreseeable future, despite increasing competition from other metals and myriad technological advancements, according to analysts.

Hydrogen fuel cells, which received much hype and investment last summer, still face safety and cost hurdles. Chinese battery giant CATL unveiled a sodium-ion battery in July that promised lower costs and faster charging times than lithium, but it is likely years away from commercialization or application in EVs.

The next-generation battery will probably not pose a threat to lithium-ion batteries in the near term.

For now, analysts see lithium sticking around, with demand likely outstripping supply by as early as this decade on the back of increasing EV sales. Market Intelligence data published in August estimated that 341,439 tonnes of lithium carbonate equivalent could be devoted to all battery applications in 2021, increasing significantly, by 136.5%, to 807,399 tonnes in 2025.

"Lithium-ion cells have received so much demand in the last decade that the supply chain is sturdy, companies have pledged to build cell production facilities, and mines are being expanded, and so competition won't be seen in the short term," said Max Reid, a research analyst at Wood Mackenzie.