S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

29 Mar, 2021

|

Euronext Amsterdam has been the most popular European stock exchange for special purpose acquisition company listings so far. |

European exchanges are seeing growing interest in special purpose acquisition companies and expect listings to increase in 2021 but not at the levels recorded in the U.S., executives at Euronext Amsterdam, Deutsche Börse and the London Stock Exchange told S&P Global Market Intelligence.

SPACs — vehicles formed solely to raise capital through an IPO and then acquire an existing private company — have drawn widespread interest on Wall Street in 2020 and early 2021, raking in billions and pushing U.S. and global IPO volumes to record highs.

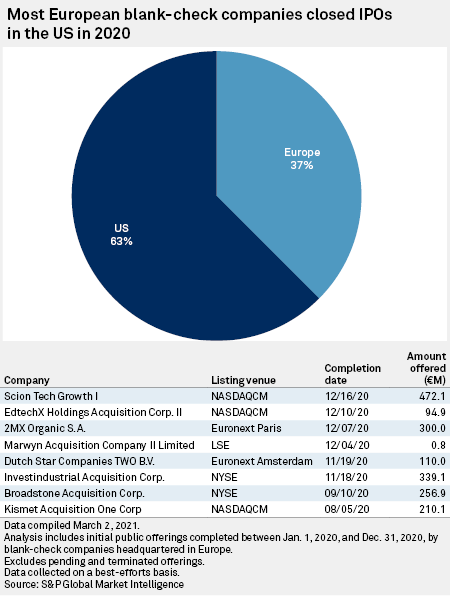

The 231 blank-check companies listed in the U.S. between Jan. 1 and March 11 overtook 2020's full-year total, according to S&P Global Market Intelligence data. In Europe, meanwhile, SPAC listings remain in the single digits with two by Feb. 28, following three Europe-based listings in 2020, the data shows.

2021 outlook

There is "huge interest" in SPACs from all corners of the market, Peter Fricke, head of capital markets sales at Deutsche Börse, said in an interview. "For the last six to eight months, SPACs and direct listings have been on the top of the agenda of every client call and all accompanying conversations with lawyers, banks and so on," he said.

Deutsche Börse expects at least a dozen further European SPAC listings this year, Fricke said. On Feb. 22, the Frankfurt Stock Exchange landed the largest European blank-check listing to date with Lakestar SPAC I SE's €275 million IPO, which is backed by German venture capitalist Klaus Hommels and aims to acquire a European late-stage growth technology company.

Euronext has also observed growing interest in SPACs across its markets in Europe and "our pipeline for 2021 looks promising," Simone Huis in 't Veld, CEO of Euronext Amsterdam, said in an interview. The first SPAC to list in Amsterdam in 2021 was ESG Core Investments BV, which raised €250 million and is targeting a majority stake in "a strongly positioned ESG company in northwestern Europe," Euronext said.

The SPAC structure was originally a U.S. phenomenon and the extent to which it can be replicated in Europe will depend not only on stock exchange listing rules but also on the flexibility of a jurisdiction's corporate law in allowing typical SPAC features to be implemented, law firm Clifford Chance said in a February note.

Amsterdam has so far been the most popular venue in Europe as the Dutch legal system is considered more accommodating for such transactions. "[U]nlike other European jurisdictions, Netherlands law does not have any rules or regulations that are targeted at SPACs specifically," global law firm Freshfields Bruckhaus Deringer said in a Feb. 26 note.

A revision of rules planned by the U.K. government, however, is likely to drive more business to London. Despite the fear of losing listings to EU exchanges in the aftermath of Brexit, London is still favored by investors and the proposed rule change could give the city "a better competitive edge to partake in the SPAC boom," research company Dealogic said in a March 12 report.

The London Stock Exchange welcomes the proposed reforms around SPACs and the introduction of additional shareholder protections, such as votes on acquisitions and redemption rights, Charlie Walker, head of the exchange group's equity and fixed income primary markets, said in a written comment. "We think there is demand for a greater number of SPACs in the U.K., but we wouldn't expect the scale seen in the U.S. due to differing market dynamics," he said.

SPACs boom

There are several factors driving the popularity of SPACs, including the abundance of capital in a low interest rate environment where investors chase higher returns and the rapid growth of Europe's technology sector, according to Huis in 't Veld and Fricke.

In Europe, tech IPOs have been lacking because startups have benefitted from state subsidies, government grants and similar financing sources, Fricke said. Now, however, there are numerous companies that have reached the right size and maturity to seek capital markets funding and enter the next stage of their development. This may create more opportunities for SPAC listings and other types of capital raises in the future, he said.

Tech companies have been among the most sought-after targets for U.S. SPACs in 2020 and the first quarter of 2021, according to S&P Global Market Intelligence data.

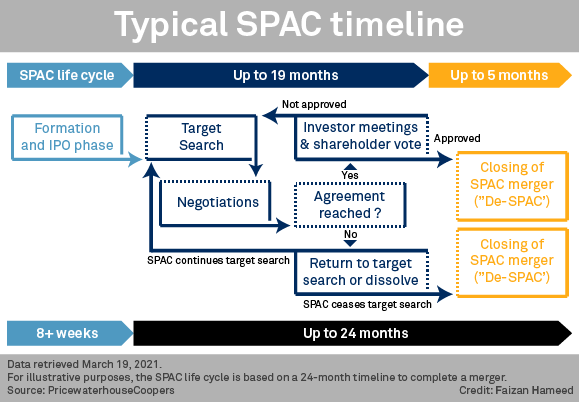

SPACs have emerged as an alternative to IPOs because they provide companies with a faster way to enter the public markets and investors with more time and flexibility to find the best acquisition targets, according to Fricke and Huis in 't Veld. As newly formed companies, SPACs have less paperwork to file and can go public in four to six months, while a regular IPO takes 12 to 18 months. Investors also have the ability to vote down an acquisition target and reclaim their investment.

There are potential downsides to working with SPACs too. Sponsors generally enjoy more protections compared to other investors in the vehicle and tend to end up with a controlling stake in the new company after the merger, according to law firm Norton Rose Fulbright. Given the lack of operations, financial history and a target at the time of the SPAC IPO, disclosure to investors is initially limited. Sponsors may also pursue companies based on prior relationships or settle for a less attractive target to avoid winding down at the end of the agreed acquisition timeframe, it added.

"Fundamentally, SPACs are an investment vehicle and sponsors need to find good companies that can perform well as public companies," said Mohsin Meghji, managing partner at New York-based corporate advisory firm M3 Partners, who listed a second SPAC in February.

Although SPACs are "here to stay," the current level of activity in the U.S. is not likely to continue much longer, Meghji said in a written comment. "Ultimately it will be the sponsors with the best track records who will survive."