S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

31 Mar, 2021

By Nina Flitman

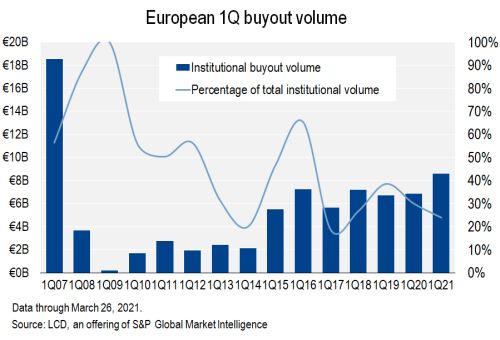

The first quarter of 2021 was the busiest opening of the year for European leveraged buyout loan volume since the Global Financial Crisis, and also hosted the biggest first-quarter supply of LBO bonds on record. “The first quarter has offered the most constructive picture we’ve seen for financings since the pandemic began,” said one senior banker.

|

The surge in buyout issuance over the first three months of 2021 illustrates just how far the markets have recovered in the year since the COVID-19 crisis — and subsequent market closures — hit hard. "In late March last year we were worried about a liquidity crisis, but thanks to state support and sponsor intervention the squeeze never came," says a financing specialist at a private equity firm. "Now we're in better shape than I could ever have imagined, and with the strongest issuance window I've seen for a very long time."

Comparing the first quarter of 2021 to the first quarter of 2020, it is clear that while the financing markets have now returned to strength, there are some key differences when it comes to buyout funding before and since the pandemic struck. Certainly, there is now a greater amount of scrutiny on assets regarding exposure to COVID-19, while issuers from sectors such as hospitality and travel have been hit particularly hard — although sources emphasize that if borrowers can prove their resilience and illustrate a roadmap to recovery, then support is available.

Bonds in play

Another important change is that bonds took a far larger role in financing buyouts in the first quarter of 2021 than in the same period in 2020. For example, Advanz Pharma Corp Ltd. Jersey turned to the bond market for the greater portion of the financing backing Nordic Capital's acquisition, with a €305 million term loan and a $1.02 billion-equivalent dual-tranche bond transaction, while the largest bond buyout deal of the quarter came from U.K. supermarket chain ASDA Group Ltd., which supported its £6.6 billion takeover of the firm by the Issa Brothers and TDR Capital with an €845 million term loan, £2.25 billion of secured notes, and a £500 million tranche of unsecured bonds. Asda's secured notes were the largest ever single-tranche issue in the European high-yield market, and the largest single-tranche offering of sterling notes.

|

Indeed, European private equity sponsors note that high-yield issuance is an increasingly important part of their financing arsenal. "We will always prefer the loan product — it’s more flexible, and it's got a shorter non-call period — but for the best execution you need competition tension across both markets," says one source. "Also, as we're looking at bigger deals it makes sense to use both loans and bonds. Europe is not the biggest market, and while there's lots of liquidity available you don't want to find the bottom of that."

Certainly, pricing tension due to the liquidity-rich bond market being in play helped to drive terms in the European loan market almost back to levels on offer before the pandemic hit. Euro-denominated single-B rated TLBs, for example, are now pricing to yield less than 4% on average for the first time in a year, according to LCD.

|

Similarly, in the secondary market, the sponsored portion of the S&P European Leveraged Loan Index (ELLI) also returned to levels last seen before the pandemic hit, as demand for the asset class in the first quarter of this year was strong, and a surge of new-money issuance from buyouts was balanced by a number of chunky repayments from borrowers such as Refinitiv US Holdings Inc., SCM Biogroup-LCD and INOVYN Ltd..

|

Dry powder

|

In the first quarter, the volume of dry powder available to private equity sponsors rose to the highest level on record, according to data from Preqin. Some sources note that private equity firms will soon put these cash reserves to work with a vengeance, however — especially having seen how accessible the financing markets are at the moment. "We've only really had this exuberance in the market since the new year, and there's a bit of a lag with the flow of M&A," said one sponsor. "This is a great market to be selling in, and the outlook feels very robust."

Others though note that despite the availability of financing, sponsors face challenges putting their dry powder to work as valuations have been pushed up by the soaring prices available in equity markets. For some issuers from favored sectors such as technology, fintech and healthcare, sources say valuations have risen by five turns or more from last year to this year.

Meanwhile, certain market participants say the strength of equity markets represents the greatest difference between the first quarters of 2020 and 2021. This factor has not only impacted comparable valuations required on buyouts, but has also meant that private equity firms are seeing an increasingly attractive alternative to secondary auctions. "The equity markets are really exploding," says one private equity banker. "The reality is that we're spending much more time advising sponsors on equity exits than ever before."

This is not to say though that prices in the equity capital markets are insurmountable, and sponsors note there are still opportunities to find value in certain assets that have enabled take-privates. For example, Nordic Capital's offer for Advanz Pharma was recommended to shareholders in January, while Recipharm AB (publ) was delisted in early March after its acquisition by EQT.

|

ESG emerges

In 2021, leveraged loans backing the takeover of building materials distributor Stark Group A/S by CVC and supporting the acquisition of mechanical and electrical drive manufacturer Flender GmbH by Carlyle both carried ESG-linked margin ratchets, with the former deal linked to a reduction in greenhouse gas emissions and the latter connected to the power volume of new gearbox installations in wind turbines.

And the €845 million term loan portion of the buyout financing for Asda carries a margin ratchet of 5 basis points linked not to a specific sustainability-linked target, but to the firm's ESG rating from a third-party provider.

While ESG-related pricing was not included on any bond buyout transactions in the first quarter, there have been two high-yield transactions including sustainability language — suggesting that such a structure may yet be included on buyout bonds going forward.

But the greatest impact of the market's increasing focus on ESG may come from the type of buyouts seen in the market, as for some sponsors, sustainability and ESG criteria have become a core part of their acquisition strategy, which will impact the sort of buyouts the market sees in the future. "In the last year, ESG has become real," says one senior market participant. "It has become an important aspect of some sponsors' business models, where there's nothing in their portfolio that isn't ESG-focused. It's part of their ethos. But there's some bifurcation there too, and other sponsors are less concerned."

Others note that this topic cannot be ignored for long by private equity sponsors. "ESG is a trend that's here to stay," says one private equity manager. "The LPs [Limited Partners] demand it, and they expect us to report on it. Even if just from a fundraising point of view, it makes sense to embrace it."