S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Feb, 2021

By Vanya Damyanova and Rehan Ahmad

With Deutsche Bank AG, BNP Paribas SA and UBS Group AG reporting strong fourth-quarter trading revenues earlier in February, other leading European investment banks such as Credit Suisse Group AG, Barclays PLC and HSBC Holdings PLC are also expected to end the boom trading year 2020 on a high note.

Market volatility and central bank measures triggered by the COVID-19 pandemic transformed trading revenues from the weak spot into the bright spot in the earnings of big European investment banks in 2020. Despite a slowdown in volatility toward the end of the year, trading revenue growth at most of those banks that have already released full-year earnings was in line with expectations and the average performance of U.S. peers, analysts said.

The European banks yet to report look likely to announce "healthy" year-over-year growth in fourth-quarter 2020 revenues as the market environment remained favorable in the quarter, Richard Barnes, senior director at S&P Global Ratings' financial institutions team, said in a written comment. Credit stood out in fixed-income, currencies and commodities trading and on the equities side, there were favorable market drivers in both cash and derivatives, according to Barnes.

Deutsche, UBS, BNP results

The full-year 2020 trading revenues of German group Deutsche Bank and Switzerland-based UBS were closer to the U.S. peer average while France-based BNP Paribas' revenues, like those of compatriot bank Société Générale SA, were adversely affected by losses on structured equity products in the first half of the year, Barnes said.

After taking "hard losses" on structured finance products, the French banks experienced a good recovery in equities trading in the fourth quarter, Johann Scholtz, an equity analyst at research and investment management company Morningstar, said in an email. Despite a "dramatic slowdown" in the fourth quarter as COVID-19-induced volatility moderated, according to Scholtz, FICC trading still dominated revenue growth.

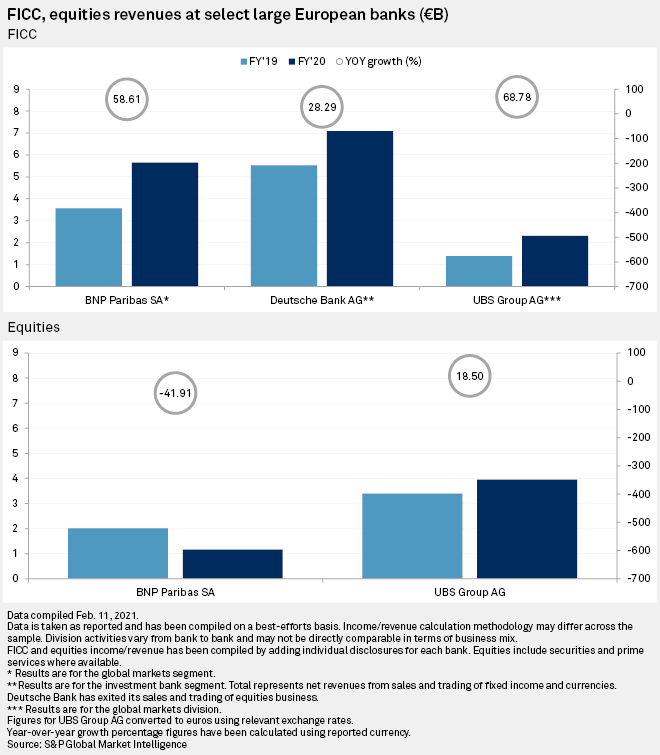

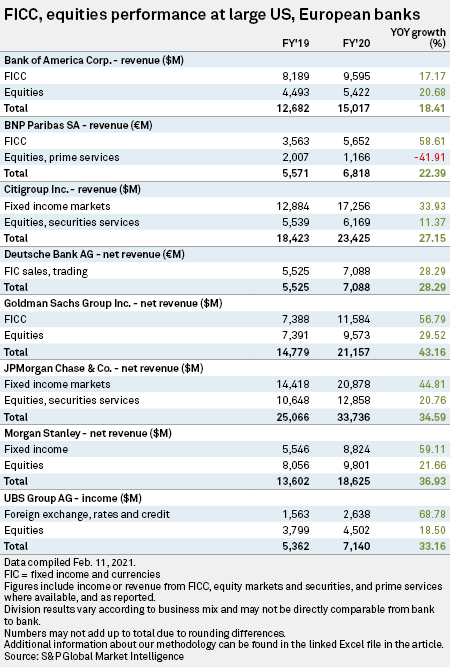

BNP Paribas' weakness in equities resulted in a 41.91% year-over-year drop in 2020 revenues in that line of business but a FICC surge of 58.61% managed to fully offset that negative effect, S&P Global Market Intelligence data shows. Despite being overweight in equities, UBS booked a stronger growth rate, of 68.78% year over year, in FICC, which was the main revenue growth driver for many of the global investment banks in 2020. After scrapping its equities sales and trading activities in the course of a long-term restructuring, Deutsche Bank's trading revenues come solely from its fixed-income and currencies business, where the German group booked a 28.29% year-over-year revenue increase.

Compared to U.S. peers, all three European banks booked higher full-year trading revenue growth than Bank of America Corp., while UBS and Deutsche Bank's growth rates were also higher than that of Citigroup Inc. in 2020. In FICC, UBS posted the highest year-over-year revenue increase among the banks that have reported so far.

To download an Excel version of the data, please click here.

Outlook for Credit Suisse, Barclays, HSBC

As UBS, Deutsche Bank and BNP Paribas reported 21%, 17% and 11.8% year-over-year increases in fourth-quarter revenues, "more of the same" is expected for Credit Suisse and the rest of the European investment banks due to report soon, although trading income may be affected by company-specific issues, Scholtz said.

Credit Suisse, reporting on Feb. 18, is expected to book fourth-quarter trading revenues of CHF1.34 billion, or slightly below the third-quarter result of CHF1.38 billion, according to a mean consensus analyst forecast released by the bank. The group's full-year trading revenues are expected at CHF6.58 billion, up from CHF5.35 billion in 2019.

Credit Suisse's strong trading exposure will bolster its overall earnings for 2020, making it a far better performer than either Barclays or HSBC, which may get a boost from their trading desks but are likely to take a hit from the weak U.K. economy, Octavio Marenzi, CEO of capital markets management consultancy Opimas told S&P Global Market Intelligence.

Barclays, releasing its earnings on Feb. 18, is expected to post fourth-quarter total income of £2.55 billion in its corporate and investment bank, or CIB, division, compared to £2.91 billion booked in the third quarter of 2020, a mean consensus analyst forecast on its website shows. Full-year CIB income is projected to stand at some £12.39 billion, higher than £10.23 billion in 2019. Trading revenues account for over half of CIB total income at the bank.

HSBC's consensus report does not specify global markets or investment bank revenue forecasts but the overall revenues for 2020 are expected to be somewhat lower than a year ago. "We see [a] mid-single digit percentage revenue decline for HSBC in 2020 as we see headwinds from the low interest rate environment and reduced demand for banking services amid [the] COVID-19 pandemic," CFRA equity analyst Firdaus Ibrahim said in a Feb. 13 note.

Low interest rates and high loan loss provisions amid COVID-19 have weighed on the U.K.-based group's revenues in 2020, with global markets being one of the only bright spots in its earnings. The group's total adjusted revenues fell 10% year over year in the third quarter, while global markets revenues were up 16%, primarily on strong FICC results. HSBC reports Feb. 23.