S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

25 May, 2023

By Camilla Naschert

|

A parched reservoir in Spain. The Iberian peninsula had a dry spring, meaning that the chances of another drought this summer are high. |

Hydropower producers in Southern Europe are set to face another summer of low production as looming droughts threaten to compound what was already one of the driest years on record in 2022.

To make matters worse, the electricity that does get produced this year will not be flowing into the same high power price environment that "more than compensated" for the lower hydro volumes during the 2022 droughts, analysts at Moody's said in a May 17 note.

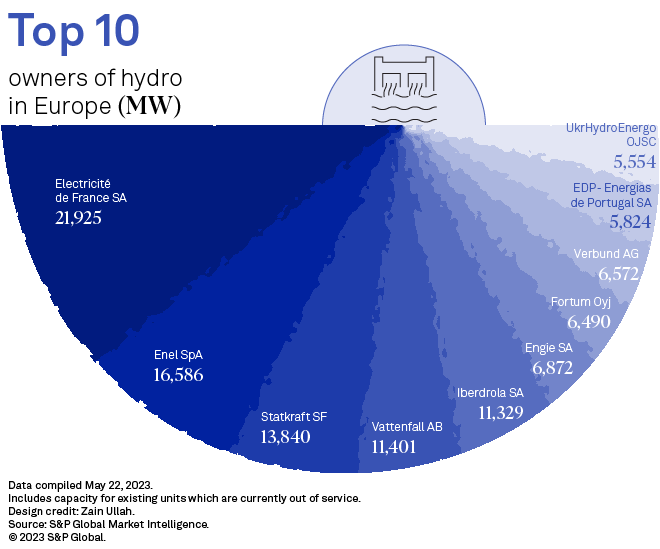

Plants in Iberia and other parts of the Mediterranean region faced the most significant dry spells in 2022, with some fleets halving their production compared to the previous year. Among the region's biggest hydro producers are Electricité de France SA, Iberdrola SA, EDP - Energias de Portugal SA and Enel SpA.

"In almost all parts of Europe, winter 2022/23 was significantly milder and drier than average," the Moody's analysts said. "It is likely that 2023 will be another year of below average production volumes."

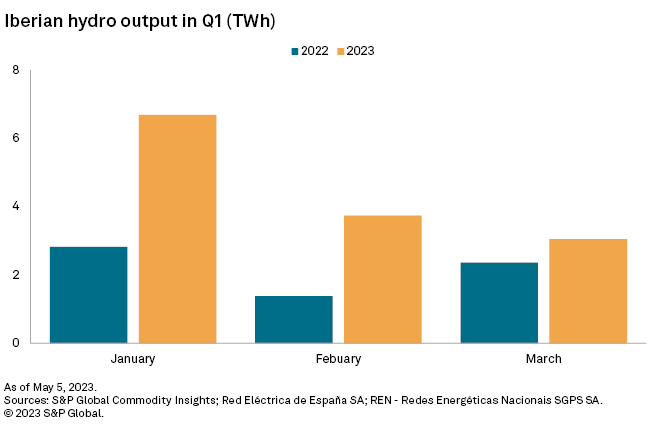

Hydro generation has recovered so far this year, with Iberdrola saying its reserves and production are up on 2022.

"Our reserves are now normalized, based on the rain that we experienced in December and January, mainly in the northwest of the country, which have also improved our pumped storage capability," Iberdrola CEO Armando Martínez Martínez said during the company's first-quarter results presentation.

With summers normally dry, the first and fourth quarters of the year are largely the months that determine reserves in Spain, an Iberdrola spokesperson said May 19.

EDP also said its hydropower levels in Spain and Portugal have normalized after a rainy winter. Electricité de France SA, the largest hydro producer in France, did not wish to comment on its reservoir levels and outlook.

While the end of 2022 brought rain and filled up storage levels on the Iberian peninsula, the spring of this year has been dry, according to Dale Mohler, senior commodity forecaster at weather service AccuWeather.

That means the region has missed its window of rainfall before the summer, and therefore runs the risk of droughts once again. "Even if you had normal precipitation there over the summer, that's not very much," Mohler said in an interview.

Mainland Spain recorded its highest-ever April temperature this year, reaching 39 degrees C.

Despite recent heavy rainfall and flooding in northern Italy, much of the country's hydro fleet may also struggle this summer. "Italy is facing one of the worst droughts in its history," Moody's analysts said.

Last year's slump in hydro production was offset by different technologies in different markets. In Italy, most of the hydro shortfall was topped up by higher coal generation, while Spain burned more gas to make up for low hydro generation.

Prices will not come to the rescue

In 2022, when European power prices were pushed to record highs in the energy crisis, hydropower producers like Statkraft AS and Verbund AG cashed in due to low hedging. But electricity prices have come down this year, limiting the market upside.

"Companies with a focus on hydropower generation and little diversification are highly vulnerable to lower hydro generation volumes," Moody's said.

Central Europe, including the UK and France, is set to see rainfall and temperatures closer to normal, according to AccuWeather. "That region is going to have a better summer, with more consistent rainfall than they had last year," Mohler said.

AccuWeather makes predictions based on long-range computer models, which include parameters such as ocean temperatures.

The Nordics, where there is significant hydropower capacity in Norway, Sweden and Finland, will not face restrictions on production, Mohler said, given that the winter and spring have been rainy and snowy. "We don't expect anything out of the ordinary," the forecaster added.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.