S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 May, 2022

By Erin Tanchico and Rehan Ahmad

Europe will remain a major hub for the green bond market even as interest rate hikes and geopolitical uncertainty in the wake of Russia's invasion of Ukraine weigh on new issuances.

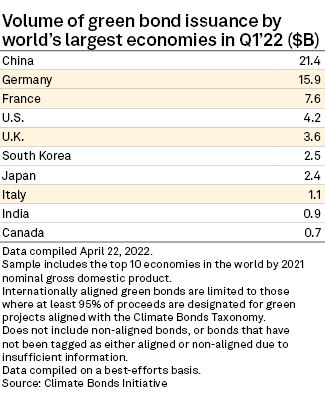

Germany and France emerged as Europe's top issuers of green bonds in the first quarter of 2022. Germany led the region with $15.9 billion of internationally aligned green bond issuance, followed by France with $7.6 billion, according to data from the Climate Bonds Initiative, or CBI.

The EU intends to sell €250 billion worth of green bonds through 2026 via its NextGeneration EU program. It raised €12 billion from the first issuance in October 2021.

"Europe has been the key driver in development and the growth of the green bond market, and we do not see that changing in 2022," said Trevor Allen, head of sustainability research at Markets 360, BNP Paribas' market strategy and economics division.

The Nordic region is also a key area to watch in Europe, Allen said.

Green bond issuance down in Q1 amid uncertainties

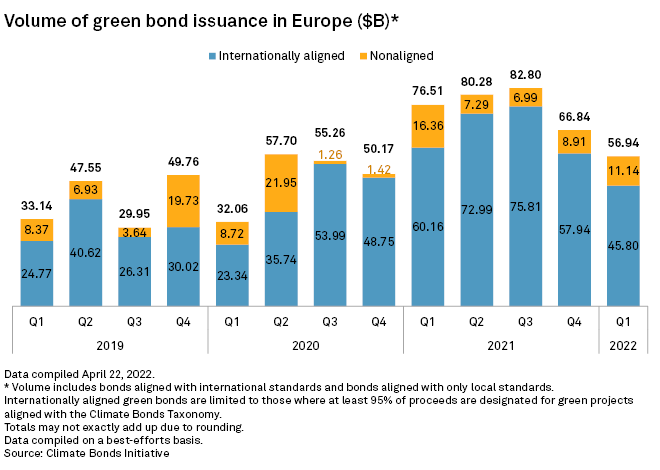

Europe sold $45.80 billion of internationally aligned green bonds in the first quarter of 2022, down 23.9% from $60.16 billion a year earlier, CBI data shows. Including green bonds aligned with only local standards, total issuance across the continent amounted to $56.94 billion in the quarter.

Europe was the highest-contributing region to green debt globally during the quarter, according to CBI data.

The weak first quarter ended a multiyear growth streak for the global green bond market, propelled by net-zero commitments from many countries. As many central banks hike interest rates to tame inflationary pressures, financing costs for green bond issuers have increased and created uncertainty for investors, analysts said. Weaker outlooks on the global economy due to Russia's invasion of Ukraine have also affected funding for energy transition projects.

"Geopolitical risk and interest rate volatility create uncertainty, which tends to put a natural dampener on primary market activity," said Sam Morton, head of European investment-grade research at Invesco's fixed income unit. "However, we still see expect to see growth in the sustainable finance market."

Rise of sustainability-linked bonds

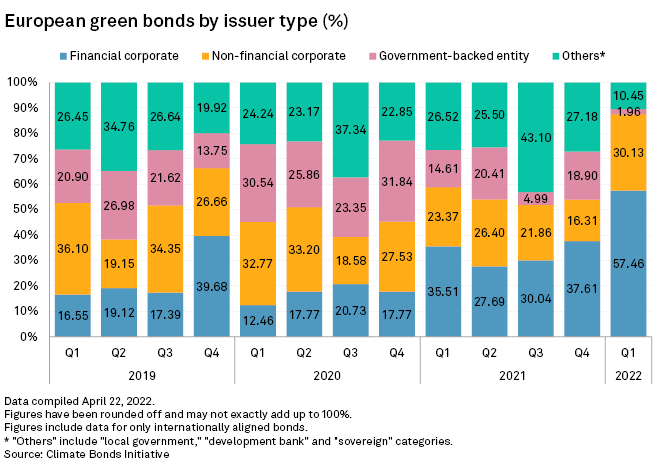

Financial corporates accounted for 57.5% of European green bond issuance, according to CBI data, with nonfinancial corporates responsible for 30.1%. This is compared to 35.5% for financial corporates and 23.4% for nonfinancial corporates a year ago.

A rise in corporate sustainable debt issuance is anticipated in 2022, driven by increased supply of sustainability-linked bonds, according to Morton.

S&P Global Ratings also expects sustainability-linked bonds to be the fastest-growing segment of the sustainable bond market in 2022, it said in a report, noting that the market will continue to become more diverse and nuanced. Unlike traditional green bonds, sustainability-linked bonds are not ring-fenced for specific environmental or social projects, thus providing more flexibility for issuers.

"The growth of sustainable debt issuance is broad-based, but France, Germany and Italy have led the way in 2022," Morton said.

Efforts to harmonize regulatory frameworks and environmental, social and governance standards will also bring more clarity to the market, according to Ratings.